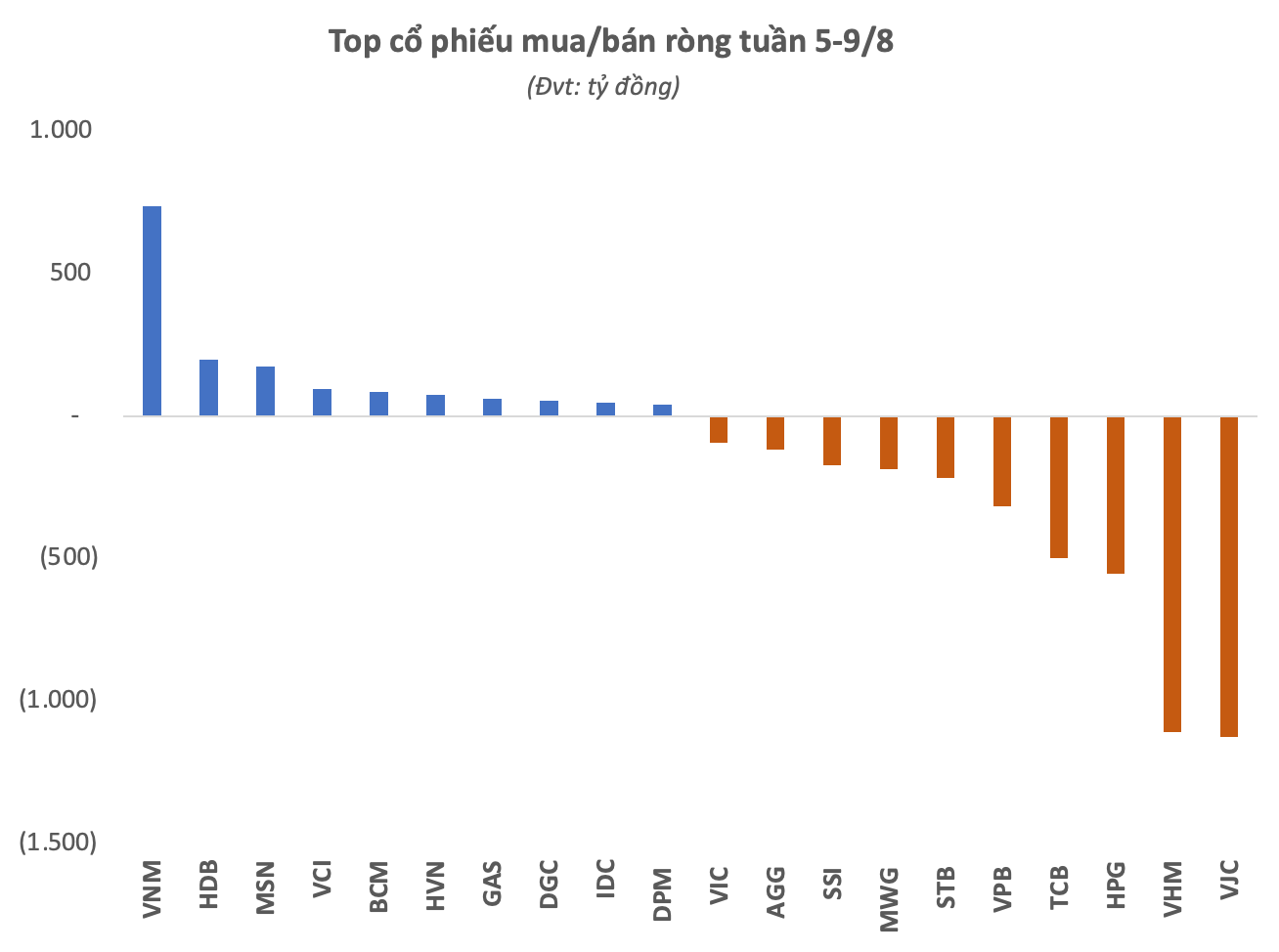

During the weekend trading session, the stock market opened in the red, pressured by selling in large-cap stocks. The VN-Index dipped near the 1,640-point mark before buying interest resurfaced, swiftly pushing the index back into positive territory. However, the gains were short-lived, as the VN-Index closed at 1,645.82 points, down 6.89 points or 0.42%. Amid this backdrop, foreign investors extended their net selling streak, offloading 1,311 billion VND across the market.

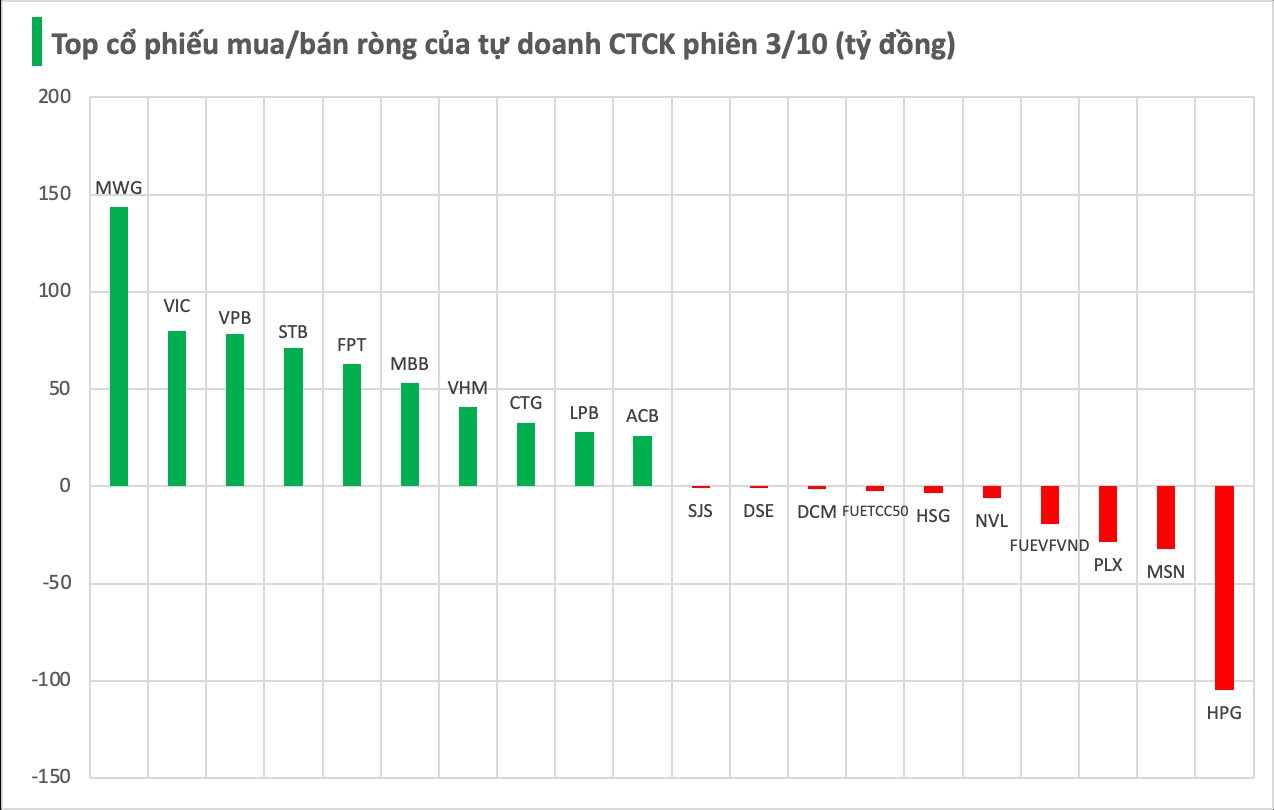

Securities firms’ proprietary trading desks continued their net buying spree, acquiring 638 billion VND worth of stocks on HOSE.

Specifically, MWG and VIC saw net purchases of 143 billion VND and 80 billion VND, respectively. They were followed by VPB (78 billion VND), STB (71 billion VND), FPT (63 billion VND), MBB (53 billion VND), VHM (41 billion VND), CTG (33 billion VND), LPB (28 billion VND), and ACB (26 billion VND), all of which were heavily bought by proprietary trading desks.

Conversely, the most heavily sold stocks by securities firms were HPG, with a net outflow of -105 billion VND, followed by MSN (-32 billion VND), PLX (-29 billion VND), FUEVFVND (-20 billion VND), and NVL (-6 billion VND). Other notable net sellers included HSG (-3 billion VND), FUETCC50 (-3 billion VND), DCM (-1 billion VND), DSE (-1 billion VND), and SJS (-1 billion VND).

Invest with Joy Daily and Win Surprising Rewards at IR Awards 2025

An office worker and a banker were both honored with awards at the prestigious IR Awards 2025. Their unexpected triumph stems from treating stock market engagement as a natural daily habit, rooted in a steadfast belief in transparency and a stress-free, relaxed investment philosophy.

Market Pulse 03/10: Red Dominates as VN-Index Struggles at 1,645 Points

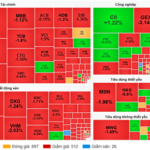

At the close of trading, the VN-Index fell by 6.89 points (-0.42%), settling at 1,645.82 points, while the HNX-Index dropped by 3.8 points (-1.41%), closing at 265.75 points. Market breadth favored decliners, with 513 stocks falling and 219 advancing. Similarly, the VN30 basket saw red dominate, with 19 stocks declining, 10 rising, and 1 unchanged.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.