Source: HOSE

|

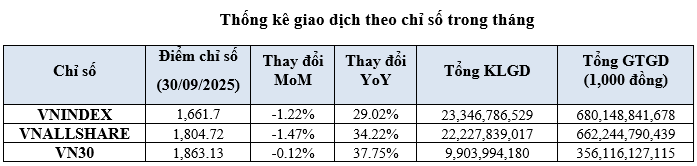

In September, only three sector indices showed growth: real estate (VNREAL) by 12%, healthcare (VNHEAL) by 5%, and raw materials (VNMAT) by 1%. Conversely, other sectors experienced declines, notably information technology (VNIT) by 8% and finance (VNFIN) by 6%.

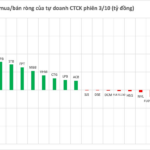

Market liquidity saw a downturn, with average daily trading volume (ADV) reaching nearly 1.2 billion shares and average daily trading value (ADTV) exceeding 34 trillion VND. This reflects a 33% drop in volume and a 31% decrease in value compared to the previous month.

Covered warrants (CW) also witnessed reduced activity, with an ADV of approximately 61.6 million CW and an ADTV of 149.3 billion VND, both declining by around 23%.

Exchange-traded funds (ETFs) followed a similar trend, with an ADV of nearly 2.5 million ETF units, down 36%, and an ADTV of approximately 70.5 billion VND, a 41% decrease.

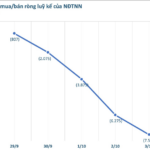

Foreign investors’ total trading value in September surpassed 152 trillion VND, accounting for 12.2% of the market’s total. They recorded a net sell-off of over 24.7 trillion VND during the month.

As of September 30, HOSE listed 696 securities, including 391 stocks, 4 closed-end funds, 18 ETFs, and 283 CWs, with a total listed volume exceeding 188.2 billion securities. Market capitalization reached over 7.2 quadrillion VND, a nearly 1% decline from the previous month, equivalent to 62.6% of 2024’s GDP and representing 94.6% of the total market capitalization.

HOSE boasts 50 companies with a market cap exceeding 1 billion USD, including six over 10 billion USD: Vingroup (VIC), Vietcombank (VCB), Vinhomes (VHM), BIDV (BID), VietinBank (CTG), and Techcombank (TCB).

– 15:00 04/10/2025

UBCKNN Approves Nam Long’s 100 Million Share Issuance

On September 30, 2025, the State Securities Commission (SSC) granted Nam Long Investment Corporation (HOSE: NLG) a certificate to offer over 100 million additional shares. The company plans to execute this issuance in Q4 2025.

Newly Established Real Estate Firm Specializing in Vinhomes Launches 10 Nationwide Offices

On October 2, 2025, SSM Group, a leading distributor of luxury real estate, will officially launch with the simultaneous opening of 10 offices in Vietnam’s major economic hubs: Hanoi, Hai Phong, Ho Chi Minh City, and Da Nang.