Indonesia Launches Pani Gold Mine, Aiming to Boost National Gold Production

Nikkei Asia reports that Indonesia has officially commenced operations at the Pani gold mine in North Sulawesi, boasting reserves of approximately 200 tons. This move is expected to position the mine as one of the country’s largest gold extraction facilities.

According to Merdeka Copper Gold, the mining conglomerate behind the project, the Pani mine is designed to process 7 million tons of ore annually, yielding around 4 tons of gold. The company aims to sustain this output while expanding operations by 2030, enhancing Indonesia’s standing in the global gold market.

Merdeka Gold Resources, the subsidiary operating the mine, listed on the Indonesia Stock Exchange on September 23. Through a new share issuance, representing 10% of total shares, the company raised 4.66 trillion rupiah (approximately $280 million).

These funds will partially finance capacity expansion, underscoring Merdeka’s long-term commitment to the precious metals sector.

Indonesia currently ranks eighth globally in gold production, trailing China, Asia’s leader. The Pani mine’s launch will not only bolster domestic supply but also strengthen the nation’s role in the global gold supply chain.

Alongside mining activities, Indonesia’s domestic gold market is experiencing significant fluctuations. State-owned miner Aneka Tambang (Antam) reported record gold prices of 2.23 million rupiah per gram on October 2. This surge reflects a combination of global geopolitical risks and domestic economic uncertainties, driving gold’s appeal as a safe-haven asset among Indonesian investors.

Aneka Tambang’s CEO, Achmad Ardianto, anticipates gold sales to reach 45 tons this year, up from 43 tons in 2024. To meet rising demand, Antam has imported approximately 30 tons of gold to date.

Merdeka Copper Gold’s activation of the Pani mine is seen as a strategic move, increasing supply, boosting export revenues, and stimulating Indonesia’s economy.

Amid growing investor interest in gold due to economic instability, this development highlights the metal’s increasing importance at both national and societal levels.

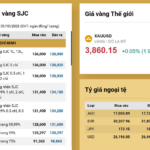

Gold Price Trends Over the Past Year (Source: Trading Economics)

Globally, gold prices have surpassed $3,800 per ounce, nearing the all-time high of $3,897. Gold is on track for its seventh consecutive weekly gain, fueled by safe-haven demand amid a U.S. government shutdown and growing expectations of a dovish Federal Reserve.

The shutdown may delay the release of September’s non-farm payrolls report, prompting investors to rely on alternative data indicating economic cooling.

ADP’s report revealed an unexpected decline in private-sector employment, while the latest ISM Services PMI signaled stagnation.

Markets now anticipate two consecutive 0.25% rate cuts by the Fed in its remaining meetings this year. Gold has risen 48% year-to-date, positioning it for its strongest annual performance since 1979.

KFC Shutters Nearly 70 Outlets in 2 Years, Laying Off 2,200 Employees: What’s Behind the Sudden Collapse?

One of the world’s oldest fast-food brands is facing unsettling signals in one of Southeast Asia’s most populous markets.

First-Time Gold Buyers Pay Prices Far Exceeding Forecasts, Prompting New State Bank Intervention

A draft circular regulating gold trading activities has been released, with an anticipated effective date of October 10th.