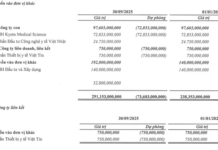

After a sharp decline in late September, Bitcoin (BTC) has begun its recovery. In the morning session of October 4th, BTC surged past $122,000, marking a 1.55% increase in just 24 hours. This upward momentum brought BTC close to its all-time high of nearly $124,000, set in mid-August. Consequently, the market capitalization rose to $2.432 trillion.

Meanwhile, Binance Coin (BNB) continued its explosive rally, soaring 6.64% in the past 24 hours to reach a new peak of $1,173. In contrast, other cryptocurrencies traded sluggishly, with ETH dropping 1% to nearly $4,484 and XRP declining by approximately 0.35%.

This price surge emerged following the U.S. government shutdown due to Congress’s failure to pass a temporary spending bill. This situation delayed the release of critical economic data, such as employment reports and non-farm payrolls. With the absence of economic indicators, systemic risk concerns heightened, prompting investors to seek alternative assets like Bitcoin as a “safe haven.”

Additionally, the optimism surrounding “Uptober”—a blend of “Up” and “October”—injected positivity into the crypto market. Historical data indicates that October often yields high returns for cryptocurrencies, averaging 20.62%. The late-September liquidation spree led to overselling, but it was swiftly absorbed by buying pressure from whales and institutional investors. This buoyant sentiment at the start of October reinforced confidence in Bitcoin’s continued upward trajectory.

Many analysts believe Bitcoin’s current rally is not merely a reaction to the U.S. government shutdown or a typical technical rebound but is underpinned by several sustainable factors.

Most recently, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) are preparing to relax a proposed tax rule. This rule would impose a minimum 15% tax on cryptocurrency companies’ unrealized gains from holding digital assets. The new regulation allows companies to defer tax payments on unrealized gains until actual sale and profit realization, rather than taxing paper gains.

Previously, taxing unrealized gains forced companies to pay taxes without actual cash flow, creating significant financial strain. This change reduces double taxation risks, levels the playing field between Bitcoin and other assets, and encourages long-term Bitcoin holdings without tax-related price volatility concerns.

Financial markets are closely monitoring the Fed’s late-October meeting, as the September jobs report remains unreleased due to the government shutdown. ADP data shows a decline in new jobs, increasing expectations of two 0.25% rate cuts by the Fed this year. This monetary easing is expected to boost growth, stimulate risk appetite, and drive Bitcoin prices higher.

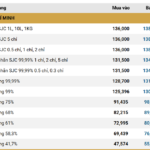

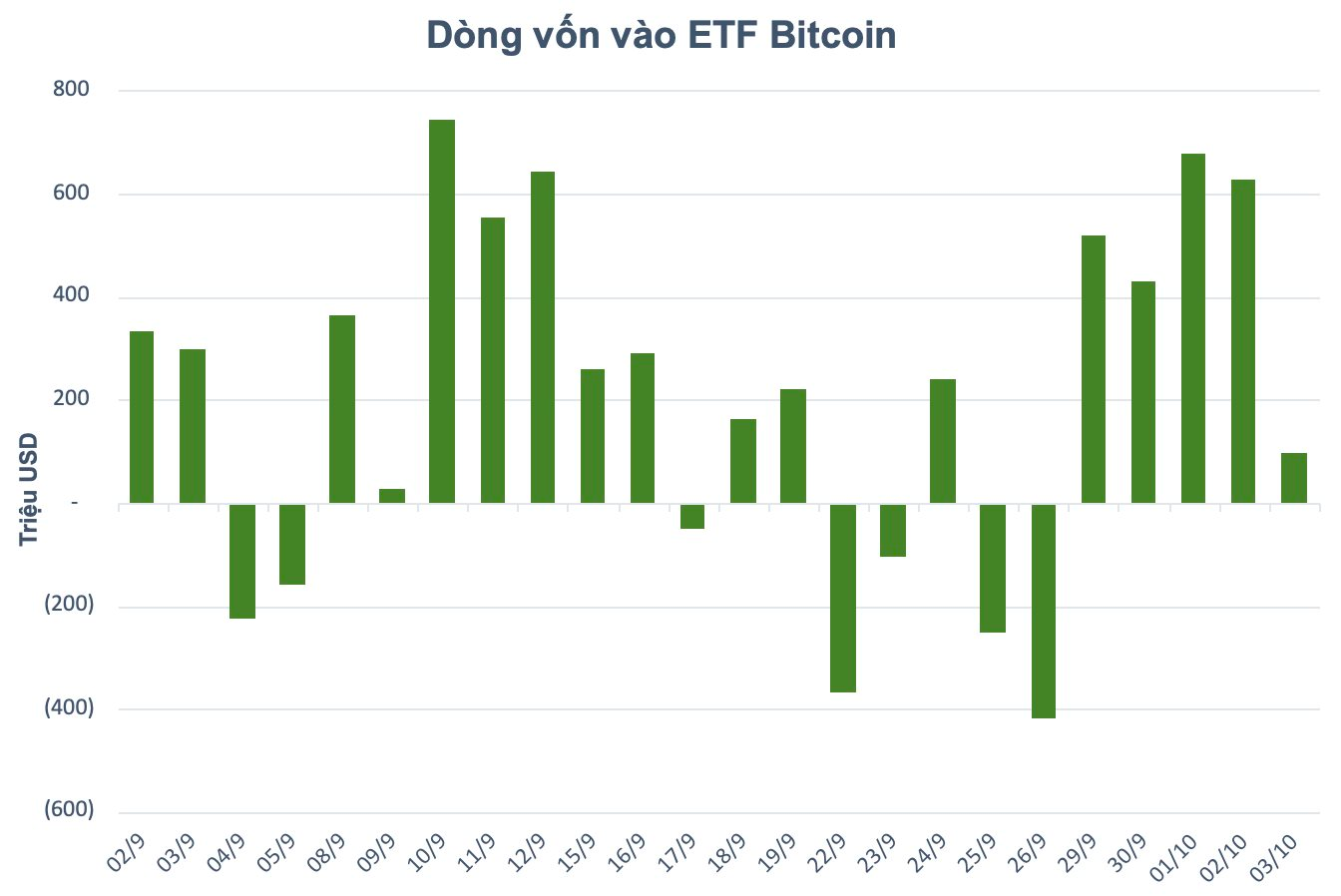

Beyond macroeconomic factors, capital inflows into Bitcoin ETFs remain a significant price driver. Over the past five days, global Bitcoin ETFs attracted a net inflow of $2.3 billion.

Leading the pack, the iShares Bitcoin Trust (IBIT) drew approximately $1 billion, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) with nearly $700 million. Since the start of 2025, Bitcoin ETFs have amassed over $22 billion in net inflows.

Furthermore, market whales continue to accumulate. Tether, the world’s largest stablecoin issuer, confirmed a $1 billion purchase in late Q2 2025. This move not only strengthens Tether’s balance sheet but also signals strong long-term confidence in the digital asset market.

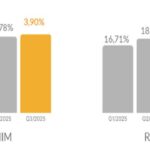

Bitcoin, Ethereum Lead Crypto Surge as Global Market Cap Tops $4 Trillion

Compared to just one week ago, the global market capitalization has surged by over $330 billion, representing a remarkable increase of nearly 9%.