Ho Chi Minh City Securities Corporation (HSC, Stock Code: HCM, HoSE) has announced the results of its recent share offering to existing shareholders.

By the end of the offering period on September 30th, HSC successfully distributed all 359.99 million shares to 27,308 shareholders. Of these, 227 million shares were allocated to 27,057 domestic investors, while 132.97 million shares were distributed to 251 foreign investors.

Following the offering, state shareholders now hold 11.25% of HSC, and foreign ownership stands at 32.27%.

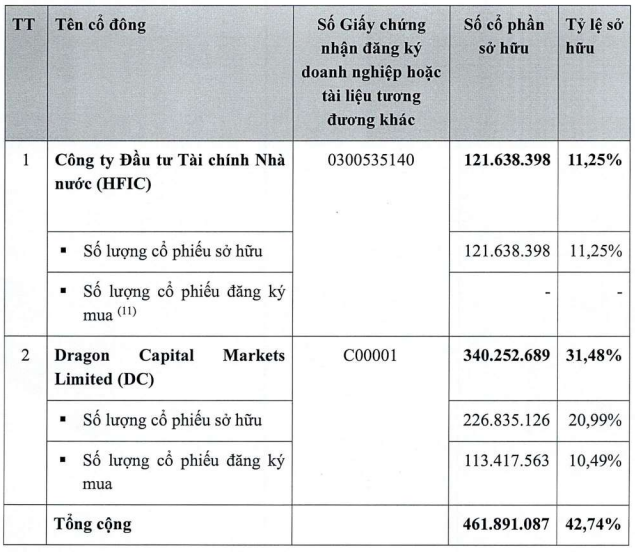

The state shareholder in HSC is the State Financial Investment Company (HFIC). HFIC transferred its share purchase rights to other shareholders, reducing its ownership from 16.88% to 11.25%, equivalent to 121.64 million shares.

Ownership ratio of the two major shareholders at HSC post-offering

In addition to HFIC, HSC’s other major shareholder is Dragon Capital Markets Limited, a subsidiary of Dragon Capital. The fund acquired all 113.42 million shares it was entitled to purchase, increasing its ownership to 31.5%, or 340.25 million shares.

Upon completion of the offering, HSC’s chartered capital increased from VND 7,208 billion to VND 10,808 billion.

With an offering price of VND 10,000 per share, HSC raised VND 3,600 billion. Of this amount, VND 2,520 billion (70%) will be allocated to margin lending activities, while the remaining VND 1,080 billion will support proprietary trading.

Regarding business performance, HSC’s audited financial report for the first half of 2025 shows total operating revenue of over VND 2,073 billion, a 5.9% increase compared to the same period in 2024. After deducting taxes and fees, net profit reached over VND 419 billion, a 29% decrease.

As of June 30, 2025, HSC’s total assets grew by 11.5% since the beginning of the year, reaching nearly VND 34,937.2 billion.

This includes financial assets measured at fair value through profit or loss (FVTPL) of over VND 13,067.8 billion and loans totaling over VND 19,813.1 billion.

Hà Ly

The IPO Boom Amidst a Stock Market Frenzy

Vietnam’s Initial Public Offering (IPO) market is experiencing an unprecedented boom, fueled by a surging stock market, new regulatory reforms, and a credit explosion.