I. VIETNAMESE STOCK MARKET FOR THE WEEK OF SEPTEMBER 29 – OCTOBER 3, 2025

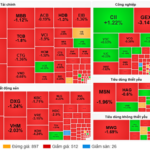

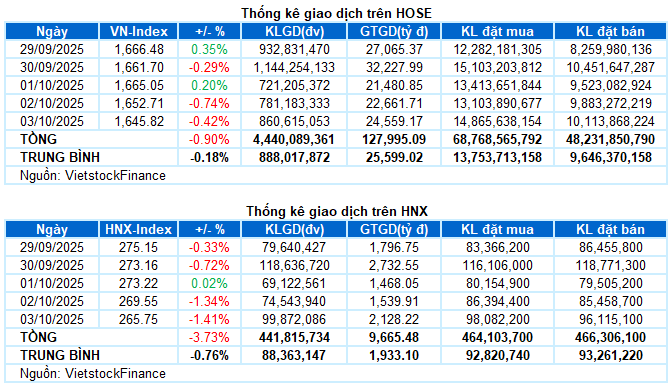

Trading: Major indices unanimously declined in the October 3 session. The VN-Index retreated to 1,645.82 points, a 0.42% decrease from the previous session; the HNX-Index also saw a sharp drop of 1.41%, closing at 265.75 points. For the week, the VN-Index lost 14.88 points (-0.9%), while the HNX-Index plummeted by 10.31 points (-3.73%) compared to the previous week.

Vietnam’s stock market concluded the first week of October on a negative note. Prolonged low liquidity, coupled with fluctuating market dynamics, eroded investor confidence. Selling pressure intensified in the final two sessions, breaking the VN-Index‘s sideways accumulation around 1,660 points. Despite efforts from a few leading stocks, the overall market weakness prevailed. The VN-Index ended the week at 1,645.82 points, nearly 15 points lower than the previous week.

Among the most influential stocks, VPB, CTG, and TCB exerted significant downward pressure in the final session, costing the VN-Index nearly 3 points. Meanwhile, VIC and VHM attempted to support the market, contributing a 6.5-point increase, but their efforts fell short of reversing the trend.

Red dominated most sectors, with energy being the worst performer, declining by 1.84%. Stocks like BSR (-2.07%), PLX (-1.62%), PVS (-3.08%), PVD (-3.03%), PVT (-1.39%), PVC (-3.48%), TMB (-1.29%), and PVB (-2.02%) faced heavy selling pressure.

Large-cap financial and industrial sectors also weighed on the market, dropping by nearly 1%. Several stocks corrected over 2%, including VPB, STB, HDB, BVH, SHS, MBS; HVN, GEE, GEX, VGC, PC1, and HHV.

In contrast, information technology and real estate sectors bucked the trend, rising over 1%. This was primarily driven by sector leaders such as FPT (+1.41%), ELC (+0.44%), VEC (+9.92%); VIC (+3.22%), VHM (+1.42%), and VRE (+3.15%). However, other stocks in these sectors performed poorly, including CMG (-1.14%), DLG (-1.4%), POT (-7.62%); CEO (-4.47%), DIG (-4.23%), KDH (-3.79%), NVL (-2.58%), TCH (-3.17%), NLG (-4.23%), and PDR (-5.68%).

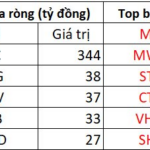

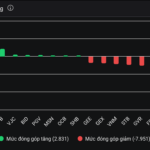

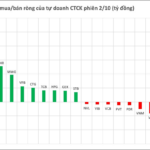

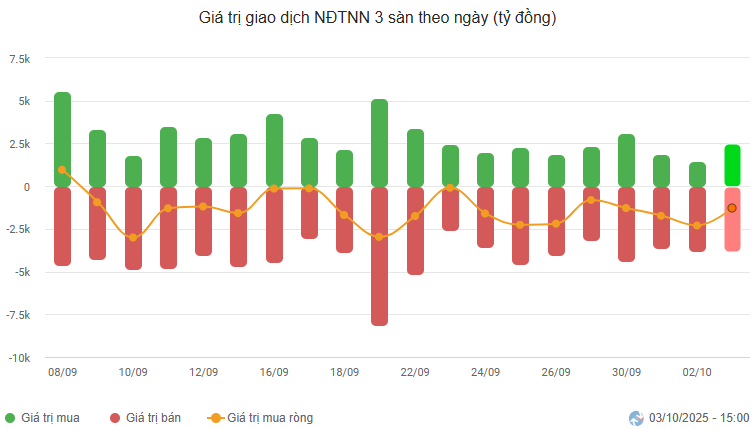

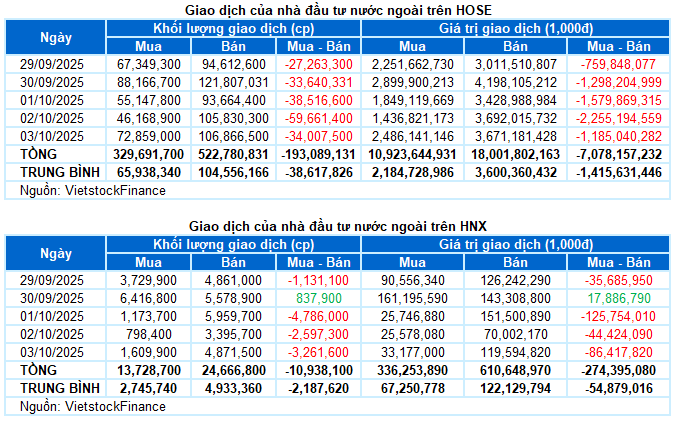

Foreign investors continued to net sell, with a total value exceeding 7.3 trillion VND across both exchanges last week. Specifically, they net sold nearly 7.1 trillion VND on the HOSE and 274 billion VND on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

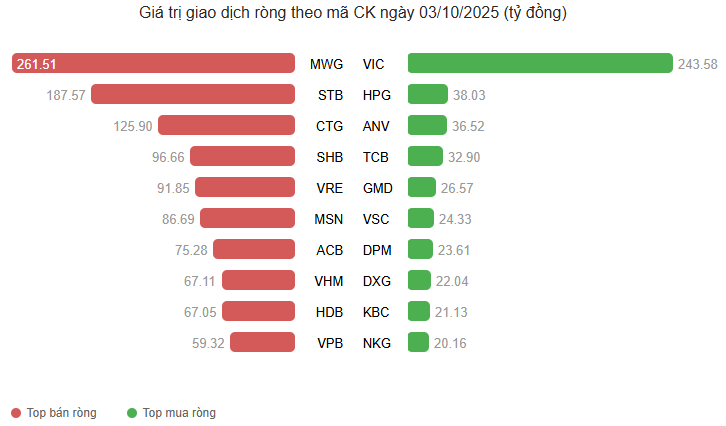

Net Trading Value by Stock Code. Unit: Billion VND

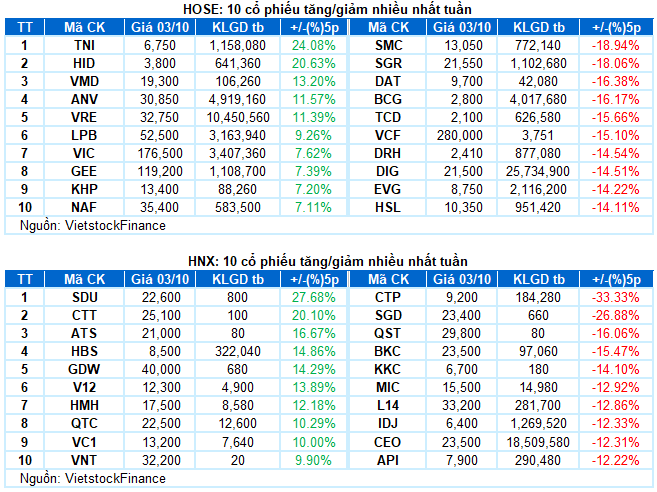

Top Gaining Stock of the Week: LPB

LPB +9.26%: LPB concluded the week with four consecutive gaining sessions, closely following the Upper Band of the Bollinger Bands.

Currently, the MACD indicator continues to widen its gap from the Signal line, indicating a supported uptrend. The potential for setting a new historical high remains promising. However, the Stochastic Oscillator has entered the overbought zone, suggesting that any pullback could find support at the previously broken August 2025 peak (around 47,000-49,000).

Top Losing Stock of the Week: SGR

SGR -18.06%: SGR continued its downward spiral last week, with 4 out of 5 sessions closing in the red. Volatile trading volumes reflect investor uncertainty.

Notably, a Death Cross has formed as the 50-day SMA crossed below the 100-day SMA, further dampening short-term prospects. In this context, the April 2024 low (around 19,500-21,000) is expected to provide support for the stock price in the near term.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 17:48 October 3, 2025

Foreign Block’s Massive Sell-Off: Unloading 1.3 Trillion VND in the Week’s Final Session – What’s Driving the Sell-Off?

In the afternoon trading session, VIC emerged as the most heavily bought stock across the entire market, with a staggering net buying value of 344 billion VND.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.

Vietstock Daily 03/10/2025: Sluggish Trading Sparks Investor Impatience?

The VN-Index tumbled towards the end of the session, slicing through the Bollinger Bands’ Middle line. This movement reflects a resurgence of bearish sentiment as buying momentum remains subdued. Meanwhile, the Stochastic Oscillator has reissued a sell signal, while the MACD continues to weaken. The August 2025 low (around 1,600-1,630 points) is expected to provide support for the index should selling pressure intensify further.