An Giang Fruit and Vegetable JSC (Antesco, stock code: ANT) has announced October 13th as the final registration date for shareholders to provide written opinions on the decision to list ANT shares on the Ho Chi Minh City Stock Exchange (HOSE).

Founded in 1975 as An Giang Agricultural Supply Company, Antesco has evolved over half a century into a leading agri-food processor in Vietnam and the Mekong Delta region. With an annual processing capacity of 75,000 tons, the company pioneered Vietnam’s export of frozen processed agricultural products to global markets.

In 2011, the company underwent corporatization, rebranding as An Giang Fruit and Vegetable JSC (Antesco) with a charter capital of VND 60 billion. At that time, the People’s Committee of An Giang Province held 2.9 million shares, representing 49% of the capital. This ratio remained unchanged for nearly a decade until the State Capital Investment Corporation (SCIC) divested its entire stake in early 2020, generating VND 60.6 billion.

In May 2021, three new major shareholders emerged: Soybean Co., Ltd. (24.92%), Baby Corn Co., Ltd. (24.12%), and Passion Fruit Co., Ltd. (10.6%), all part of the Ylang Holdings ecosystem led by Mr. Pham Ngo Quoc Thang. Following their investment, Antesco accelerated its expansion efforts. In June 2023, the company became the parent entity of B’LaoFood, owner of a 50,000-ton/year vegetable processing plant in Loc Son Industrial Park (Lam Dong), which commenced operations in early 2023 after groundbreaking in April 2021.

Antesco has consistently increased its capital from VND 60 billion in late 2020 to the current VND 205 billion.

From September 25th to October 30th, 2025, the company plans to privately issue 3.5 million shares at VND 12,900 per share to strategic investor Ylang Holdings. Post-transaction, Ylang Holdings will hold 8.1 million shares, equivalent to 33.8% of the capital. The proceeds of approximately VND 45 billion will be used to repay VietinBank debt. Antesco’s charter capital will increase from VND 205 billion to VND 240 billion.

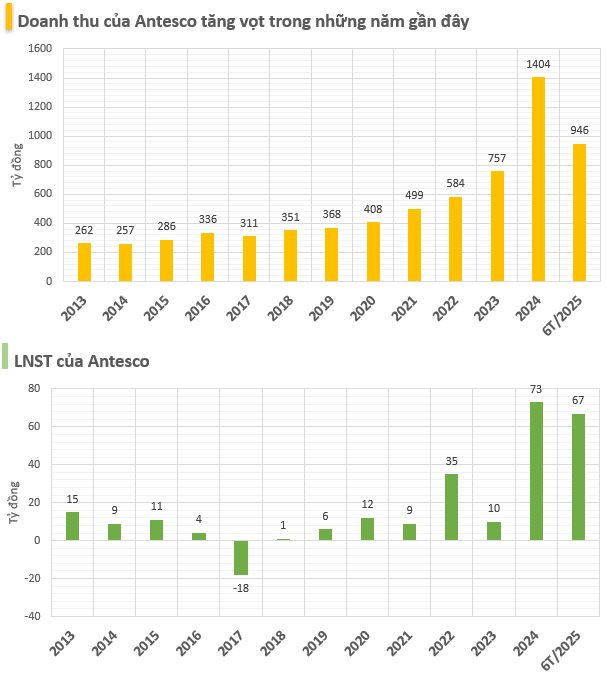

In the first half of 2025, Antesco reported VND 946.5 billion in revenue and VND 77.5 billion in pre-tax profit, up 35.5% and 81% year-on-year, respectively. These results achieved 61% of the annual revenue target and 91% of the profit target.

On October 3rd, ANT shares reached an all-time high of VND 31,900 per share, surpassing the previous peak of VND 31,500 on July 30th, 2025. Compared to a year ago, the stock has nearly doubled and increased eightfold from the sub-VND 4,000 range in late 2022.

Foreign Investors Continue Sell-Off: Which Stocks Faced the Heaviest Dumping in Session 2/10?

Foreign investors’ trading activity has been a notable drawback, as they engaged in significant net selling across all three major exchanges.

Cà Mau Province Authorities to Auction Shares of Local Environmental Enterprise

On September 30th, the Ho Chi Minh City Stock Exchange (HOSE) announced the opening of registration for auction agents to participate in the sale of nearly 536,000 shares held by the People’s Committee of Ca Mau Province in Ca Mau Environment and Urban Joint Stock Company (Camenco). The expected scale of this auction is over 10 billion VND.