The market experienced a lackluster transition from Q3 to Q4/2025, maintaining a narrow accumulation range below the 1,700-point resistance level. The benchmark index fluctuated narrowly around 1,660 points during the first three sessions, with declining liquidity and intensified selling pressure in the subsequent sessions. The week’s trading activity revealed a divergence in sector performance, as selling pressure primarily stemmed from stocks that had previously rallied, such as real estate and public investment. Conversely, buying interest returned to select large-cap stocks in the banking and securities sectors. By week’s end, the VN-Index closed at 1,645.82 points, down 14.88 points (-0.90%), remaining above the psychological support level of 1,600 points.

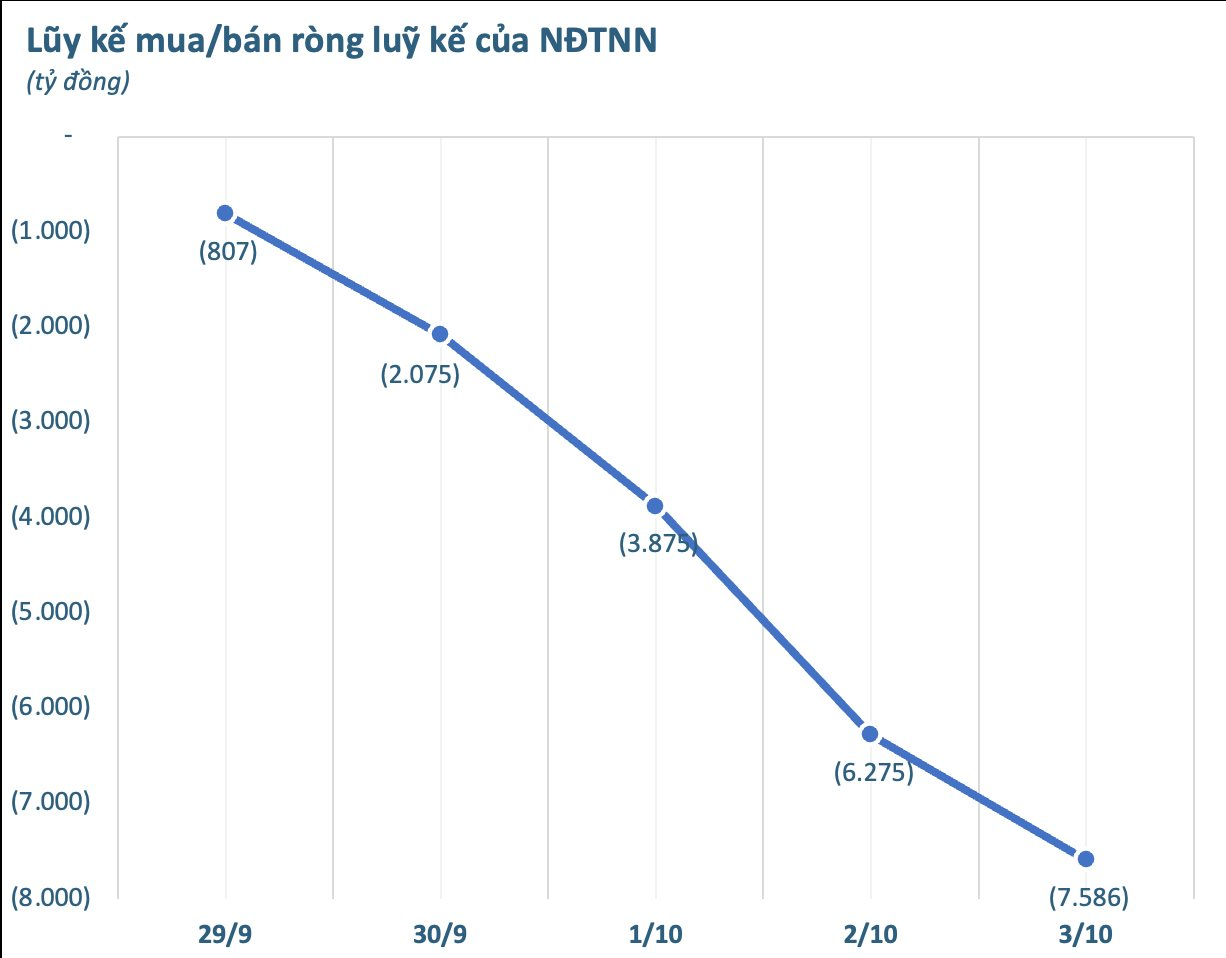

Foreign investors continued their strong net selling trend, offloading thousands of billions of dong. Over the five sessions, foreign investors net sold VND 7,586 billion.

On individual exchanges, foreign investors net sold VND 7,252 billion on HoSE, VND 273 billion on HNX, and VND 61 billion on UPCoM.

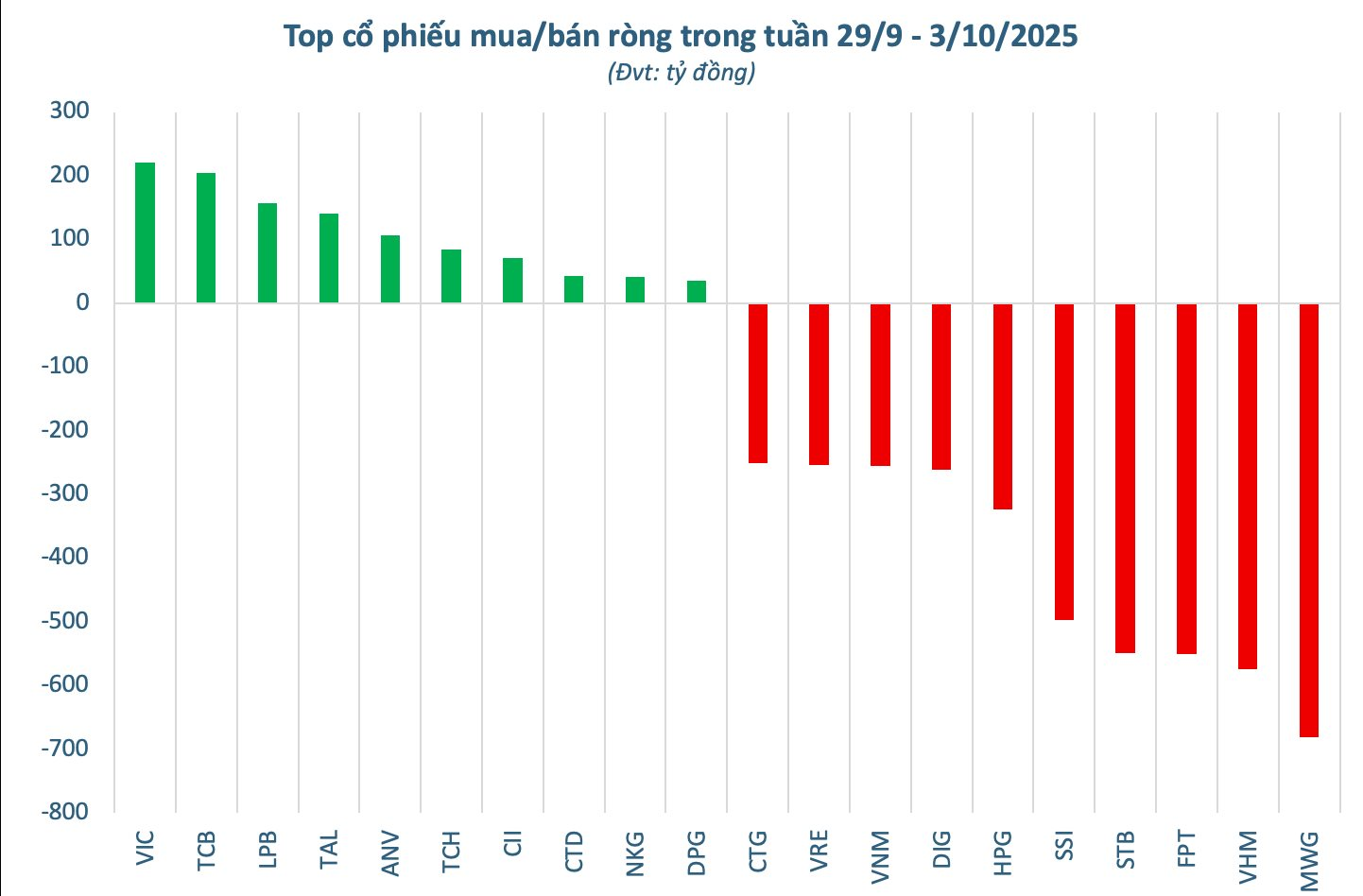

Among specific stocks, MWG faced the heaviest net selling pressure, with a total value of VND 681 billion, significantly outpacing other stocks. VHM followed with net selling of VND 573.3 billion, while FPT (VND 550.1 billion) and STB (VND 548.5 billion) also experienced substantial outflows. Other large-cap stocks under withdrawal pressure included SSI (VND 496.3 billion), HPG (VND 323.3 billion), DIG (VND 260.7 billion), and VNM (VND 255.5 billion). VRE, CTG, MSN, and SHB recorded net selling ranging from VND 217 billion to VND 253 billion each.

On the buying side, VIC led with net purchases of VND 221.7 billion, followed by TCB (VND 205.1 billion), LPB (VND 157.5 billion), and TAL (VND 141.1 billion). ANV (VND 106.3 billion), TCH (VND 84.1 billion), and CII (VND 71.1 billion) also attracted notable foreign interest. Additionally, CTD, NKG, DPG, GMD, and GEE recorded net buying values ranging from VND 26 billion to over VND 43 billion.

Market Pulse 03/10: Red Dominates as VN-Index Struggles at 1,645 Points

At the close of trading, the VN-Index fell by 6.89 points (-0.42%), settling at 1,645.82 points, while the HNX-Index dropped by 3.8 points (-1.41%), closing at 265.75 points. Market breadth favored decliners, with 513 stocks falling and 219 advancing. Similarly, the VN30 basket saw red dominate, with 19 stocks declining, 10 rising, and 1 unchanged.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.