At the Q3 regular press conference of the Ministry of Finance, Deputy Minister Nguyen Duc Chi announced that Vietnam has been implementing comprehensive measures to develop its stock market sustainably, stably, and transparently. This is a critical requirement for executing the approved capital market and securities market development strategy.

According to the Ministry of Finance’s leadership, the legal framework for the securities market has progressively improved, laying a solid foundation for sustainable growth. Market governance, organization, and oversight have been rigorously executed in collaboration with international organizations.

The Ministry of Finance and the State Securities Commission have proactively engaged with international bodies, providing information and evidence to ensure objective and transparent evaluations of Vietnam’s market.

Deputy Minister Nguyen Duc Chi emphasized that while the final decision rests with international organizations, Vietnam will continue to collaborate closely to build trust and advance the market upgrade process.

“Upgrading is not a one-time goal but an ongoing process that requires long-term commitment. The ultimate objective is to foster a stable, transparent securities market that effectively supports the economy, businesses, and long-term capital markets,” Chi stressed.

Deputy Minister of Finance Nguyen Duc Chi.

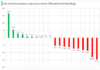

Recently, multiple initiatives have been launched to meet upgrade criteria and facilitate foreign investor participation. In the March assessment, Vietnam met 7 out of 9 required criteria. However, to achieve a market upgrade, Vietnam must satisfy 9 mandatory criteria and 2 non-mandatory reference criteria. Regulatory authorities have addressed the remaining criteria in recent months.

Specifically, the Ministry of Finance issued Circular 68, adding provisions for foreign institutional investors to place stock purchase orders without requiring full payment at the time of order placement.

The Government enacted Decree 245, amending certain provisions of the Securities Law. This decree eliminates the ability of shareholder meetings and public company charters to set foreign ownership limits below those stipulated by law and international commitments, thereby enhancing market accessibility for foreign investors.

Multiple initiatives have been launched to meet upgrade criteria and facilitate foreign investor participation.

The State Bank of Vietnam also issued Circular 25, amending Article 6 and related provisions of Circular 17. These changes streamline the opening and use of payment accounts for non-resident foreign investors engaging in indirect investment activities in Vietnam.

The circular took effect immediately upon signing on August 31, demonstrating Vietnam’s determination to swiftly address bottlenecks and create a more transparent legal framework for the securities market.

In a recent assessment, Vietcap Securities expressed confidence that FTSE Russell will announce a positive outcome for Vietnam on October 8. If Vietnam is upgraded, approximately 30 stocks will be added to index fund portfolios, potentially attracting at least $1 billion from passive funds during implementation.

FTSE Russell evaluates eligible stocks based on criteria such as minimum foreign ownership ratios, market capitalization, liquidity, and free float (reviewed quarterly; any violations may result in index exclusion).

Unlocking Market Potential: Ministry of Finance Announces Initiatives to Upgrade Stock Market and Crypto Asset Framework

Elevating the stock market’s ranking is an ongoing process, intrinsically tied to fostering transparency and sustainability. The Ministry of Finance, the Securities Commission, and international agencies are collaborating closely to achieve this goal. Leadership from the Ministry of Finance underscores that the development of the stock market must prioritize stability, transparency, and long-term sustainability.

Top Prospect Stocks Poised to Ride the Year-End Wave: Insights from Leading Securities Firms

Amid Vietnam’s economic landscape geared toward high growth, the third and fourth quarters present an opportune moment to identify investment opportunities in promising stocks for 2026 at attractive price levels.

Leading Brokerage Firm Goes Big: Offers Luxury Car Giveaway to Clients

The stock market’s year-end frenzy just got more thrilling with MBS’s launch of the “Breakthrough Trading – Win VF3” campaign, boasting an unprecedented prize structure. Investors need only trade from 10 million VND to stand a chance at winning the electric VF3 car, iPhone 17 Pro, and other high-value tech and fashion rewards.

Vietnam Stock Market Upgrade Decision Meeting Scheduled for This Week

Vietcap Securities remains confident in its outlook, anticipating a positive announcement from FTSE Russell regarding Vietnam’s market classification next Wednesday.