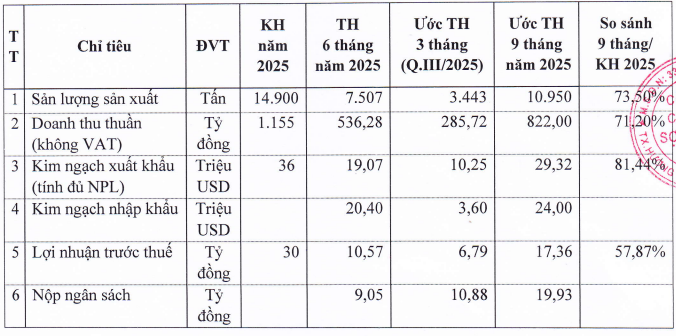

Compared to the 2025 plan, revenue and profit achieved 71% and 58% of the target, respectively.

|

Estimated business results for the first 9 months of 2025 by SPB

Source: SPB

|

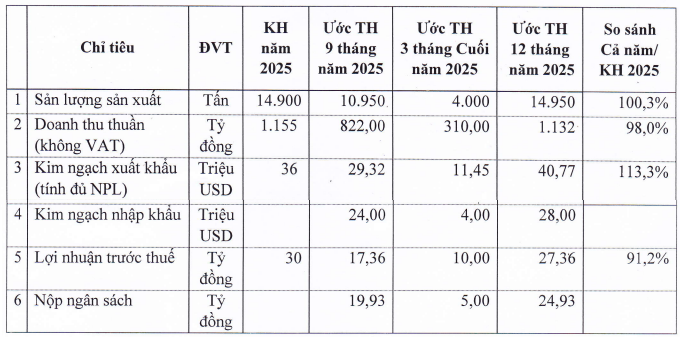

Not only the 9-month results, but SPB also estimates the business performance for the last quarter and the full year of 2025.

Specifically, SPB‘s net revenue and pre-tax profit for 2025 are projected to reach 1.132 trillion VND and over 27 billion VND, respectively. This represents a nearly 15% decrease in revenue but a significant 77% increase in profit compared to the previous year. These figures equate to 98% of the revenue target and 91% of the profit target set by the company at the beginning of the year.

|

Estimated business results for Q4 and full-year 2025 by SPB

Source: SPB

|

Regarding investment activities in 2025, SPB has adjusted the implementation timeline for the equipment replacement project at Factory 2 (including trial operation) to December 31, 2025, due to unforeseen circumstances.

Additionally, the total investment cost for minor upgrades in 2025, including supplementary investments for replacement or improvement of small-scale equipment at Factories 1, 2, and 3, amounts to approximately 34 billion VND.

– 3:35 PM, October 3, 2025

Sure, I can assist with that.

## ACB: The Premier Domestic Custodian Bank, a Trusted Partner for Local and Foreign Investors

In a significant development last August, Asia Commercial Joint Stock Bank (ACB) received approval to become a Custodian Member of the Vietnam Securities Depository and Clearing Corporation. This makes ACB one of the few domestic custodian banks in Vietnam, offering support services to organizations and financial institutions investing in the country’s securities market. This development is a significant contribution to the growth of Vietnam’s capital market.

Optimizing Trade and Investment Opportunities: Strengthening the Vietnam-Laos Partnership

On August 16, a mid-term conference was held in Cua Lo, Nghe An, to evaluate the implementation of the Vietnam-Laos Agreement on the Plan of Cooperation for 2024. The event was co-chaired by the leaders of the Ministries of Planning and Investment of both countries to review and promote the Bilateral Cooperation Agreement between Vietnam and Laos for the period 2021-2025.