According to preliminary statistics from the Customs Department, Vietnam’s crude oil imports in August reached over 670,000 tons, valued at more than $653 million. This reflects a 32% decrease in volume but an 18.3% increase in price compared to July.

Cumulatively, in the first eight months of the year, Vietnam imported over 8.7 million tons of crude oil, worth more than $5.2 billion, marking a 4% decline in volume and a 9.1% drop in value compared to the same period in 2025.

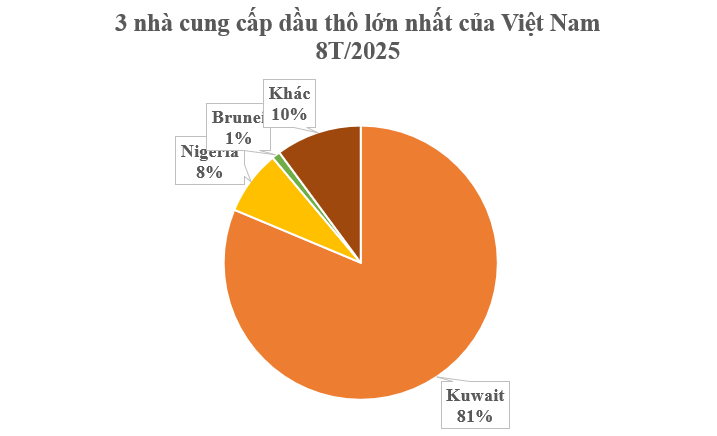

In terms of market sources, a Middle Eastern oil field has been Vietnam’s largest crude oil supplier for many years. Specifically, Kuwait exported over 7.1 million tons of crude oil to Vietnam, valued at more than $4.2 billion, representing a 10% decrease in volume and a 15% decline in value compared to the first eight months of 2024. The average import price was $591 per ton, a 6% decrease from the same period in 2024.

Nigeria ranked second, supplying over 666,000 tons valued at more than $384 million, a significant 27% increase in volume and a 9% rise in value compared to the same period in 2024. The average export price was $576 per ton, a 14% decrease year-over-year.

Brunei was the third-largest supplier, providing over 86,000 tons valued at nearly $50 million, a 5% increase in volume but a 10% decrease in value compared to the previous year. The average price was $580 per ton, reflecting a 15% decline.

Annually, Vietnam spends a substantial amount of foreign currency on importing raw materials, including coal, crude oil, petroleum products, and liquefied petroleum gas, to support production, consumption, and economic development. Kuwait, which began exporting crude oil in 1946 and is a founding member of OPEC, is the fifth-largest producer within the organization, with proven oil reserves of 101.5 billion barrels.

Despite being a resource-rich nation and a significant crude oil exporter, Vietnam still relies on importing crude oil and petroleum products from other countries. This is due to declining domestic oil production. In 2023, Vietnam’s crude oil output was approximately 10.84 million tons, a slight decrease from the previous year.

According to experts, crude oil is categorized into sweet and sour types (based on sulfur content) and light and heavy types (based on density). Each refinery is designed to process specific oil types or blends with particular characteristics. For instance, the Dung Quat Refinery (Binh Son Refining and Petrochemical Joint Stock Company) is designed to process oil from the Bach Ho field. Bach Ho oil, produced by the Vietsovpetro joint venture, is a light sweet crude with a sulfur content of 0.03% by weight. In contrast, the Nghi Son Refinery is configured to process Kuwaiti oil blends with a sulfur content of 2.52%.

Consequently, even though Vietnam extracts domestic oil, not all crude types are compatible with the processing technologies of the Nghi Son and Dung Quat refineries. This necessitates exporting domestically produced crude oil unsuitable for local refining and importing compatible crude oil for processing.