Amidst a bullish stock market with numerous stocks surging, even hitting their ceiling, VMD shares of Vimedimex Pharmaceutical Joint Stock Company bucked the trend.

VMD’s stock price was swiftly pushed to the floor level from the opening session on October 6th, retreating to 17,950 VND per share. Notably, this marked the second consecutive floor session after three previous ceiling sessions.

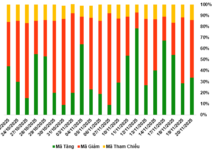

VMD stock price as of the morning session on October 6th

The stock behaved like a rollercoaster following Vimedimex’s trading suspension. Most recently, the Ho Chi Minh City Stock Exchange (HOSE) announced the decision to suspend VMD stock trading. HOSE stated that the reason was due to the company’s failure to disclose information on measures and roadmap to rectify the warned stock status by October 2nd, 2025, exceeding the 15-day deadline.

Previously, VMD stock was placed under warning from September 16th, 2025, for late submission of the 2025 semi-annual audited financial report, exceeding the deadline by 15 days. HOSE required the company to disclose information on rectification measures, but as of October 2nd (15 days after the decision), the company had not complied.

Additionally, HOSE decided to place VMD under special control from October 8th, 2025, due to the late submission of the semi-annual audited financial report by more than 30 days.

HOSE also warned that VMD stock would be suspended if the company failed to rectify the reasons for the trading suspension.

The company’s operations faced challenges following leadership turmoil. In late July, Vimedimex requested a three-month extension for the 2025 semi-annual report due to force majeure.

In a related development, Vimedimex’s ecosystem recently entered the digital asset space. Specifically, Vimexchange Cryptocurrency and Digital Asset Trading Joint Stock Company was established in June 2025 with a charter capital of 10,000 billion VND, the first digital asset company in Vietnam to reach this capital level. Vimedimex contributed 5,000 billion VND for a 50% stake, while Hoang Binh Securities, part of the Vimedimex ecosystem, contributed 200 billion VND for a 2% stake.

Unlocking the Power of Digital Assets: HVA Unveils Plans for DNEX, a $425 Million Crypto Exchange in Da Nang

The Vietnamese government’s recent pilot of the crypto asset market has spurred HVA Investment Joint Stock Company (UPCoM: HVA) to announce its plans for DNEX, a digital asset exchange based in Danang. With a formidable collaborative capital scale of VND 10,000 billion, the exchange is slated to launch in 2025, marking a significant step forward in the country’s digital asset landscape.