The International Financial Center in Ho Chi Minh City is poised to become a catalyst for attracting global capital and knowledge. Photo: LÊ VŨ |

Perfecting the Legal Framework for the International Financial Center

According to Resolution 222/2025/QH15 (Resolution 222) dated June 27, 2025, issued by the National Assembly, Vietnam aims to establish an International Financial Center (IFC) to attract financial resources, enhance international integration, and lay the groundwork for breakthrough growth in the new era. The Global Financial Centres Index (GFCI) Report No. 37 (March 2025) indicates that there are currently 119 financial centers worldwide, and Vietnam’s goal is to rank among the top 75 by 2035 and ascend to the top 20 by 2045, on par with leading regional centers like Hong Kong, Singapore, Seoul, and Dubai.

To realize this ambition, Vietnam has demonstrated strong political commitment by issuing Resolution 222, establishing the highest legal foundation for the integration process. Building on this, the Prime Minister issued Decision 114/QĐ-BCĐTTTC on August 1, 2025, outlining a concrete action plan to launch the IFC in Ho Chi Minh City and Da Nang by the end of 2025. This includes expediting eight detailed decrees to guide Resolution 222, streamlining the management apparatus, and establishing a specialized court to handle disputes.

In terms of specific implementation, Vietnam will promptly develop strategic infrastructure and urban spaces for the IFC in Ho Chi Minh City and Da Nang, applying special mechanisms to accelerate the construction of physical and urban infrastructure. Simultaneously, the development of telecommunications and digital infrastructure will be synchronized to ensure the financial center has the best possible foundation before operations commence. Additionally, the government will introduce regulations for controlled pilot testing of financial technology (FinTech) services and innovation, expand and upgrade commodity trading markets, develop high-quality financial products and services, and implement preferential policies to attract domestic and foreign investment. These concrete steps, backed by a clear plan, form the cornerstone for Vietnam’s long-term vision of becoming one of the world’s leading financial centers.

Preferential Policies as a Lever for Investment Attraction

Vietnam is well-positioned to develop an IFC, supported by a stable political environment, strong integration commitment, rising international stature, and an economy ranked among the world’s top 25 by GDP (PPP). Significant investments in transportation, technology, and digital infrastructure, coupled with the emergence of a high-quality workforce, further bolster this potential. Vietnam’s strategic location offers a unique advantage, with convenient travel distances from its IFC to other major regional financial centers and a time zone that does not overlap with 21 of the world’s top centers. This enables Vietnam’s IFC to leverage temporal and spatial gaps in the global financial network.

|

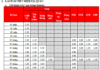

According to research by the Tony Blair Institute, strategic investors can be categorized based on infrastructure, technology, media and member attraction, and financial products and services. Regardless of category, they must meet stringent criteria, with a $1 billion capital commitment being a critical condition. |

Amid shifting global geopolitical dynamics, this presents a golden opportunity for Vietnam to emerge as a hub for development, an international capital transit point, and a next-generation financial center. Against this backdrop, Resolution 222 has established an open legal framework with numerous special preferential policies, positioning Vietnam’s IFC as an attractive destination for global investors.

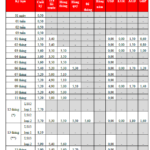

Key incentives include streamlined legal procedures to attract priority financial organizations. Members are permitted to apply international accounting standards or those of specific countries, and transactions between members and with foreign entities can be conducted in foreign currencies. Tax policies are particularly favorable, with a corporate income tax rate of 10% for 30 years, a maximum tax exemption of up to four years, and a 50% reduction in taxable income for a maximum of nine subsequent years for priority sectors. For other sectors, the tax rate is 15% for 15 years, with a maximum two-year exemption and a 50% reduction for up to four subsequent years.

Additionally, experts, scientists, and managers working at the IFC are exempt from personal income tax until the end of 2030. Immigration and customs procedures for the IFC are also prioritized. The government will allocate cleared land for lease or transfer for up to 70 years to support projects in priority sectors. Furthermore, the IFC is authorized to pilot new financial products and business models not yet regulated by law. This package of incentives, the most liberal to date, is designed based on international best practices, aiming to swiftly align Vietnam with the standards of the world’s leading financial centers.

Additional Incentives with Conditions for Strategic Investors

Strategic investors are IFC members meeting criteria related to business sectors, financial capacity, reputation, and long-term investment commitments. They are seen as key drivers of the IFC’s development.

Under Resolution 222, strategic investors enjoy superior incentives, including priority in implementing critical infrastructure and support service projects, land leases without bidding for priority projects, and the right to invest, develop, manage, lease, or transfer projects within the IFC. They are also authorized to provide investment support and land clearance services for other investors, develop large-scale infrastructure, and create ecosystems to attract financial institutions, multinational corporations, and international experts. These mechanisms are designed to ensure their leadership role and create strong appeal for major financial institutions, shaping the IFC’s long-term development.

Alongside these benefits, strategic investors have higher obligations than other members. They must demonstrate financial capacity and experience, commit to long-term investment, and complete infrastructure projects within five years. Additionally, they are responsible for promoting the IFC’s image and supporting the attraction of international financial institutions.

More specific criteria for selecting strategic investors are under discussion, including a minimum $1 billion investment commitment, operations in priority sectors such as securities, banking, insurance, FinTech, or green finance, compliance with legal and ESG standards, and contributions to communication and network development.

According to research by the Tony Blair Institute, strategic investors can be categorized based on infrastructure, technology, media and member attraction, and financial products and services. Regardless of category, they must meet stringent criteria, with a $1 billion capital commitment being a critical condition.

Lão Trịnh

– 07:00 04/10/2025

Ho Chi Minh City: When Will the Mai Chi Tho Bike Lane Pilot Be Expanded Citywide?

Cycling enthusiasts in Ho Chi Minh City can now enjoy a dedicated bike lane on Mai Chi Tho Street as part of a pilot program. However, plans to expand this initiative face challenges due to limited infrastructure, narrow sidewalks, and other unresolved issues that require immediate attention.

The $860 Million Project: Foreign Giant’s Exit and Vietnamese Tycoon’s Takeover Bid in Ho Chi Minh City

Eco Smart City, once envisioned as a landmark development with an initial investment of over $8.7 billion, was set to transform the heart of Thu Thiem. However, after years of delays, Lotte officially withdrew from the project. Shortly thereafter, the consortium of Sunshine – Dia expressed interest in taking over the prime 7.45-hectare site.

Ho Chi Minh City Offers 88 Residential Projects Available for Foreign Buyers

After three rounds of updates, Ho Chi Minh City now boasts a total of 88 residential projects available for sale to foreign buyers.