Technical Signals of VN-Index

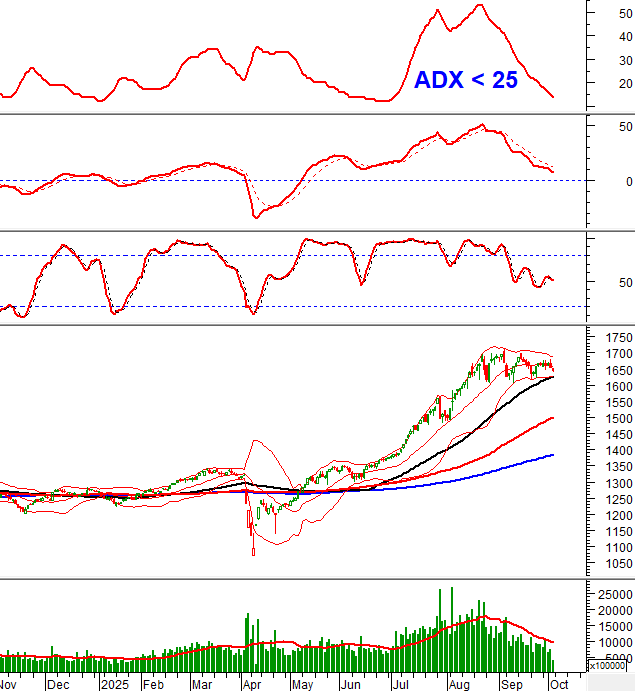

During the morning trading session on October 3, 2025, the VN-Index continued its downward trend, approaching the previous low from August 2025 (around 1,600-1,630 points).

The Stochastic Oscillator has recently issued a sell signal, indicating that market volatility is likely to persist in upcoming sessions.

Technical Signals of HNX-Index

In the morning session on October 3, 2025, a Triangle pattern has formed, targeting a price decline to the 245-250 point range.

The short-term outlook remains unfavorable as the MACD indicator continues to trend downward, breaking below the zero line.

KDH – Khang Dien House Investment and Trading JSC

During the morning session on October 3, 2025, KDH shares experienced a fifth consecutive sharp decline, accompanied by a Big Black Candle pattern and above-average trading volume, reflecting significant investor pessimism.

The stock price remains below the 50-day SMA, with the MACD indicator crossing below zero and continuing to decline after issuing a sell signal. This suggests a persistently negative short-term outlook.

If the bearish scenario persists, the long-term 100-day and 200-day SMA levels will serve as key support in upcoming sessions for KDH.

PVD – Petrovietnam Drilling and Well Services Corporation

In the morning session on October 3, 2025, PVD shares broke below the medium-term Bullish Price Channel and extended their decline for a fourth consecutive session, highlighting investor pessimism.

Currently, PVD is trading near the Lower Band of the Bollinger Bands, while the MACD indicator remains below zero after issuing a sell signal. Without improvement in upcoming sessions, the negative outlook is likely to persist.

(*) Note: The analysis in this article is based on realtime data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:02 October 3, 2025

Market Pulse 03/10: Red Dominates as VN-Index Struggles at 1,645 Points

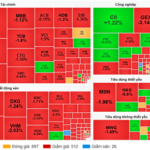

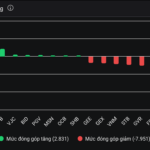

At the close of trading, the VN-Index fell by 6.89 points (-0.42%), settling at 1,645.82 points, while the HNX-Index dropped by 3.8 points (-1.41%), closing at 265.75 points. Market breadth favored decliners, with 513 stocks falling and 219 advancing. Similarly, the VN30 basket saw red dominate, with 19 stocks declining, 10 rising, and 1 unchanged.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

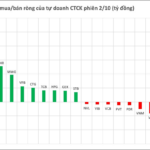

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.

Foreign Block’s Massive Sell-Off: Unloading 1.3 Trillion VND in the Week’s Final Session – What’s Driving the Sell-Off?

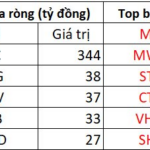

In the afternoon trading session, VIC emerged as the most heavily bought stock across the entire market, with a staggering net buying value of 344 billion VND.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.