Illustrative Image

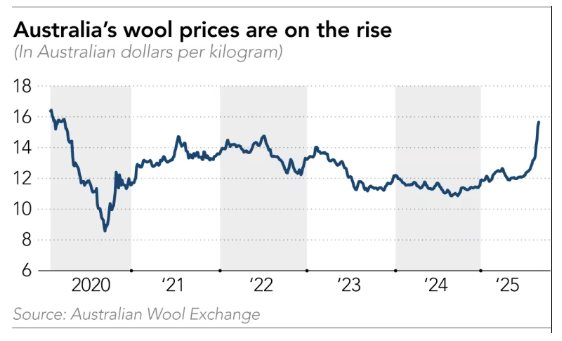

Australian wool prices are surging as Chinese importers ramp up purchases amid concerns over limited supply, according to data from the Australian Wool Exchange (AWEX).

Prices at the Eastern Market Indicator (AWEX-EMI) rose by 1.12 AUD (0.70 USD) over the past two trading days, marking the fifth-largest weekly increase since the index’s inception in 1996. This also represents the longest consecutive price rally since 1987, spanning 11 straight weeks.

Australian wool prices continue their steep ascent. Source: Nikkei

Industry experts attribute the surge primarily to heightened demand from China, which imports over 85% of Australian wool for its textile and apparel sectors. Australia’s wool production is projected to decline by 11.8% in the 2024/25 season, as farmers shift to other crops or face drought conditions. In August, wool tested in Australia fell by 24% year-on-year.

Eamon Timms, Brokerage Director at Fox and Lillie, noted that the buying frenzy following the Nanjing Wool Market Conference in September reflects growing anxiety among Chinese businesses about supply shortages. “There’s a sense of panic and FOMO in the market,” he stated.

Beyond supply constraints, consumer shifts away from synthetic fibers like polyester—driven by concerns over microplastics and fashion waste—are further bolstering demand for wool and cotton. Rabobank analyst Paul Joules highlights that Chinese wool inventories are at historic lows, prompting importers to accelerate purchases.

The supply crunch has rippled into retail markets. Research by Sheng Lu, a University of Delaware expert, reveals an 18% drop in merino wool products sold by major U.S. brands between May and September. Some luxury retailers have raised prices, with one merino wool dress increasing by 8%.

While the price surge benefits the industry, critics caution that the trend may not be sustainable. Gary Turner, Chairman of the Australian Wool Industry Secretariat (AWIS), warns that recent farmer sales could distort supply perceptions. This week, 34,000 bales were offered, with over 40,000 expected next week.

Despite this, production outlooks remain fragile. Prolonged droughts in eastern and southern Australia over the past 18 months continue to strain farmers, with output heavily dependent on upcoming rainfall.

Source: Nikkei Asia