Recently, Dat Phuong Group Joint Stock Company (Stock Code: DPG, HoSE) has released preparatory documents for the Extraordinary General Meeting of Shareholders in 2025, scheduled for October 28, 2025.

Accordingly, Dat Phuong Group will propose to shareholders the approval of a plan to privately issue nearly 17.8 million shares to a maximum of 20 professional securities investors with strong financial capabilities and the potential to contribute to the company’s business operations.

The offering price will not be less than 1.5 times the book value per share of the company, based on the latest consolidated financial report published before the Board of Directors’ resolution to implement the issuance plan.

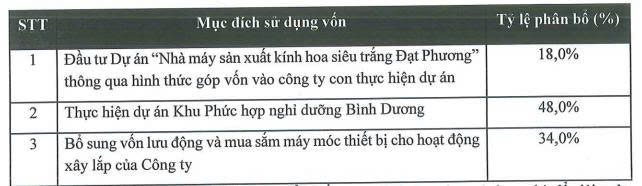

The purpose of this issuance is to increase equity capital, enhance financial capacity for project investment, supplement working capital, and procure machinery and equipment for the company’s construction activities.

The entire proceeds from the issuance are expected to be allocated as follows:

Source: DPG

The expected timeline for the share issuance is within 2025 or 2026, following approval from the State Securities Commission (SSC).

If the issuance is approved, Dat Phuong Group’s chartered capital will increase from approximately 1,008 billion VND to nearly 1,185.9 billion VND.

Additionally, during the meeting, Dat Phuong Group will report to shareholders on the company’s business strategy.

The company announced that in June 2025, the People’s Committee of Quang Nam Province (formerly) reinstated the Investment Policy for the Binh Duong Integrated Resort Project (Binh Duong Project) and designated Dat Phuong Group as the project’s investor.

The project spans 178.1 hectares, located in Thang An Commune, Da Nang City, with a total investment of 3,000 billion VND.

The project is expected to generate revenue for Dat Phuong Group between 2027 and 2029, significantly contributing to the group’s overall profitability during this period.

Vinaconex-ITC Welcomes New Chairman, Accelerates Cát Bà Amatina Project Under Fresh Ownership

Vinaconex-ITC’s shareholder structure has undergone a significant transformation with the addition of four new shareholders: Hanoi Anpha Real Estate Trading Floor LLC, Imperia An Phu LLC, Silver Field International Trading LLC, and Phu Quoc East Zone LLC.

Revitalizing Leadership: Vinaconex-ITC’s Strategic Overhaul Propels Cát Bà Amatina Project Forward

On September 26th in Hanoi, Vinaconex Tourism Investment and Development Joint Stock Company (Vinaconex-ITC, UPCoM: VCR) held its 2025 Extraordinary General Meeting of Shareholders. The meeting approved the early termination of the 2021-2026 Board of Directors and Board of Supervisors term, while also electing additional members and completing the personnel structure for the 2025-2030 term.