Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 814 million shares, equivalent to a value of more than 23.1 trillion VND; the HNX-Index reached over 83.2 million shares, equivalent to a value of more than 1.7 trillion VND.

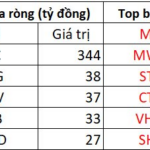

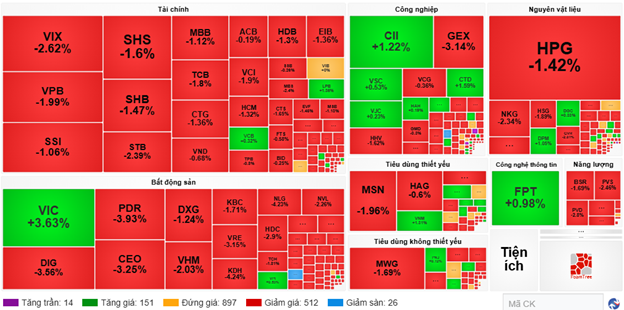

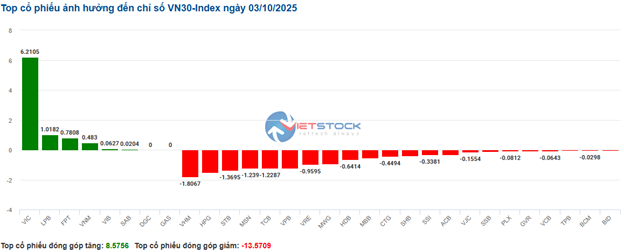

The VN-Index opened the afternoon session on a positive note as buying pressure returned, helping the index quickly recover to its reference level. However, selling pressure re-emerged towards the end of the session, causing the index to reverse and close in the red. In terms of impact, VPB, CTG, TCB, and HPG were the most negatively influential stocks on the VN-Index, contributing to a decline of over 3.6 points. Conversely, VIC, VHM, LPB, and VRE maintained their green status, adding more than 7.6 points to the overall index.

| Top 10 stocks influencing the VN-Index on October 3, 2025 |

Similarly, the HNX-Index experienced a rather pessimistic trend, with negative impacts from stocks such as SHS (-2.8%), CEO (-4.47%), KSV (-1.82%), PVS (-3.08%), and others.

| Top 10 stocks influencing the HNX-Index on October 3, 2025 |

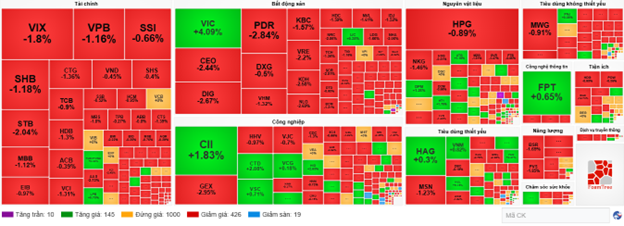

At the close, the market declined with red dominating most industry groups. The energy sector saw the sharpest decline at 1.84%, primarily due to stocks like BSR (-2.07%), PLX (-1.62%), PVS (-3.08%), and PVD (-3.03%). The materials and communication services sectors followed with declines of 1.52% and 1.29%, respectively. Conversely, the information technology sector was among the few to maintain a green status, leading the market with a 1.27% increase, largely driven by FPT (+1.41%), ELC (+0.44%), VEC (+9.92%), and HPT (+8.66%).

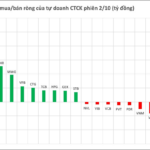

In terms of foreign trading, foreign investors continued to net sell over 1.185 trillion VND on the HOSE, focusing on stocks like MWG (261.51 billion), STB (187.57 billion), CTG (125.9 billion), and SHB (96.66 billion). On the HNX, foreign investors net sold over 86 billion VND, concentrated in SHS (32.06 billion), IDC (22.71 billion), CEO (8.38 billion), and MBS (8.04 billion).

| Foreign net buying and selling trends |

Morning Session: Weak Recovery Efforts

No significant recovery efforts were observed by the end of the morning session. At the mid-session break, the VN-Index fell by more than 10 points (-0.63%), settling at 1,642.32 points; the HNX-Index dropped to 266.24 points, a decline of 1.23%. Declining stocks outnumbered advancing ones, with 538 stocks falling and 165 rising.

Among the top 10 stocks influencing the VN-Index, VHM had the most negative impact, reducing the index by 1.87 points. TCB and CTG followed, further dragging the index down by over 2 points. Conversely, VIC was a notable bright spot, contributing nearly 6 points of increase.

| Stocks with the strongest impact on the VN-Index in the morning session of October 3, 2025 (measured in points) |

Most industry groups were submerged in red. The energy sector temporarily led the decline with a 1.57% drop due to negative performances from stocks like BSR (-1.69%), PLX (-1.47%), PVS (-2.77%), PVD (-3.03%), PVT (-1.1%), PVC (-1.74%), and MVB (-2.63%).

Large-cap sectors such as finance and industry exerted significant pressure on the overall index, both falling by 0.8%. Numerous stocks declined by more than 1%, including CTG, TCB, VPB, MBB, STB, HDB, SHB, VIX, BVH; HVN, GEE, GEX, VGC, PHP, PC1, and HHV.

Conversely, the information technology sector temporarily led the market, primarily due to the positive contribution of the leading stock FPT, which increased by 0.98%.

Source: VietstockFinance

|

Foreign investors net sold nearly 902 billion VND across all three exchanges. Selling pressure was concentrated in two stocks: MWG and STB, with values of 149.97 billion and 124.61 billion, respectively. Meanwhile, VIC led the net buying list with a value of 164.73 billion VND, significantly outpacing other stocks.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of October 3, 2025 |

10:30 AM: Red Dominates the Market

Negative trading sentiment continued to weaken key indices. As of 10:30 AM, the VN-Index fell by more than 10 points, trading around 1,642 points. The HNX-Index declined by over 2 points, trading around 266 points.

Banking stocks such as STB, TCB, VPB, and HDB negatively impacted the VN30-Index, reducing it by 1.36 points, 1.22 points, 1.22 points, and 0.64 points, respectively. Conversely, VIC, LPB, FPT, and VNM were among the few pillar stocks helping the VN30 retain more than 8.4 points.

Source: VietstockFinance

|

The financial sector continued to face challenges as widespread selling pressure persisted. Specifically, CTG fell by 1.55%, VCB by 0.16%, BID by 0.25%, and MBB by 0.93%. On the other hand, a few stocks showed slight recoveries, including LPB (+0.78%), DSE (+0.17%), and ORS (+0.37%).

The energy sector also performed poorly, recording the sharpest decline in the market at 1.48%. Selling pressure was concentrated in large-cap oil and gas stocks such as BSR (-1.69%), PLX (-1.32%), PVS (-1.85%), and PVD (-1.82%).

Compared to the opening, sellers gradually gained the upper hand, with 425 declining stocks and 145 advancing stocks.

Source: VietstockFinance

|

Market Open: Pillar Stocks Continue to Pressure the VN-Index

The market opened with red dominating most sectors. The VN30 index had the most negative impact, as most stocks within this group declined.

The financial sector followed suit, with stocks like VIX, SSI, VPB, SHB, STB, and HDB all in the red.

Real estate stocks also performed negatively from the opening, particularly DIG (-1.34%), PDR (-1.31%), CEO (-1.22%), and DXG (-0.25%).

Additionally, the industrial sector showed lackluster performance, with a majority of stocks in the red at the opening, including CII (-0.2%), VJC (-0.62%), GEX (-1.48%), and HHV (-0.97%).

The information technology sector performed well, supported primarily by FPT, which increased by 1.09% right from the opening.

– 15:25 03/10/2025

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.

Vietstock Daily 03/10/2025: Sluggish Trading Sparks Investor Impatience?

The VN-Index tumbled towards the end of the session, slicing through the Bollinger Bands’ Middle line. This movement reflects a resurgence of bearish sentiment as buying momentum remains subdued. Meanwhile, the Stochastic Oscillator has reissued a sell signal, while the MACD continues to weaken. The August 2025 low (around 1,600-1,630 points) is expected to provide support for the index should selling pressure intensify further.