Recently, Hoa Sen Group Joint Stock Company (Hoa Sen Group, Stock Code: HSG, HoSE) announced the Board of Directors’ Resolution on the dissolution of Hoa Sen International Port Joint Stock Company.

The reason for the dissolution is attributed to the impact of the global economic situation, rendering business operations ineffective.

The debt settlement plan has been agreed upon, following the proposal made by the Board of Directors of Hoa Sen International Port at the company’s Shareholders’ Meeting.

Hoa Sen International Port is located at 14, Lot E, Tan Thanh Commercial Center, Van Hanh Ward, Phu My District, Ho Chi Minh City.

Illustrative image

As of June 30, 2025, Hoa Sen International Port is an affiliate of Hoa Sen Group, with a 49% ownership/voting rights stake.

However, in the notes to the consolidated financial statements for Q3 of the fiscal year 2024-2025 (April 1, 2025, to June 30, 2025), Hoa Sen Group has not yet contributed capital to Hoa Sen International Port, despite the affiliate being established in 2019.

Regarding business performance, according to the consolidated financial statements for Q3 2024-2025, Hoa Sen Group reported a net revenue of approximately VND 9,509.2 billion, a 12.3% decrease compared to the same period last year. After deducting taxes and fees, the company’s net profit reached nearly VND 273.8 billion, a slight increase of VND 374 million.

For the first half of 2025, Hoa Sen Group generated a net revenue of approximately VND 28,181.2 billion, a 3.4% decline compared to the first six months of 2024; post-tax profit reached VND 646.8 billion, a 7.1% decrease.

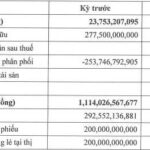

As of June 30, 2025, Hoa Sen Group’s total assets increased slightly by 2.2% compared to the beginning of the year, reaching nearly VND 19,139.7 billion. Inventory accounted for VND 8,042.3 billion, representing 42% of total assets.

On the liabilities side, total payables stood at over VND 7,884 billion, an 8.8% decrease from the beginning of the year. Short-term loans and finance leases amounted to VND 4,630.4 billion, comprising 58.7% of total liabilities.

IR AWARDS: October 2025 Disclosure Schedule Highlights

In October, several key events will shape the stock market landscape. Notable highlights include the release of the PMI, the Q3/2025 Socio-Economic Report, the maturity of 41I1FA00, the deadline for Q3 Financial Statements, and the outcome of the FOMC (Fed) meeting.

From Steel Mill to Vietnam’s Largest Construction & Interior Superstore Giant: How Hoa Sen Group Redefined Differentiation

From a humble steel sheet manufacturer and distributor, Hoa Sen Group has meticulously crafted Vietnam’s premier ecosystem for construction materials and interior solutions. This distinction stems from strategic choices, relentless technological innovation, and an unwavering commitment to social responsibility and sustainable development.

The Billionaire’s Debt: How the ‘Beer’ Tycoons’ Maneuverings Left a Trail of Debts

As of the end of the first half of 2025, Duong Man reported a net profit of over VND 17.4 billion. The company’s total liabilities stood at over VND 1,102.1 billion, representing a significant 174.66 times their equity.