Dong A Steel Joint Stock Company (stock code: GDA) has approved the transfer of its GDA shares from the Unlisted Public Company Market (UPCoM) to the Ho Chi Minh City Stock Exchange (HOSE).

The company’s Board of Directors has authorized the Chairman and/or CEO to select a listing advisor, determine the final shareholder registration date, and complete the necessary procedures for the transfer. Dong A Steel will submit its listing application to HOSE at an appropriate time, ensuring compliance with legal regulations.

Earlier, during the 2025 Annual General Meeting, shareholders approved the HOSE listing plan, delegating the Board to decide on the timing based on market conditions. Established in 1998 as Dong A Co., Ltd., the company rebranded to Dong A Steel Joint Stock Company and began trading on UPCoM on September 7, 2023.

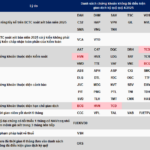

In its 2025 semi-annual consolidated financial report, Dong A Steel recorded net revenue of VND 8,233 billion, down 18.3% year-on-year, with after-tax profit of VND 150.3 billion, a 43.6% decline.

The company specializes in steel and mechanical products, including cold-rolled steel, color-coated steel, galvanized steel, and zinc-coated steel boxes. Mr. Nguyen Thanh Trung currently serves as Chairman of the Board.

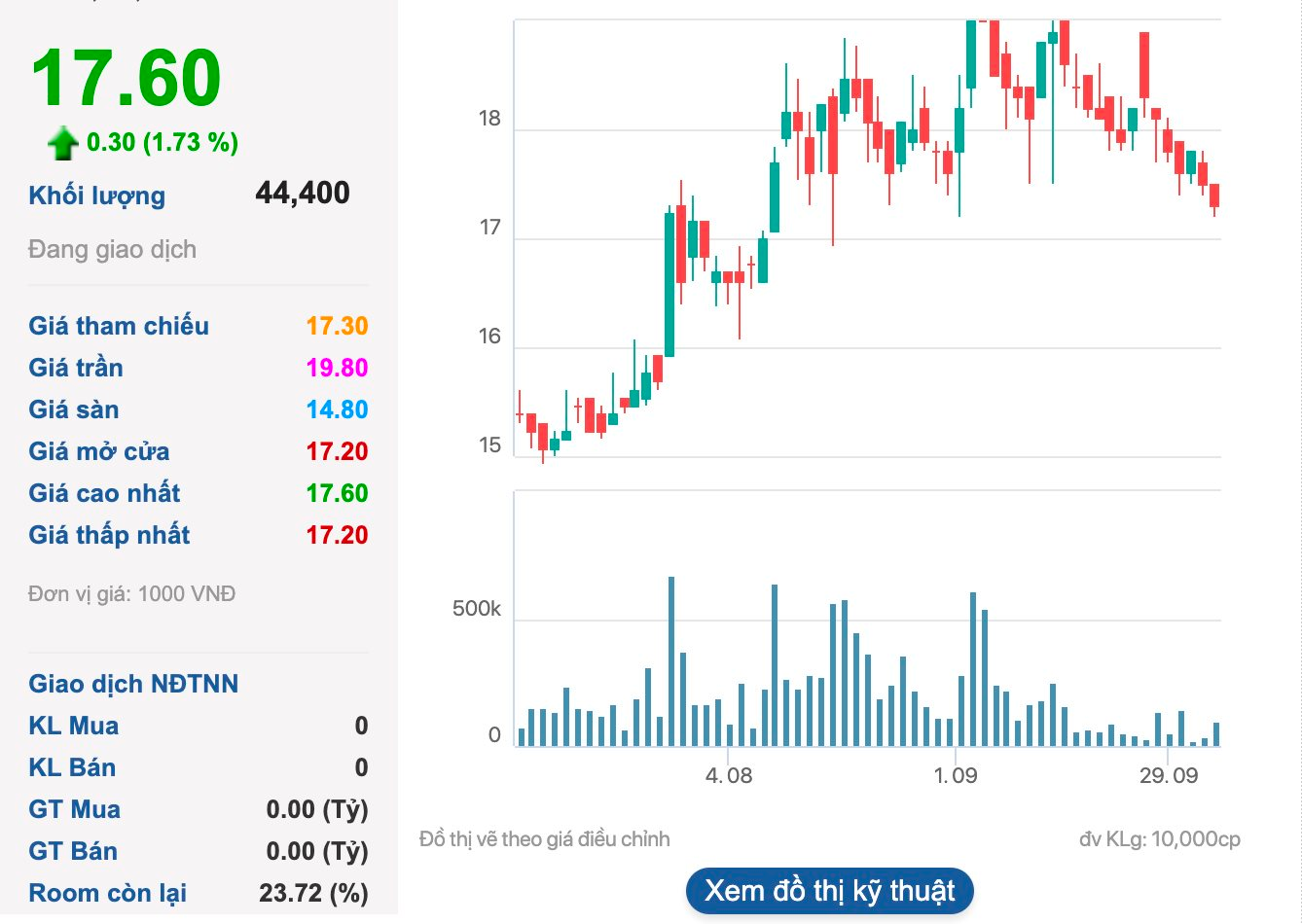

On October 6, 2025, GDA shares closed at VND 17,600, up 1.73% from the previous session.

Masan Consumer Corporation (stock code: MCH) has also approved its transfer from UPCoM to HOSE, with a targeted listing in Q4 2025 or H1 2026. The reference price for its HOSE debut will be the average of the last 30 UPCoM trading sessions before delisting.

The listing plan was approved at the 2024 AGM and formally ratified by the Board in March 2025. Masan Consumer will hold an Extraordinary General Meeting in October or November 2025, with October 22 as the record date for written shareholder voting.

Founded in 2000, Masan Consumer has expanded from seasoning products to eight core consumer categories. Brands like Chin-su, Omachi, Kokomi, Nam Ngư, and 247 Energy Drink each generate over VND 2 trillion in annual revenue.

HOSE Welcomes New Listings

HOSE recently approved listings for Nam Tan Uyen Industrial Park JSC (NTC) and CRV Real Estate Group JSC, further diversifying its market.

On September 29, HOSE approved the listing of 24 million NTC shares, valued at VND 240 billion. NTC began trading on UPCoM in December 2016 at VND 14,300 per share and currently trades at VND 161,800.

NTC manages three industrial parks in Tan Uyen City, totaling 966 hectares. Its expanded Nam Tan Uyen Industrial Park (Phase II, 344 hectares) is under construction and will significantly increase industrial land supply in the coming years.

CRV Real Estate Group’s 672 million shares, representing VND 6,724 billion in charter capital, were also approved for HOSE listing. Established in 2006 with an initial capital of VND 5 billion, CRV reached its current capital by early 2022.

As of Q1 2025, major shareholders include Hoang Huy Financial Services (38%), Hoang Huy Services (35%), Hoang Giang Development (8.5%), and HHS Capital (7.5%). The HOSE listing aims to enhance capital raising, governance transparency, and shareholder trading convenience.

Masan Consumer Set to List on HoSE

Masan Consumer is poised to list on the Ho Chi Minh Stock Exchange (HoSE) in Q4 2025 or the first half of 2026.

Over 15 Million Shares Suddenly Halted from Trading, Prices Plummet to Floor After Three Consecutive Limit-Up Sessions

Negative news instantly triggered a sell-off in this stock, driving its price to the daily limit down after three consecutive sessions of hitting the upper limit.