On September 30, Reuters published an analysis of Vietnamese furniture manufacturers’ strategies in response to new U.S. tariffs. The focus was on Trayton Group, a mid-range manufacturer that exports 70% of its production to the U.S. Their sofas and armchairs are sold under major retailers’ brands or their own Simon Li label in large chains, including

Costco.

Trayton’s manufacturing facility in Vietnam. (Source: Trayton Group).

Notably, Trayton Group signed an agreement to shift most of its production from China to Vietnam shortly after Donald Trump’s re-election as U.S. President. According to the company’s CEO, the new tariffs will not alter this strategy.

Recently, Trump signed a document imposing a 25% tariff on wooden furniture starting October 14, with potential increases to 50% for dressers and kitchen cabinets, and 30% for upholstered items next year.

In an interview with Reuters, Trayton’s founder and CEO, Simon Lichtenberg, acknowledged that his company is directly impacted by the tariffs on upholstered goods. He believes this could squeeze profit margins, but most of the burden will be “absorbed” by U.S. consumers through higher prices.

“Relocating to Vietnam, where we currently ship 50 containers weekly to the U.S.,

remains the right strategy,” Lichtenberg affirmed. He noted that U.S. tariffs on Chinese goods are even higher. China remains the hub for the company’s R&D center and most of its 1,000+ international staff.

U.S. Production is “Nearly Impossible”

In a Truth Social post, Trump declared: “I will impose significant tariffs on any country that doesn’t manufacture furniture in the U.S.”

However, manufacturers find this idea impractical. ”

It would be

nearly impossible to produce in the U.S.,” Lichtenberg stated bluntly. The reasons include high costs and a severe shortage of skilled labor.

This view is echoed by Jonathan Sowter, head of Jonathan Charles Fine Furniture, a high-end wood furniture manufacturer with 2,500 skilled workers in Vietnam, exporting about 60 containers monthly to the U.S.

Sowter plans to boost exports to other markets, with price increases inevitable. However, he emphasized: ”

We have no intention of producing in the U.S.,” as the company’s highly skilled workforce cannot be found there.

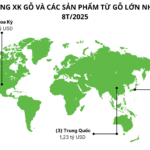

Vietnam Closely Trails China in Furniture Exports to the U.S.

Trayton’s move is not unique. It follows similar actions by major Chinese competitors like Man Wah Furniture and KUKA Home, which shifted production to Vietnam in recent years to avoid U.S. tariffs.

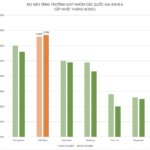

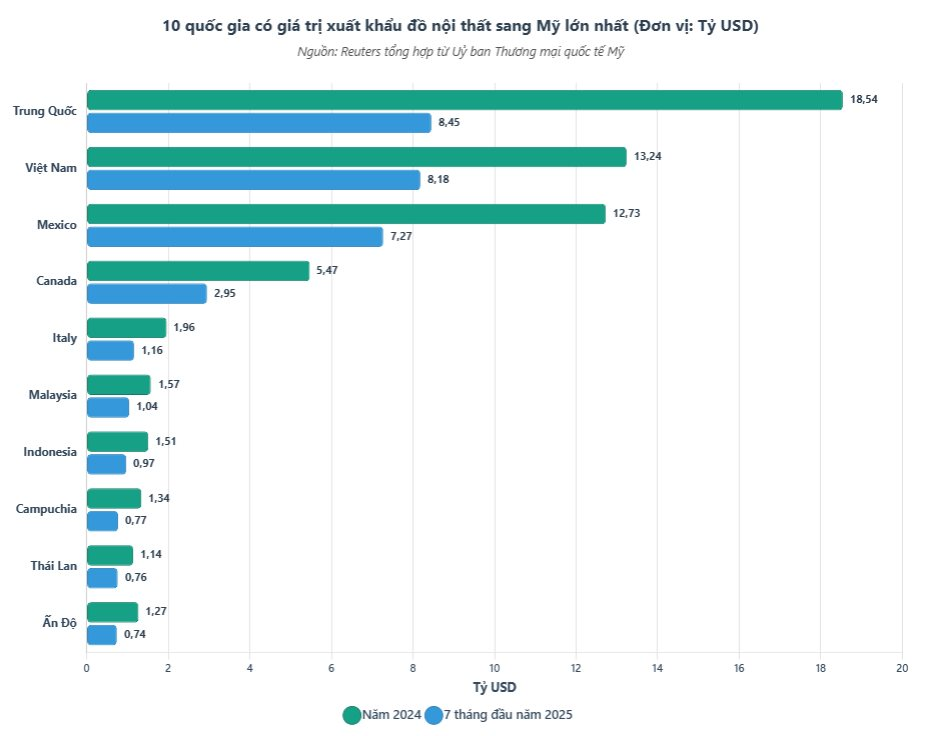

As a result, Vietnam is poised to surpass China as the primary furniture supplier to the U.S. this year. U.S. data shows that in the first seven months, Vietnam’s furniture exports to the U.S. reached nearly $8.2 billion, accelerating compared to 2024. Meanwhile, China’s exports slowed, totaling $8.4 billion in the same period.

The U.S. is currently the largest market for Vietnamese-made furniture and wood products, and it is Vietnam’s fifth-largest export category to the world’s largest economy.

While Vietnamese exporters were initially shocked by the tariffs, Lichtenberg remains optimistic. He hopes that the company’s high-quality products will continue to appeal to price-insensitive buyers.

”

Consumers are less price-sensitive with furniture since they purchase it only every few years,” he concluded. This is the significant bet that businesses are placing on the U.S. market.

By Francesco Guarascio, Phương Nguyễn | Reuters

Vietnam’s Economy Through an International Lens: The 2025 Momentum and Long-Term Prospects

International financial institutions recognize Vietnam as a regional growth highlight, with a 7.5% GDP increase in the first half of 2025. This strong performance sets the stage for the country’s ambitious full-year target of 8.3-8.5%, reinforcing confidence in its sustainable economic outlook.