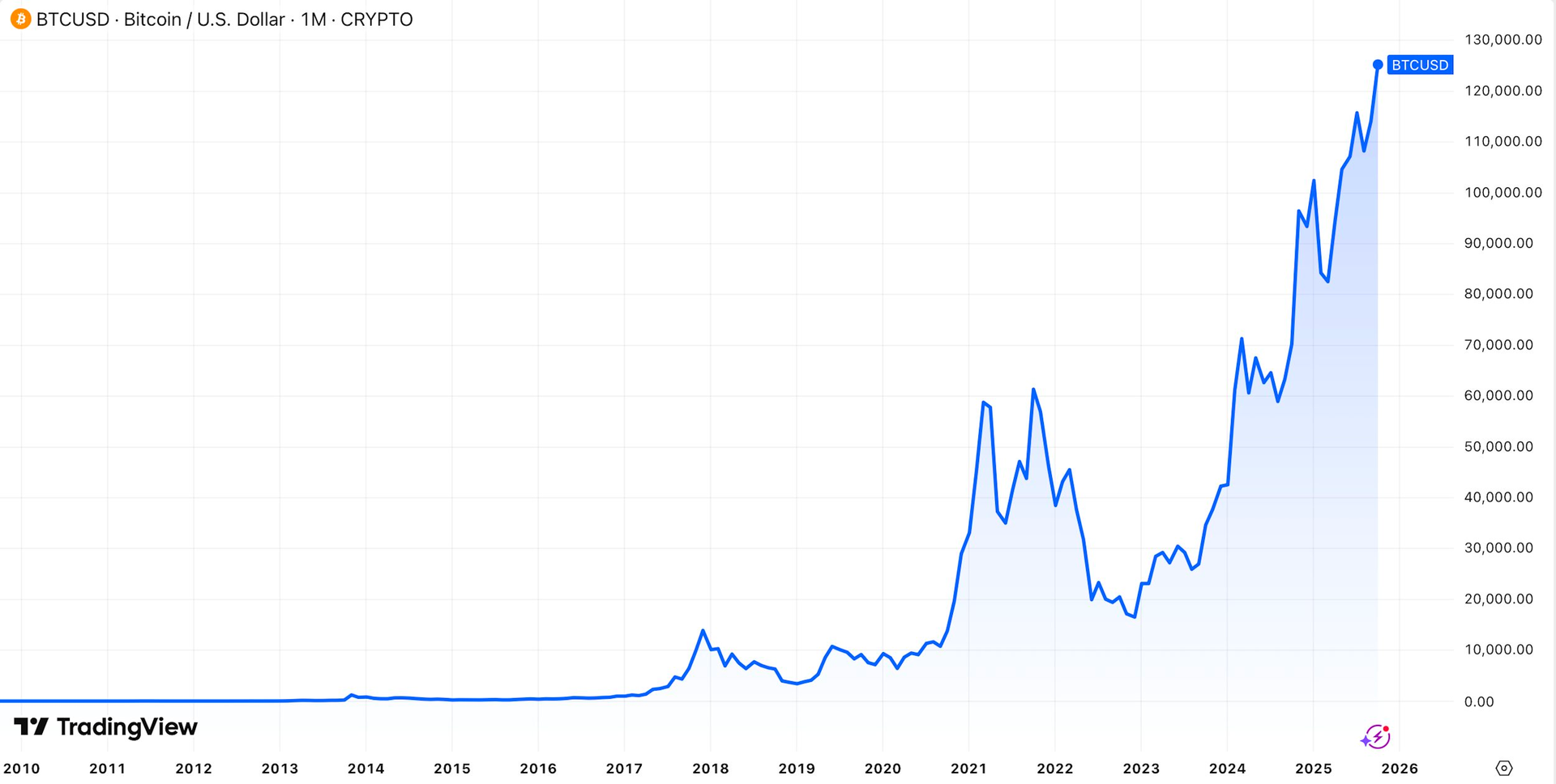

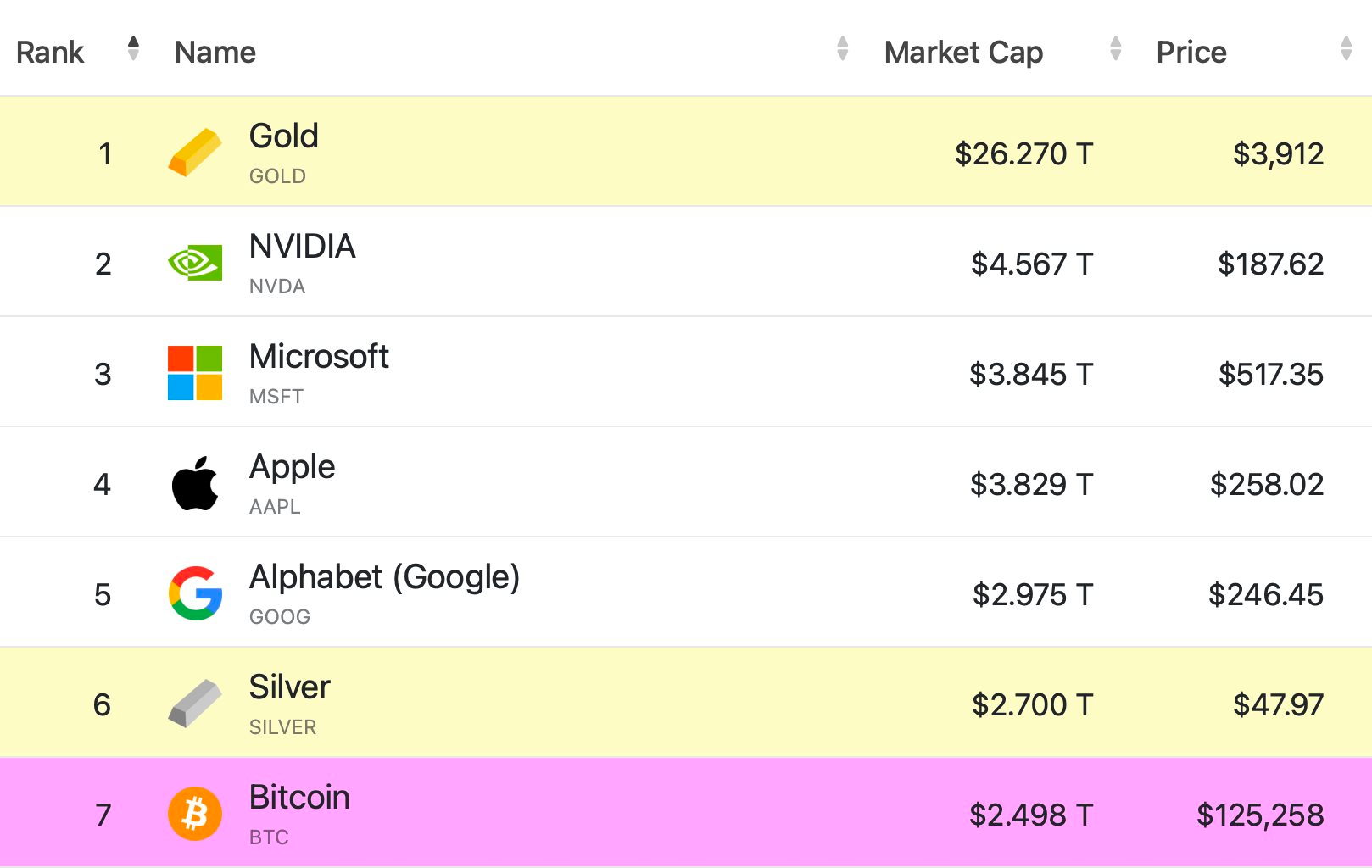

Bitcoin (BTC) is off to a stellar start this “Uptober,” surging past the $125,000 mark and setting a new all-time high. Since the beginning of October, BTC has rallied 10%, pushing its market capitalization to a record-breaking $2.5 trillion.

This remarkable figure propels Bitcoin ahead of Amazon’s market cap, making it the 7th most valuable asset globally (according to companiesmarketcap), trailing only gold, silver, and tech giants like NVIDIA, Microsoft, Apple, and Alphabet (Google’s parent company).

“Uptober” is a playful blend of “October” and “Up,” reflecting the belief that October often brings bullish momentum to the crypto market. Historically, Bitcoin has risen in October 10 out of the past 12 years, with an average gain of over 20%. Notably, Uptober typically follows September, dubbed “Redtemper,” Bitcoin’s historically weakest month.

Beyond seasonal trends, several factors are fueling Bitcoin’s recent rally. The U.S. government’s partial shutdown due to budget disputes has injected uncertainty into traditional markets, prompting investors to seek refuge in Bitcoin, akin to gold.

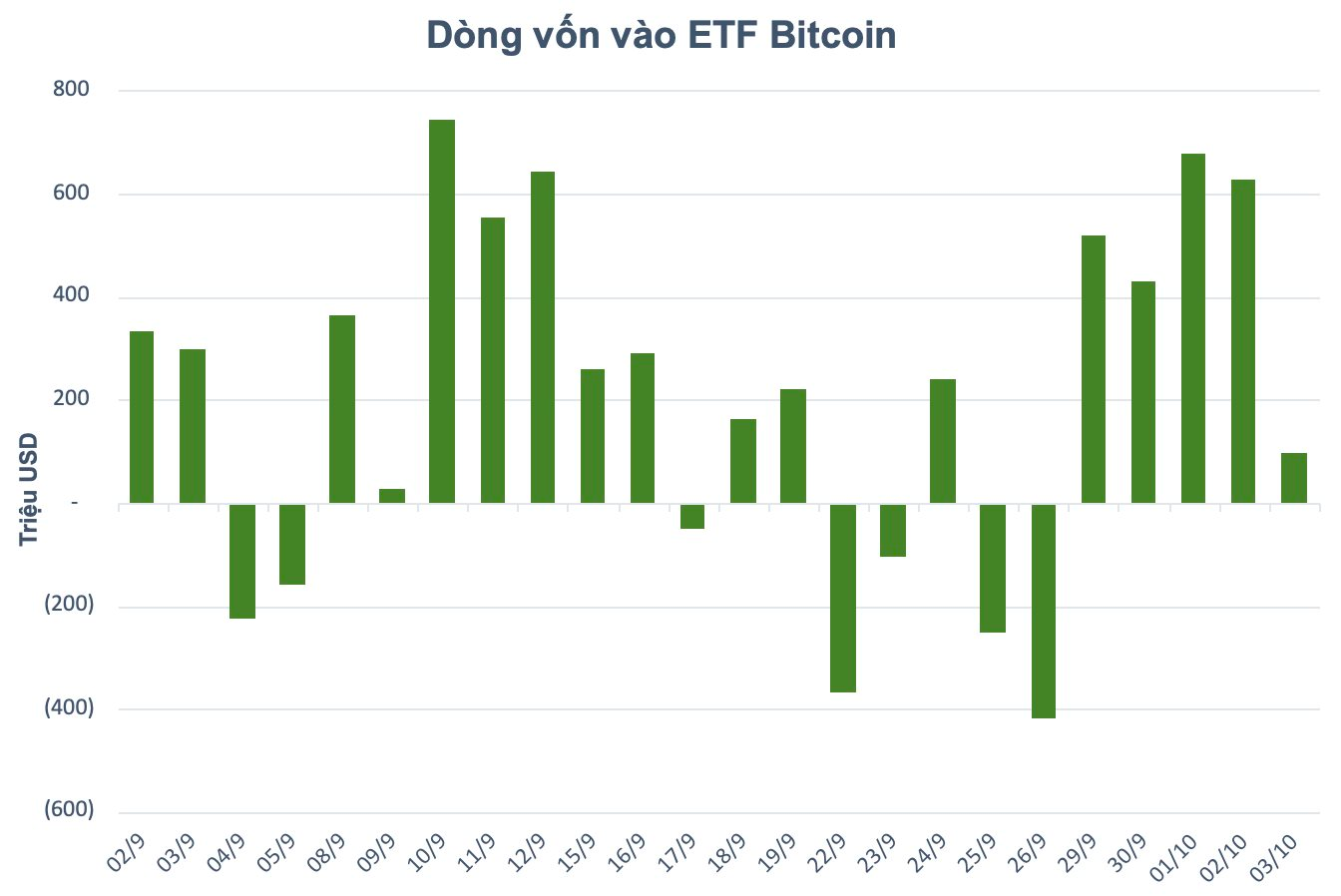

In just the past week, Bitcoin ETFs have seen net inflows exceeding $3 billion, with the iShares Bitcoin Trust ETF leading at approximately $1 billion. Year-to-date, total inflows into Bitcoin ETFs have surpassed $24 billion.

Additionally, the U.S. Treasury and IRS are poised to relax a proposed tax rule that would have imposed a 15% minimum tax on crypto companies’ unrealized gains from holding digital assets. The revised rule allows companies to defer tax payments until actual profits are realized through asset sales.

Previously, companies were burdened by taxes on paper gains, creating significant financial strain despite lacking actual cash flow. This update eliminates double taxation risks, levels the playing field between Bitcoin and other assets, and encourages long-term crypto holdings without tax-related price volatility concerns.

“Whales Quietly Accumulate, Bitcoin Nears All-Time High”

Bitcoin’s resurgence is more than a fleeting reaction to the U.S. government shutdown or a typical technical rebound. This rally is underpinned by a convergence of robust, long-term supportive factors, signaling a deeper shift in its trajectory.

Bitcoin Surges Amid US Government Shutdown Concerns

The Bitcoin surge has sparked a rally across major altcoins, with Ethereum (ETH), Solana (SOL), and XRP leading the charge, each recording impressive gains of 4–6% in the past 24 hours.