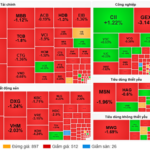

Vietnam’s stock market ended the week on a subdued note. Despite a brief rally in the main index, selling pressure quickly dominated. By the close of the October 3rd session, the VN-Index fell by 6.89 points to 1,645.82. Trading volume remained low, with HoSE recording an order-matching value of VND 23.1 trillion.

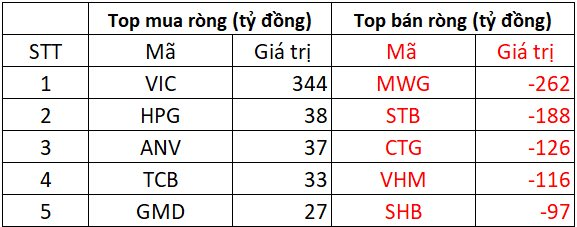

Against this backdrop, foreign investors continued their net selling streak, offloading VND 1.311 trillion across the market. The breakdown is as follows:

On HoSE, foreign investors net sold approximately VND 1.218 trillion

On the buying side, VIC led the market with a significant net purchase of VND 344 billion. HPG, ANV, TCB, and GMD followed, with net buying values ranging from VND 27 billion to VND 38 billion.

Conversely, MWG saw the heaviest foreign selling, totaling VND 262 billion. Other stocks like STB, CTG, and VHM also faced substantial net selling by foreign investors, each exceeding VND 100 billion. SHB was also net sold, amounting to VND 97 billion.

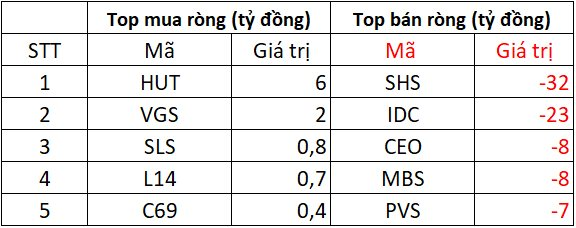

On HNX, foreign investors net bought nearly VND 86 billion

In terms of purchases, HUT and VGS were net bought by foreign investors, ranging from VND 2 billion to VND 6 billion. SLS, L14, and C69 also saw minor net buying, each in the hundreds of millions of dong.

On the selling side, SHS and IDC were net sold for VND 32 billion and VND 23 billion, respectively. CEO, MBS, and PVS also faced net selling, each around VND 7-8 billion.

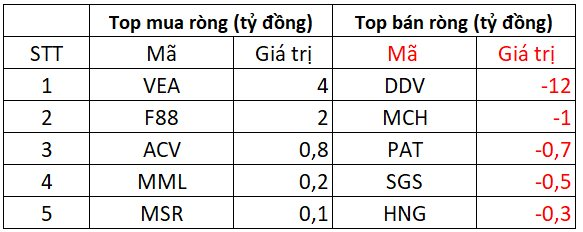

On UPCOM, foreign investors net sold VND 8 billion

On the buying side, VEA and F88 were net bought for VND 2-4 billion, while ACV, MML, and MSR saw minor net buying, each in the hundreds of millions of dong.

Conversely, DDV was net sold for VND 12 billion, and MCH for VND 1 billion. PAT, SGS, and HNG also faced light net selling, each in the hundreds of millions of dong.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.

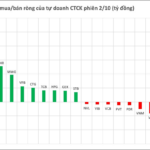

Billions Deployed to Scoop Up Vietnamese Stocks Amid Market Dip: Which Securities Are Brokerage Firms Most Aggressively Targeting?

Proprietary trading firms recorded a net purchase of VND 343 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Vietstock Daily 03/10/2025: Sluggish Trading Sparks Investor Impatience?

The VN-Index tumbled towards the end of the session, slicing through the Bollinger Bands’ Middle line. This movement reflects a resurgence of bearish sentiment as buying momentum remains subdued. Meanwhile, the Stochastic Oscillator has reissued a sell signal, while the MACD continues to weaken. The August 2025 low (around 1,600-1,630 points) is expected to provide support for the index should selling pressure intensify further.

Steel Industry Shareholders Profit, But Celebrations on Hold

Following the sharp decline in April 2025 due to tariff shocks, many steel stocks have successfully formed a V-shaped recovery. However, compared to the broader market’s upward momentum, the sector still appears sluggish, as all steel stocks underperformed the VN-Index. This reflects investors’ lingering caution toward the industry.