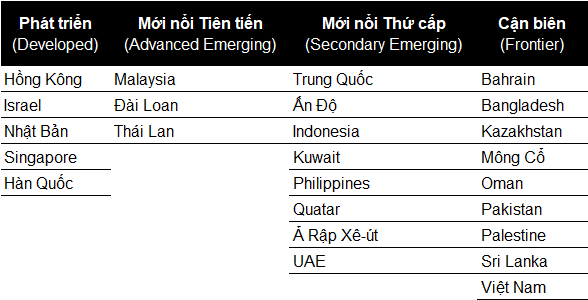

According to FTSE Russell’s classification, Vietnam’s stock market is currently ranked as a Frontier market. In Asia, this category places Vietnam alongside countries like Bangladesh, Pakistan, and Palestine—nations grappling with conflicts, political crises, and lackluster economic growth prospects.

A clear sign that the “Frontier” label has become too restrictive for Vietnam’s growth is the fact that Vietnamese stocks accounted for 36.2% and 28.3% of the total market capitalization in the FTSE Frontier Index Series and MSCI Frontier Market Index, respectively, as of August 29, 2025.

With the strategic vision of becoming a high-income nation by 2045, Vietnam—already a prominent industrial and export hub with world-class seaports—is implementing sweeping reforms to enhance its business environment. A key focus is modernizing the stock market, with the short-term goal of upgrading from Frontier to Secondary Emerging Market status under FTSE Russell’s classification by 2025.

On September 15, during a meeting between Vietnam’s Ministry of Finance delegation and the London Stock Exchange (LSE), Minister Nguyễn Văn Thắng expressed confidence in achieving this upgrade by October 2025. Vietnamese regulators have diligently met FTSE Russell’s criteria, as the company is a subsidiary of the LSE.

If successful, Vietnam will join the Secondary Emerging Market category after seven years of consideration, alongside Asia’s most economically dynamic nations like China, India, and Saudi Arabia—a resource-rich economy undergoing impressive transformation.

Market Upgrade for Strategic Repositioning

Vietnam aims to align with higher-growth and more developed economies in Asia

|

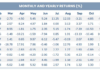

FTSE Russell Market Classification for Asian Countries

Source: Compilation of Asian equity markets from FTSE Equity Country Classification, published on April 8, 2025

|

|

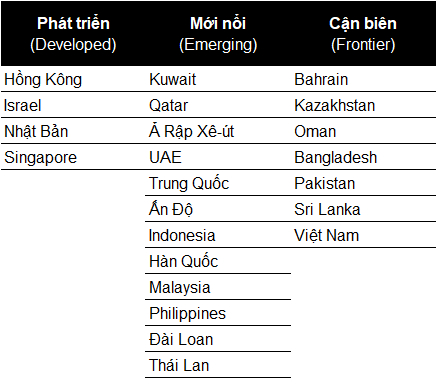

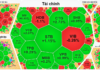

MSCI Market Classification for Asian Countries

Source: Latest annual market classification review by MSCI

|

|

Under the Stock Market Upgrade Plan approved by the Prime Minister on September 12, 2025, Vietnam targets: – Short-term: Meet FTSE Russell’s criteria for upgrading to Secondary Emerging Market status in 2025; maintain this classification. – Long-term: Achieve MSCI Emerging Market and FTSE Russell Advanced Emerging Market status by 2030. |

Currently, all other ASEAN-6 economies except Vietnam have stock markets classified as Emerging or higher. Singapore, notably, is a Developed Market.

While Vietnam has been Southeast Asia’s fastest-growing economy over the past decade, its stock market lags behind neighbors like Thailand, Indonesia, the Philippines, and Malaysia.

FTSE Russell reports that Malaysia achieved Advanced Emerging Market status in June 2011, Thailand in March 2012, and Indonesia and the Philippines have held Secondary Emerging Market status since 2006.

The World Bank’s 2023 report on capital market development asserts that Vietnam must exit the Frontier category to achieve high-income status, as remaining in this group would hinder access to financing needed for sustained growth.

Increased international capital participation will introduce future volatility risks. However, the World Bank argues that Vietnam must attract substantial private investment, particularly through equity, including international sources.

The banking sector, for instance, stands to benefit significantly. Upgrading could provide financial institutions with broader access to capital for restructuring. Progress in attracting foreign investment will also catalyze major IPOs and state-owned enterprise privatizations.

– 12:00 06/10/2025

Prime Minister Chairs Online Government-Locality Conference

On the morning of October 5th, Prime Minister Pham Minh Chinh chaired the Government’s online conference with local authorities for September 2025, addressing several critical topics.

The Billionaire Behind Vietnam’s 2,870-Hectare Reclaimed Megacity and Its Multi-Billion-Dollar Projects: Two Decades of Silent Preparation by Pham Nhat Vuong

In 2024 and 2025, Vingroup unveiled a series of mega-projects spanning from North to South Vietnam. Yet, few are aware that behind the grand groundbreaking ceremonies lies a decade-long gestation period, sometimes exceeding 20 years. Vingroup’s relentless pursuit underscores a persistent market bottleneck—protracted legal procedures that perpetually stifle supply.

Ministry of Education Tightens Control on Illicit Fees, Prepares to Restructure University Network by 2026

The Ministry of Education and Training is not only tackling prolonged overcharging issues but also preparing a comprehensive plan to restructure the network of higher education and vocational institutions. This initiative aims to create a transparent, efficient system that is closely aligned with the practical needs of the economy.

Unlocking Vietnam’s Billion-Dollar Economic Potential: The Golden Land Opportunity

Vietnam boasts a myriad of advantages that set it apart as a dynamic and vibrant destination. From its rich cultural heritage and breathtaking landscapes to its rapidly growing economy and strategic geographic location, Vietnam offers unparalleled opportunities for both personal and professional growth. Its diverse ecosystems, bustling cities, and warm, welcoming people make it a unique and compelling place to explore, invest, and thrive.