As October 2025 unfolds, Agriseco Securities forecasts the VN-Index to continue its sideways movement within a broad range before establishing a new trend.

Positive factors influencing the market include: (1) the gradual release of Q3/2025 business results, expected to show continued growth across various sectors; (2) an anticipated economic acceleration in the final quarter, targeting an 8.3–8.5% growth rate through increased public investment and monetary easing; (3) the potential FTSE upgrade of Vietnam to emerging market status, which could attract foreign capital.

However, investors should remain cautious about lingering risks such as significant net selling pressure from foreign investors, high exchange rates, and the possibility of market upgrade progress falling short of expectations.

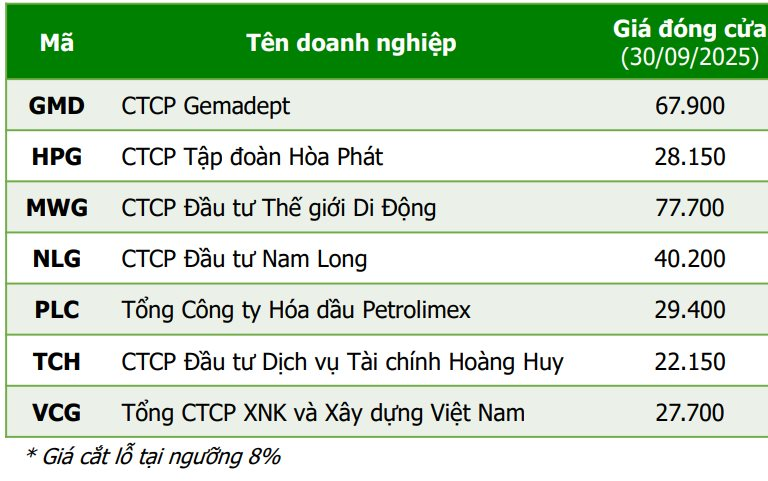

Based on these insights, Agriseco Research recommends a October portfolio of 7 stocks with strong fundamentals, positive Q3/2025 earnings projections, and benefits from government economic support policies.

For Gemadept Corporation (ticker: GMD), Agriseco anticipates that on-schedule projects like Nam Dinh Vu Port Phase 3 and Gemalink Phase 2A will soon contribute to earnings. In Q3/2025, a 10% increase in deep-water port handling fees is expected to boost GMD’s operations, given its position as the largest deep-water port operator in Vietnam. Handling fees may rise another 10% in 2026 as planned.

Another familiar name in the recommended portfolio is Hoa Phat Group (ticker: HPG). Agriseco projects HPG’s Q3 earnings to grow over 20% year-on-year. Steel consumption has increased due to: (1) a vibrant domestic real estate market and accelerated infrastructure project disbursements offsetting export declines; (2) Blast Furnace No. 6’s September operation adding HRC supply. Additionally, gross margins are expected to improve as steel prices fell only 1% year-on-year while input costs (coke, iron ore) dropped 12%.

In the Retail sector, Agriseco highlights Bach Hoa Xanh (BHX) as a key growth driver for Mobile World Group (ticker: MWG). By September, BHX opened 463 new stores, primarily in Central Vietnam, leaving significant expansion room. Existing Mobile World and Dien May Xanh stores showed improved efficiency post-restructuring, with August sales rising 14% year-on-year despite no new openings. Agriseco forecasts Q3 profits to surge over 80% year-on-year due to higher sales and operational efficiency.

In Real Estate, Nam Long Investment Corporation (ticker: NLG) is expected to see improved sales driving future earnings growth as markets near Ho Chi Minh City, like Long An and Dong Nai, recover due to infrastructure development and provincial mergers. For 2025, NLG’s net profit is projected to rise over 30% year-on-year from financial revenue gained by selling a 15.1% stake in Izumi City to Tokyu Corporation, with proceeds expected in late 2025.

Similarly, Hoang Huy Financial Services Investment Corporation (ticker: TCH)’s earnings growth is tied to new project launches. TCH focuses on three major 2025–2027 projects: Hoang Huy Gren River, New City II, and Hoang Huy Commerce H2 – Rose Residence. Notably, Green City and New City 2, expected to deliver by late 2025, are projected to be TCH’s primary revenue sources in the next 2–3 years.

Additionally, subsidiary CRV completed its HOSE listing application in June 2025 and set a 2025 target of VND 4 trillion in revenue (+82% year-on-year) and VND 1.6 trillion in net profit (+250% year-on-year). A successful IPO and CRV’s target achievement would benefit TCH through cash inflows, asset value increases, and enhanced real estate transparency and credibility.

Meanwhile, accelerated public investment in the final months of 2025 is expected to boost asphalt sales, positively impacting Petrolimex Petrochemical Corporation (ticker: PLC).

As of August 2025, public investment disbursement reached 46.3% of the Prime Minister’s target, with expectations of rapid acceleration to meet the 2021–2025 medium-term goal. With Vietnam aiming for 3,000 km of highways by 2025 and 5,000 km by 2030, asphalt demand for infrastructure projects is set to rise, potentially increasing PLC’s asphalt revenue and profit in 2025.

Agriseco notes that Bitumen prices, a key input for asphalt production, have declined since early 2025, tracking global crude oil trends. In 2025, organizations like OPEC and EIA predict Brent crude oil prices to fall 8–10% year-on-year. Lower input costs will help asphalt companies like PLC reduce production expenses and improve gross margins.

Agriseco highlights Vinaconex (ticker: VCG)’s real estate segment as a key earnings growth driver in 2025, supported by high-margin project deliveries. Premium projects like Vera Diamond City and Vinaconex Diamond Tower saw strong Q3/2025 absorption rates.

In Q3/2025, VCG completed the sale of 107.1 million shares in VINACONEX ITC (ticker: VCR) at a minimum price of VND 48,000 per share, generating over VND 5.3 trillion. This divestment significantly boosted profits and attracted investment. The infrastructure construction segment is also expected to drive revenue growth, supported by a VND 27 trillion backlog.

Week 29/9 – 3/10: Foreign Investors Offload Another VND 7.6 Trillion, Which Stocks Were Hit Hardest?

Foreign investors maintained their strong net selling pressure, recording another week of net outflows exceeding 7,000 billion VND.

“Reaching a Decade-High Peak: This Locality Leads the Nation in GRDP Growth for the First 9 Months of the Year”

Quảng Ninh has recorded an impressive economic growth rate of approximately 11.67% over the past nine months, ranking first among 34 provinces and cities nationwide. This marks the highest growth rate the province has achieved in the last decade, surpassing its previous annual fluctuations between 8.02% and 10.12%.

Central Bank Projects 19-20% Credit Growth for 2025

As of September 29, 2025, Vietnam’s economic credit growth has surged to 13.37% compared to the end of 2024, according to data from the State Bank of Vietnam (SBV).