Quarterly Press Conference of the Ministry of Finance – Q3 2025 – Image: VGP

|

Comprehensive Measures to Develop Vietnam’s Capital Market

During the Ministry of Finance’s Q3 2025 press conference held on October 3, Deputy Minister Nguyen Duc Chi emphasized that Vietnam is implementing a series of synchronized measures to develop its securities market sustainably, transparently, and stably. These efforts align with the approved strategy for capital market and securities market development.

Ministry leaders highlighted that recent legislative advancements have strengthened the market’s regulatory framework. The National Assembly has amended laws, the Government has issued decrees, the Ministry of Finance has released circulars, and the State Bank of Vietnam has collaborated on relevant regulations. These initiatives have created a robust foundation for sustainable market growth.

Market governance, organization, and oversight have been rigorously enhanced through collaboration with international organizations. The Ministry of Finance and the State Securities Commission (SSC) have proactively engaged with global bodies, providing data to ensure objective evaluations of Vietnam’s market. Deputy Minister Chi noted that while final decisions rest with international organizations, Vietnam remains committed to fostering trust and advancing market upgrades.

“Market upgrades are an ongoing process, not a one-time goal. Our ultimate aim is to establish a stable, transparent securities market that effectively supports the economy, businesses, and long-term capital mobilization,” Deputy Minister Chi stated.

To meet FTSE Russell and MSCI standards, the Ministry has issued key regulations, adopted new technologies, and expanded dialogue with international investors and rating agencies. Since May 5, 2025, a new IT system has been operational, catering to foreign investment funds and enabling central counterparty clearing (CCP) mechanisms for core markets.

In 2025, the Ministry and SSC actively engaged with global investors. Notably, on September 15, 2025, in London, Minister Nguyen Van Thang met with the London Stock Exchange (LSE) and FTSE Russell, signing an MoU to develop a joint index between VNX and FTSE Russell. The SSC also hosted an Investment Promotion Conference in the UK, showcasing Vietnam’s reforms and investment opportunities.

Minister Thang further chaired the Vietnam-Italy Investment Forum, engaging Italian financial institutions to promote Vietnam’s securities market in Europe.

Regulatory Framework for Digital Asset Trading Platforms Underway

Regarding digital assets, SSC Vice Chairman Ha Duy Tung outlined Government Resolution 05, which pilots regulated digital asset activities in Vietnam. The SSC is drafting guidelines for licensing, criteria, and oversight of digital asset service providers. No formal applications have been submitted to date.

Deputy Minister Chi added that the Ministry’s implementation plan for Resolution 05 includes tax policies and accounting standards. Several firms have expressed interest and are preparing applications. The Ministry aims to finalize regulations promptly, ensuring transparent and lawful market participation.

“Developing the securities market, including digital assets, is a shared responsibility. Our long-term vision is a transparent, modern, and sustainable market that supports economic growth and effective capital mobilization,” Deputy Minister Chi concluded.

– 15:22 04/10/2025

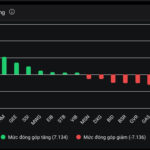

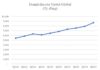

Market Retreats as Blue-Chip Stocks Take a Breather

The VN-Index closed today’s session (September 30) down nearly 5 points, weighed down by weakness in real estate and public investment stocks. Even Vingroup’s blue-chip shares lost momentum, despite VRE hitting its ceiling price.

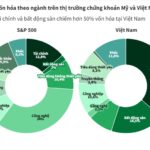

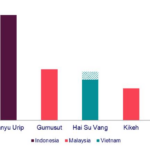

Premium Stocks Scarce in Vietnam’s Market

The VN-Index has surpassed the 1,600-point milestone for the first time, potentially paving the way for an upgrade. However, experts caution that the market still lacks diversity, heavily dominated by financial and real estate stocks.