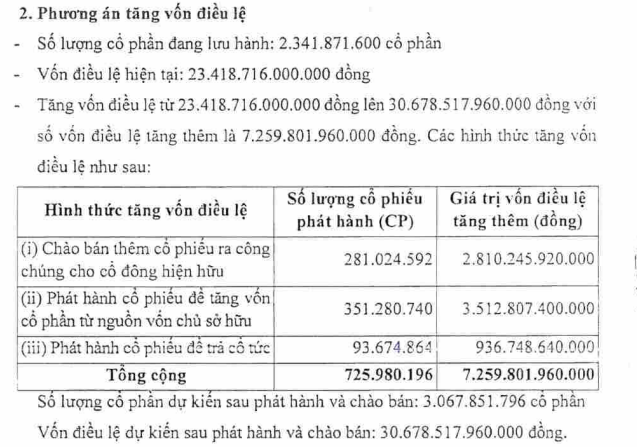

PetroVietnam Power Corporation (PV Power, stock code: POW, listed on HoSE) has announced the simultaneous implementation of three capital increase schemes through the issuance and offering of nearly 726 million shares in total.

First, PV Power will offer 281 million shares to existing shareholders. The rights issue ratio is 12%, meaning shareholders holding 100 shares will be entitled to purchase 12 new shares.

The offering price is set at VND 10,000 per share. Share purchase rights can be transferred once. The implementation is scheduled for 2025, with completion expected in Q1/2026.

The anticipated proceeds of VND 2,810 billion from this offering will be allocated to fund equity capital for the Nhon Trach 3 and Nhon Trach 4 power plant projects and to settle contracts with contractors, with disbursement planned from Q4/2025 to Q1/2026.

Second, PV Power plans to issue 351.2 million shares to increase capital from retained earnings (bonus shares). The rights issue ratio is 15%, allowing shareholders holding 100 shares to receive 15 new shares.

The funding for this issuance will come from the Development Investment Fund in PV Power’s audited financial statements for 2024.

Third, the company will issue 93.6 million shares as dividends. The dividend ratio is 4%, equivalent to VND 400 per share. The funding will be sourced from undistributed after-tax profits in the 2024 audited financial statements.

Upon completion of these three issuance schemes, PV Power’s charter capital will increase from VND 23,418.7 billion to VND 30,678.5 billion.

These schemes were approved at the Extraordinary General Meeting of Shareholders held on September 25, 2025. Since its IPO in 2018, PV Power’s charter capital has remained unchanged at VND 23,418.7 billion, with Vietnam Oil and Gas Group (Petrovietnam) holding nearly 80% of the shares.

In addition to the capital increase plan, POW shareholders also approved amendments to the business lines and updates to the company’s headquarters address.

PV Power’s management stated that to issue shares, the maximum foreign ownership ratio must be determined. However, some registered business lines currently have foreign ownership limits below 50%. Therefore, PV Power needs to adjust its operations to remove activities restricted for foreign investors.

Regarding business performance, in the first half of 2025, PV Power recorded consolidated revenue of nearly VND 17,970 billion and after-tax profit of VND 1,234 billion, representing increases of 13% and 87.5%, respectively, compared to the same period last year.

As a result, POW has surpassed its annual profit target by 180%, despite achieving less than half of its revenue goal.

SHB Seeks Shareholder Approval via Written Consent for 2025 Capital Increase Plan

Saigon-Hanoi Commercial Joint Stock Bank (SHB) announces October 16, 2025, as the final registration date for shareholders to be included in the list for written voting on the 2025 charter capital increase plan and other matters within the authority of the General Meeting of Shareholders.

Vietnam Airlines Successfully Raises Nearly VND 9,000 Billion, Ministry of Finance No Longer the Largest Shareholder

Vietnam Airlines (HOSE: HVN), the national flag carrier of Vietnam, has successfully raised nearly VND 9,000 billion through a public offering of 900 million shares.