Recently, VinaCapital Fund Management Joint Stock Company (VinaCapital) announced its intention to purchase shares of Khang Dien House Investment and Trading Joint Stock Company (Stock Code: KDH, HoSE). According to the announcement, the Hung Thinh VinaCapital Equity Fund, a member of VinaCapital, has registered to buy 900,000 KDH shares to restructure its investment portfolio. The transaction is expected to take place via order matching and/or negotiation from October 8, 2025, to November 6, 2025.

If successful, the Hung Thinh VinaCapital Equity Fund’s ownership of KDH shares will increase from 616,410 to over 1.5 million shares, raising its stake from 0.0549% to 0.135% of Khang Dien House’s capital.

Illustrative image

Previously, during the trading period from August 12, 2025, to September 10, 2025, the same VinaCapital fund failed to purchase 850,000 registered shares due to unfavorable market conditions. As a result, its ownership stake in Khang Dien House remains at 0.0549%.

Conversely, on September 30, 2025, another VinaCapital fund, Vietnam Investment Limited, successfully sold nearly 9.3 million KDH shares as previously registered. Following the transaction, its holdings decreased from over 13.3 million shares to more than 4 million shares, reducing its stake from 1.189% to 0.361% of Khang Dien House’s capital.

Based on KDH’s closing price of VND 33,800 per share on September 30, 2025, the VinaCapital fund is estimated to have generated nearly VND 314.2 billion from the sale.

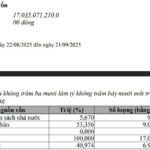

Regarding business performance, Khang Dien House’s audited consolidated financial report for the first half of 2025 showed net revenue of over VND 1,759.2 billion, a 79.8% increase compared to the same period in 2024. However, after deducting taxes and fees, net profit reached over VND 314.9 billion, an 8.5% decline.

For 2025, Khang Dien House aims to achieve a post-tax profit of VND 1,000 billion. As of the first two quarters, the company has completed 31.5% of its profit target.

As of June 30, 2025, Khang Dien House’s total assets increased by VND 496.8 billion to over VND 31,254.5 billion. Inventory accounted for VND 23,007.4 billion, or 73.6% of total assets.

On the liabilities side, total payables stood at nearly VND 11,546.2 billion, up by nearly VND 242 billion since the beginning of the year. Short-term and long-term loans totaled VND 9,142.4 billion, representing 79.2% of total liabilities.

PV

Billionaire Nguyen Thi Phuong Thao and Truong Gia Binh Discuss Strategies to Revive HOSE

The riveting behind-the-scenes tale of the dramatic “rescue” of the HOSE platform from a crippling order congestion crisis four years ago was recounted with raw emotion by billionaire Nguyễn Thị Phương Thảo at ViPEL.

VinaCapital Member Fund Seeks to Offload Over 9 Million KDH Shares

VinaCapital’s fund, Vietnam Investment Limited, has recently filed to offload approximately 9.3 million shares of KDH as part of its portfolio restructuring strategy.