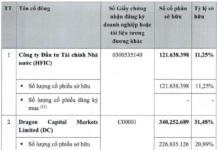

On October 3, Bamboo Capital Group (stock code: BCG) and its subsidiary Tracodi (stock code: TCD) announced that they had received a decision from the competent authority to suspend the trading of BCG and TCD shares due to the non-completion of the audited financial report for 2024 as required. The suspension will take effect from October 9, 2025.

“The suspension of BCG and TCD shares is an unforeseen situation. We sincerely apologize for any inconvenience caused to our shareholders,” stated Bamboo Capital in its announcement.

We are committed to strengthening our governance system and accelerating the completion of the audited financial report. Bamboo Capital and its subsidiaries will focus all resources on promptly resolving this issue, ensuring transparency, stabilizing business operations, and protecting shareholders’ interests.

According to Bamboo Capital, the primary cause of the delay stems from personnel changes, including key financial and accounting staff, the substantial volume of financial records to be handed over, and the additional time required to process bond obligations and debt restructuring with relevant authorities.

Bamboo Capital Apologizes to Shareholders

However, companies within the Bamboo Capital ecosystem have proactively implemented specific remediation measures.

The personnel structure at both Bamboo Capital and Tracodi has been largely stabilized, with clear responsibilities assigned, particularly in the financial and accounting departments.

Bamboo Capital stated that the companies have been actively working with auditors, partners, and bondholders to expedite data consolidation and issue the audited financial report as soon as possible.

Regarding debt restructuring, both Bamboo Capital and Tracodi have been collaborating with banks and financial institutions to restructure debt and address bond packages, achieving certain progress.

The companies anticipate releasing the audited financial report for 2024 by December 31, 2025.

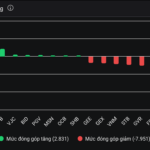

In the stock market, as of the close on October 3, both BCG and TCD experienced consecutive floor price drops for two sessions, with no buyers and a total sell order of nearly 40 million shares.

Currently, TCD shares are priced at 2,100 VND per share, and BCG shares at 2,800 VND per share, representing a 55% decline since the beginning of the year.

Nearly 4% of Companies “Locked Out,” Shareholders Rush to Sell, Businesses Take New Measures

The volume of sell orders at the floor price reached a staggering 32 million shares, representing approximately 3.6% of the total outstanding shares.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.

Billion-Dollar Windfall: $150 Million Set to Flow to Iconic Conglomerate

Vingroup has approved the issuance of VND 3.5 trillion in non-convertible, unsecured bonds, backed by assets, with a 24-month maturity period.