Dragon Capital Boosts Acquisitions

| TAL Stock Performance from Early 2024 to October 3, 2025 |

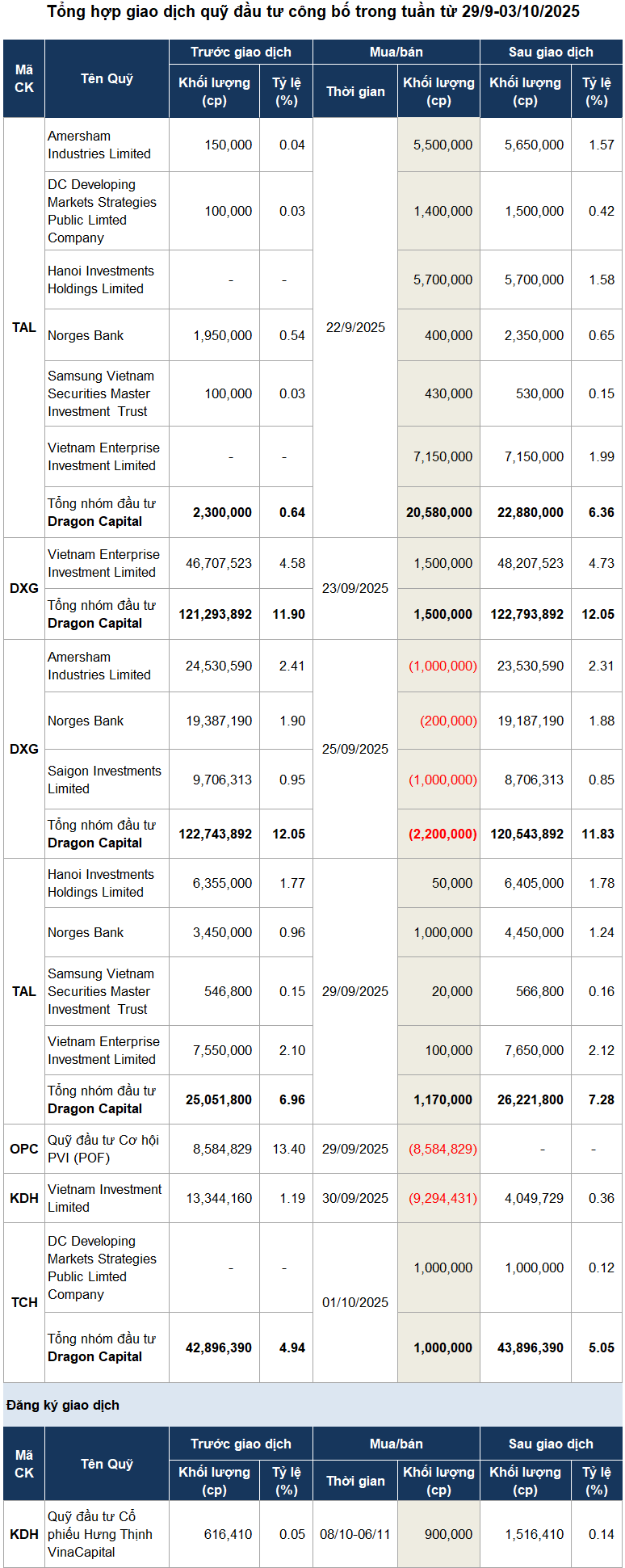

On September 29, Dragon Capital acquired nearly 1.2 million shares of TAL (Taseco Real Estate Investment JSC), increasing its ownership to over 7%, equivalent to 26 million shares. Based on the closing price, the transaction was valued at approximately VND 56 billion.

Previously, on September 22, the fund invested VND 620 billion to purchase 20 million shares in TAL’s private placement at VND 31,000 per share, becoming a major shareholder with over 6% ownership. On the market, TAL shares doubled in just four months, reaching VND 47,300 per share by the end of October 3.

| TCH Stock Performance from Early 2024 to October 3, 2025 |

Continuing its buying spree, on October 1, Dragon Capital acquired 1 million shares of TCH (Hoang Huy Financial Services Investment JSC), raising its ownership to 5.05%, or nearly 43.9 million shares, officially becoming a major shareholder. At a closing price of VND 22,900 per share, the transaction was valued at nearly VND 23 billion.

The fund’s move came shortly after TCH completed a rights issue of over 200 million shares to existing shareholders, achieving 100% distribution. By October 3, TCH closed at VND 21,400 per share, down 12% over the past month but still up more than 60% year-to-date.

VinaCapital and POF Divest

| KDH Stock Performance from Early 2024 to October 3, 2025 |

In contrast to Dragon Capital’s buying, Vietnam Investment Limited, a VinaCapital affiliate, successfully sold nearly 9.3 million shares of KDH (Khang Dien House) on September 30 to rebalance its portfolio. The entire transaction was conducted via agreement, totaling over VND 316 billion (VND 34,000 per share), higher than the closing price of VND 33,800 per share. Post-transaction, the fund’s ownership in KDH dropped to 0.4%, or over 4 million shares.

This move occurred as KDH shares fell approximately 7% since early September, despite remaining at their highest levels since mid-2022.

| OPC Stock Performance from Early 2024 to October 3, 2025 |

Similarly, the PVI Opportunity Fund (POF) fully divested its 13.4% stake in OPC Pharmaceuticals JSC by selling all 8.6 million shares on September 29. The transaction, conducted via agreement, generated nearly VND 190 billion, officially removing POF from the shareholder list. On the market, OPC shares declined over 5% from early July to October 3, closing at VND 22,500 per share.

Source: VietstockFinance

|

– 07:28 October 5, 2025

Strategic Shareholder Restructuring at HSC Post-IPO

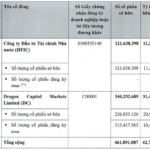

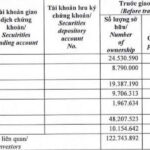

HSC has successfully completed the sale of 359.99 million shares to 27,308 shareholders, increasing its chartered capital to VND 10,808 billion. Following this offering, the State’s ownership stake in the company has decreased.

Billionaire Nguyen Thi Phuong Thao and Truong Gia Binh Discuss Strategies to Revive HOSE

The riveting behind-the-scenes tale of the dramatic “rescue” of the HOSE platform from a crippling order congestion crisis four years ago was recounted with raw emotion by billionaire Nguyễn Thị Phương Thảo at ViPEL.