Closing the session on October 2, the VN-Index ended at 1,652 points, down 12 points or 0.74%.

The Vietnamese stock market opened the October 2 session in the green, with the VN-Index quickly expanding its gains and nearing the 1,680-point mark. The primary momentum came from large-cap stocks, notably VIC, alongside banking stocks like MBB, LPB, and VPB. However, increasing selling pressure in the latter half of the morning session narrowed the gains of leading stocks, causing the VN-Index to hover around 1,670 points until the end of the morning session.

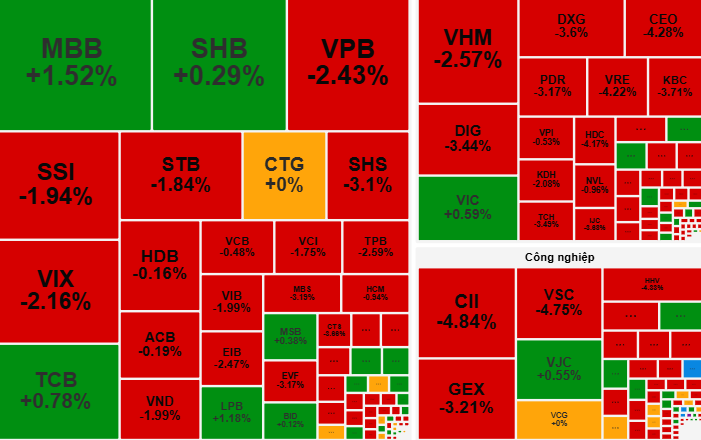

In the afternoon session, the VN-Index continued to fluctuate within a narrow range before experiencing significant volatility and dropping to around 1,650 points. Selling pressure dominated the HOSE floor, with 243 declining stocks compared to 84 advancing ones. Large-cap stocks were also affected, as the red spread, leaving only a few stocks like VIC, MBB, and LPB with slight gains.

By the close, the VN-Index settled at 1,652 points, down 12 points or 0.74%.

According to VCBS Securities, liquidity is gradually decreasing, indicating a phase of supply-demand testing for stocks. The firm advises investors to selectively choose stocks with positive third-quarter earnings expectations, currently in an accumulation trend, or showing convincing supply-demand testing signals, to gradually invest during volatile periods. Notable sectors include banking and retail.

Rong Viet Securities (VDSC) notes that the market failed after multiple attempts to rise. Increasing stock supply adds pressure, while supportive capital remains cautious. For the market to regain balance and return to an upward trend, stronger capital is needed to absorb the stock supply.

Given this information, many investors are concerned that selling pressure will intensify in the October 3 session. Stock trading should be approached with caution to minimize risks.

Top 7 Stocks with Strong Fundamentals and Positive Q3/2025 Earnings Outlook: Ideal Picks for October Investment

Agriseco identifies several positive factors influencing the market, including the gradual release of Q3 business results, the anticipated economic acceleration in the final quarter, and the potential for a ratings upgrade.

Technical Analysis for the Afternoon Session of October 3rd: Re-testing the August 2025 Low

The VN-Index continues its downward trajectory, edging closer to the August 2025 low (around 1,600-1,630 points). Simultaneously, a Triangle pattern has emerged, targeting a price decline to the 245-250 point range.

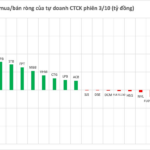

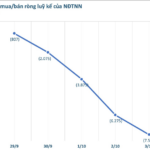

Market Pulse 03/10: Red Dominates as VN-Index Struggles at 1,645 Points

At the close of trading, the VN-Index fell by 6.89 points (-0.42%), settling at 1,645.82 points, while the HNX-Index dropped by 3.8 points (-1.41%), closing at 265.75 points. Market breadth favored decliners, with 513 stocks falling and 219 advancing. Similarly, the VN30 basket saw red dominate, with 19 stocks declining, 10 rising, and 1 unchanged.