According to preliminary statistics from the General Department of Customs, Vietnam’s livestock feed exports in August 2025 surged by 46% compared to August 2024, reaching nearly $128.2 million.

For the first eight months of 2025, exports in this category totaled approximately $869.5 million, marking a 29% increase compared to the same period in 2024.

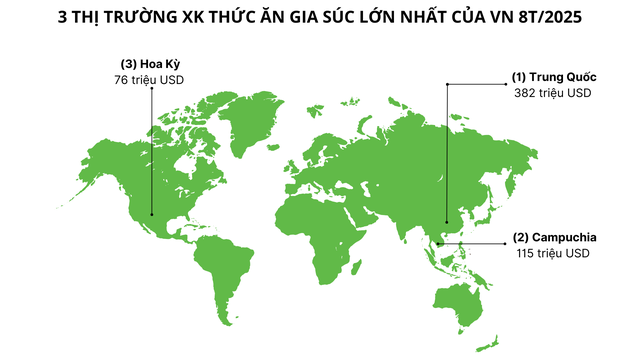

China was the largest importer of Vietnamese livestock feed in the first eight months of 2025, accounting for 44% of the total export value, with over $382.4 million, a 41% rise compared to the same period in 2024. In August 2025 alone, exports to China soared by 90% compared to August 2024.

Cambodia ranked second, with a 13% market share, reflecting a 44% increase compared to the same period in 2024. In August 2025, exports to Cambodia reached $19.02 million, a 41.5% jump compared to August 2024.

Meanwhile, exports to the U.S. market in August 2025 decreased by 23.9% compared to August 2024, totaling $10.6 million. For the first eight months of 2025, exports to the U.S. declined by 14.5% compared to the same period in 2024, reaching $75.99 million.

The National Agricultural Extension Center highlights that the livestock industry has long played a crucial role in economic development and ensuring national food security. Currently, livestock farming is a vital livelihood for over 10 million rural households.

The Ministry of Agriculture and Rural Development reports that Vietnam annually requires 32-33 million tons of livestock feed. Alongside spending nearly $3 billion on imports, the industry is also focusing on exports. The number of feed production plants has grown significantly in both quantity and capacity. In 2019, Vietnam had 261 plants producing 18.9 million tons; by 2023, this increased to 294 plants with a production capacity of 20 million tons. Foreign-invested enterprises account for approximately 60% of production volume, while domestic enterprises contribute around 40%.

With its strong growth potential in recent years, Vietnam’s livestock feed market is attracting numerous enterprises, including many foreign-invested companies expanding their production operations. Notable players include Cargill Group (USA), Haid (China), CP Group (Charoen Pokphand Group – Thailand), De Heus (Netherlands), BRF (Brazil), Mavin (France), Japfa (Singapore), and CJ (South Korea).

Under the Livestock Feed Processing Industry Development Plan by 2030, Vietnam’s industrial livestock feed production is projected to reach 24-25 million tons by 2025 and 30-32 million tons by 2030, meeting at least 70% of domestic demand for processed livestock feed.

The global population growth necessitates a significant increase in food production to ensure worldwide food security. Additionally, as disposable incomes rise in developing countries, the demand for animal protein such as meat, dairy, and eggs also increases. These shifts in population growth and dietary preferences directly translate into higher demand for livestock feed.

Groundbreaking Ceremony for Two Mega Projects Totaling 182 Trillion VND in Hai Phong

On September 26th, Prime Minister Pham Minh Chinh attended the groundbreaking ceremony for two significant projects in Hai Phong: the infrastructure development of the Tan Trao Industrial Zone (Phase 1) and the Hai Phong LNG Thermal Power Plant.