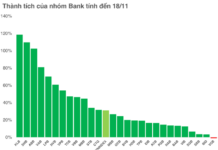

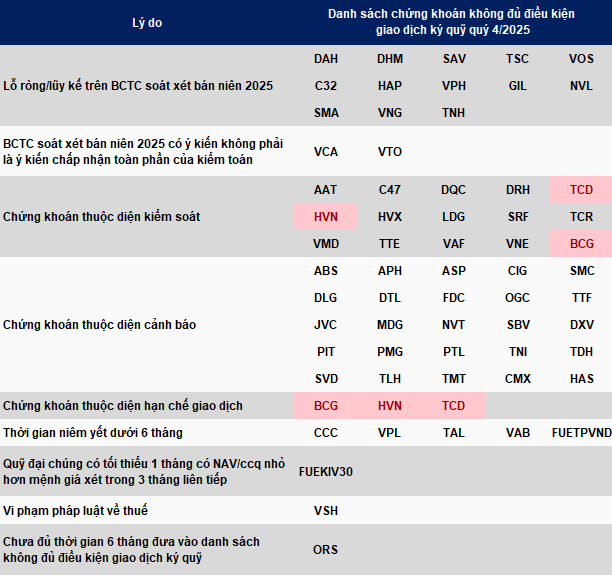

On October 2, 2025, the Ho Chi Minh City Stock Exchange (HOSE) released a list of 63 securities ineligible for margin trading in Q4 2025, marking a 3-security increase from the Q3 list.

Most securities were flagged due to being under warning (25) or special control (15). Others were excluded for net/accumulated losses in the 2025 semi-annual audited financial statements (13), less than 6 months of listing (5), trading restrictions (3), non-clean audit opinions in the 2025 semi-annual reports (2), tax law violations (1), or insufficient 6-month period since the last margin ineligibility (1). Additionally, the public fund FUEKIV30 was barred from margin trading for having a NAV/share below par value for at least one month in the past three consecutive months.

Notably, three securities—aviation giant HVN and the duo BCG, TCD—faced dual restrictions for both warning and control status.

* Red-highlighted securities face dual penalties – Source: HOSE, compiled by the author

|

– 14:16 05/10/2025

Nearly 4% of Companies “Locked Out,” Shareholders Rush to Sell, Businesses Take New Measures

The volume of sell orders at the floor price reached a staggering 32 million shares, representing approximately 3.6% of the total outstanding shares.