In the midst of the booming digital economy, small and medium-sized enterprises (SMEs) in Vietnam are undergoing a significant transformation, shifting from traditional models to digital operations. They have emerged as pioneers, becoming the new backbone of the consumer market. However, challenges related to cash flow, working capital, and short-term financing remain significant barriers, especially during peak seasons like holidays and Tet, when demand for shopping, inventory, and payments surges.

To address these challenges, VIB and Visa have collaborated to introduce a comprehensive financial solution for supply chains in Vietnam.

Ms. Tuong Nguyen – Deputy CEO of VIB and Ms. Dang Tuyet Dung, Director of Visa Vietnam and Laos.

A Flexible Financial Ecosystem for Distribution Businesses

The solution is built on a deep understanding of the real needs of businesses, including suppliers, manufacturers, distributors, and retailers, focusing on three key elements: Capital – Cash Flow – Payment.

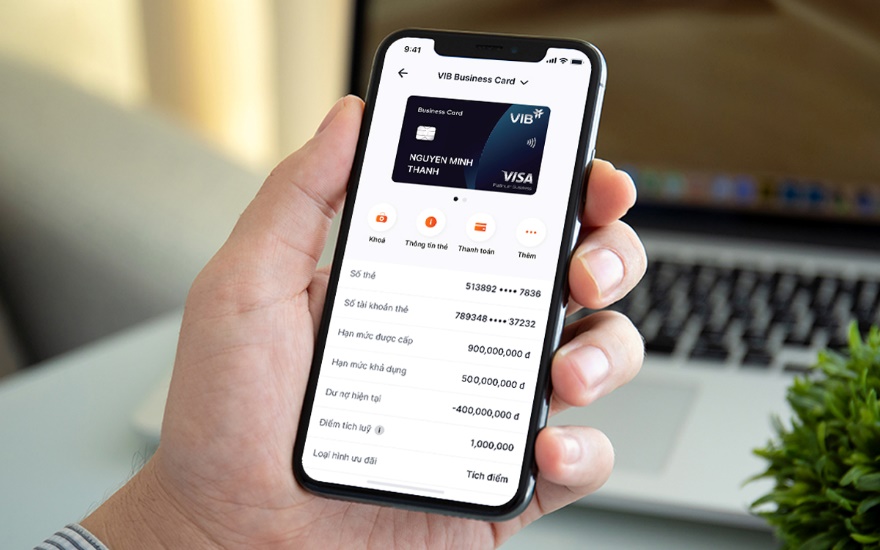

The VIB Business Card (Visa) is designed as a short-term capital source for SMEs, with a credit limit of up to 1 billion VND and an interest-free period of up to 58 days – the longest in the market. This helps businesses manage short-term capital, optimize financial costs, and ensure uninterrupted operations. The card offers flexibility with unlimited reward points or lifetime annual fee waivers, and allows for unlimited supplementary cards to meet diverse operational needs. Cardholders spending over 500 million VND/year enjoy unlimited access to airport lounges. The combination of VIB’s financial solutions and Visa’s technology platform helps businesses comply with new regulations on cashless transactions for VAT refunds, while ensuring transparent, efficient, and sustainable cash flow management.

VIB’s High-Yield Business Account is designed to optimize cash flow, helping SMEs and businesses turn idle capital into passive income, offering both high returns and flexible withdrawal options. With attractive interest rates ranging from 2.5%/year to 4.5%/year – among the highest in the market, customers can withdraw funds at any time without losing interest. For example, a business receiving 1.1 billion VND in sales and activating the High-Yield Account with a threshold of 100 million VND, maintaining a balance of 1 billion VND for 90 days, can earn a total profit of 9.2 million VND – significantly higher than the interest from a regular transaction account. This smart solution helps businesses optimize capital efficiency while ensuring liquidity for short-term financial needs.

The QR Checkout & SoftPOS payment solutions on the VIB Business digital banking platform offer businesses a modern, secure, and transparent payment ecosystem. Transactions are processed quickly, streamlining payment collection, reducing cash risks, and automating recording and reconciliation for convenience. The QR payment service includes a notification speaker to manage cash flow by store or cashier. The SoftPOS solution turns smartphones into mobile POS devices, integrated with the VIB Business App, offering maximum flexibility. All revenue from payment channels is stored on a cloud platform, enabling easy receipt retrieval and ensuring transparency in every transaction.

Ms. Tuong Nguyen, Deputy CEO of VIB, shared: “With this financial ecosystem, we aim to support distributors, retailers, and SMEs in managing their finances more effectively. The solution not only eases cash flow and capital pressure during peak seasons but also promotes a sustainable approach, where every idle fund is utilized to create additional value.”

Visa: Vietnam Leads the Region in Business Card Adoption

A recent study by Visa, conducted by KoreFusion, reveals that Vietnamese businesses lead the Asia-Pacific region in using business cards for B2B payments. Card payments in Vietnam account for 8.3% of total B2B sales at accepting merchants – the highest in the region and more than double the average of 3.3%.

At the launch event, Ms. Dang Tuyet Dung, Director of Visa Vietnam and Laos, emphasized: “Vietnamese businesses are regional leaders in adopting business cards. However, SMEs still face challenges in fully leveraging digital technology. This is why Visa and VIB have introduced a supply chain financial solution, offering three clear benefits: expanded access to capital, enhanced transparency and security, and optimized cash flow.”

With Visa’s B2B payment solution, VIB cardholders can make payments to any business account, even if the recipient does not accept card payments, improving cash flow with attractive early payment discounts, enhancing expense control, and reducing operational tasks through digitization and data utilization.

Ms. Dung also affirmed: “For over 30 years, Visa has been committed to developing safe, convenient payment methods, contributing to Vietnam’s digital economy. Our partnership with VIB today is not just about a financial product but also a catalyst for Vietnamese businesses to expand regionally and globally.”

According to Visa’s research, expanding B2B card acceptance can improve net profit margins by an average of 52 basis points and boost sales by 2.14%, with half of the increase coming from new customers. This presents a significant opportunity for Vietnamese SMEs, which often face operational cost and debt management pressures.

Combining VIB’s financial strength with Visa’s global technology platform, the solution is expected to create a new path for Vietnam’s supply chains, where capital management, payments, and profitability operate within a transparent, secure, and sustainable ecosystem.

Experience the VIB Business Card here and start enjoying VIB’s flexible financial ecosystem today.