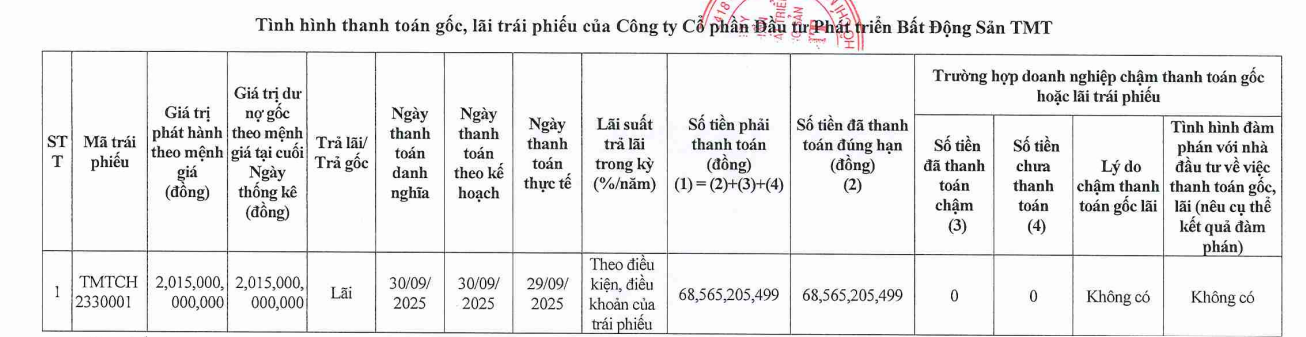

TMT Real Estate Investment and Development Joint Stock Company (TMT Real Estate) has submitted a report to the Hanoi Stock Exchange (HNX) detailing the principal and interest payments on its corporate bonds.

The company successfully paid approximately VND 69 billion in interest for the bond series TMTCH2330001. The scheduled payment date was September 30, 2025, but the actual payment was made a day earlier on September 29, 2025.

Source: HNX

Previously, on June 30, 2025, TMT Real Estate had already paid nearly VND 560 billion in interest for the same bond series.

The TMTCH233001 bonds were issued on June 30, 2023, with a total value of VND 2,015 billion. The bonds have an 84-month term, maturing on June 30, 2030.

Details regarding bondholders, issuance purposes, and collateral assets remain undisclosed. However, HNX reports that these bonds carry an annual interest rate of 14%.

This is the only bond series currently in circulation by TMT Real Estate. As of October 1, 2025, the outstanding value of this series stands at VND 2,015 billion.

Established on July 6, 2021, TMT Real Estate primarily engages in real estate trading, land use rights ownership, and leasing.

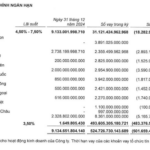

At inception, the company’s charter capital was VND 20 billion, held by three shareholders: Trần Anh Vinh (5%), Nguyễn Thị Mỹ Linh (85%), and Lê Thị Thu Linh (10%). Lê Thị Thu Linh (born in 1978) serves as the Director and legal representative.

In June 2023, coinciding with the issuance of the VND 2,015 billion bond series, the company increased its charter capital 18-fold, from VND 20 billion to VND 360 billion.

TMT Real Estate is known as the controlling shareholder of Mỹ Phước Investment and Development LLC.

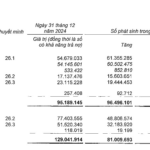

According to a registration change in late May 2025, Mỹ Phước’s charter capital is VND 2,380 billion, with TMT Real Estate holding 84.842%. The remaining shareholders are Mekong Investment and Technical Consulting JSC (0.084%) and The Cielo Dragon LLC (15.074%).

Trần Anh Vinh (born in 1964) serves as Mỹ Phước’s Director and legal representative. Vinh is recognized as a founding shareholder and former Director/legal representative of TMT Real Estate before Nguyễn Thế Nhiên assumed this role.

Nguyễn Thế Nhiên is also authorized to manage TMT Real Estate’s VND 2,015 billion capital contribution in Mỹ Phước as of May 2025.

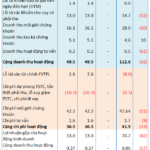

According to documents, in October 2023, Mỹ Phước Investment and Development pledged all asset rights arising from Business Cooperation Contract No. 1506/2023/TPRE-MPC (dated June 15, 2023) and its amendments with Tiến Phước Real Estate JSC for the Tiến Phước Housing Project (Ho Chi Minh City) as collateral at PVcomBank Saigon Branch.

Simultaneously, TMT Real Estate pledged its VND 2,373 billion capital contribution (99.916% of charter capital) and associated benefits in Mỹ Phước Investment and Development at PVcomBank Saigon Branch.

Rendering of the Senturia Nam Sài Gòn Project. Image: Tiến Phước Group.

The Tiến Phước Housing Project, commercially known as Senturia Nam Sài Gòn, spans 19.8 hectares with a 29.34% construction density. It comprises 441 units, including 263 townhouses, 94 villas, and 84 shophouses.

This project is one of Tiến Phước Group’s flagship developments. Founded in October 1992 as Tiến Phước Agricultural Products and Essential Oils Company, it was renamed Tiến Phước LLC in 2003 and converted to a joint-stock company in April 2015.

Currently, Nguyễn Thị Mỹ Phương serves as CEO of Tiến Phước Group. She is the eldest daughter of Nguyễn Thành Lập (founder of Tiến Phước Group) and sister to Nguyễn Thị Mỹ Linh (founding shareholder of TMT Real Estate).

Beyond Senturia Nam Sài Gòn, Tiến Phước Group has developed several prominent projects in Southern Vietnam, including Le Meridien Hotel (3C Tôn Đức Thắng, HCMC), Long Trường Residential Area (HCMC), Senturia Vườn Lài (9.8 hectares, HCMC), Palm Heights (30 hectares, HCMC), and Senturia An Phú (18.2 hectares, HCMC).

Vingroup Plans to Issue VND 2.5 Trillion in Corporate Bonds

Vingroup is set to issue VND 2.5 trillion in 24-month bonds as part of its debt restructuring strategy.