I. MARKET TRENDS IN WARRANTS

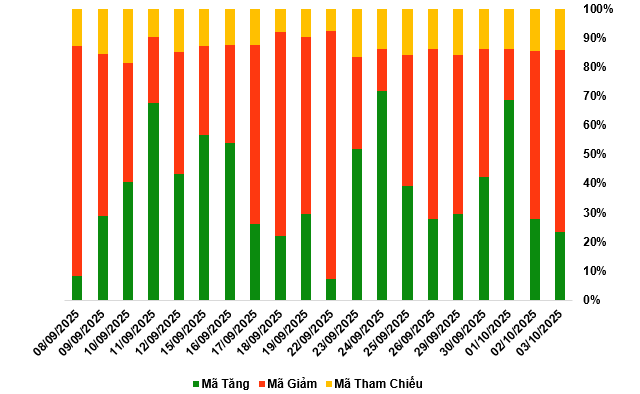

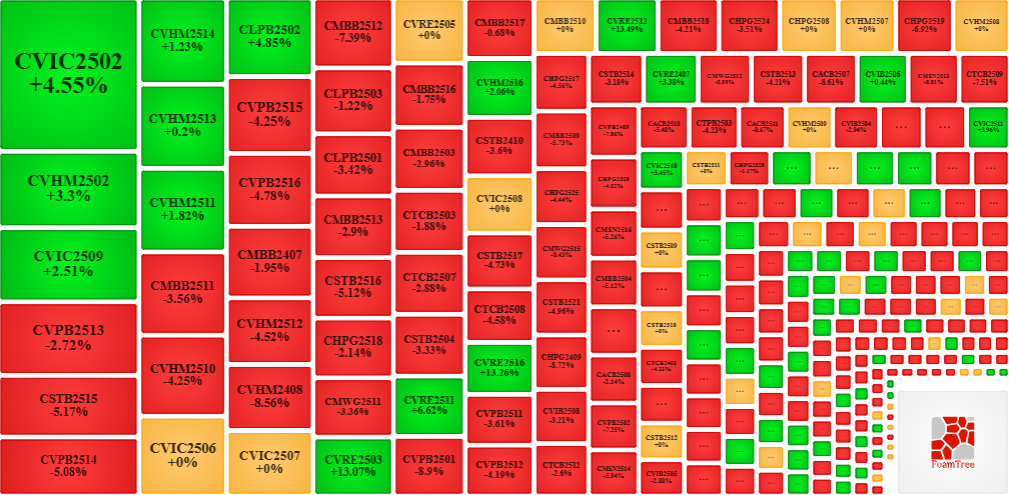

By the end of the trading session on October 3, 2025, the market recorded 66 gainers, 176 losers, and 40 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

During the October 3, 2025 trading session, sellers dominated the market, causing most warrant prices to decline. Notably, the top decliners included CVPB2513, CSTB2515, CVHM2510, and CMBB2407.

Source: VietstockFinance

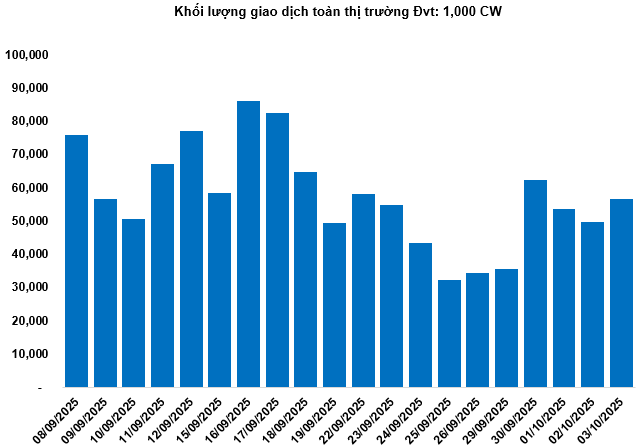

Total market volume on October 3 reached 56.54 million CW, up 13.78%; trading value hit 141.44 billion VND, a 10.88% increase from October 2. CHPG2520 led the market in both volume and value, with 4.78 million CW traded, equivalent to 14.7 billion VND.

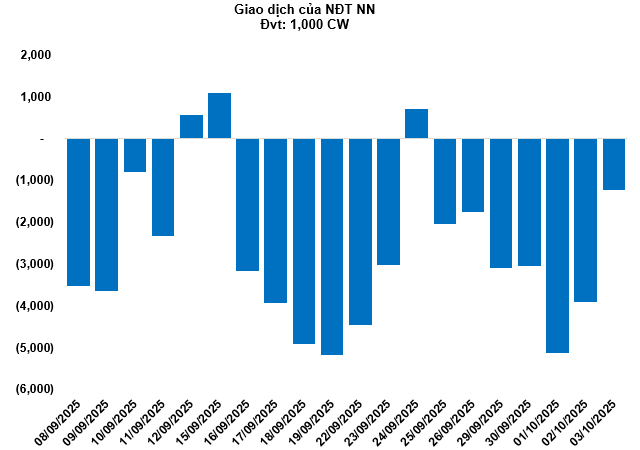

Foreign investors continued net selling on October 3, totaling 1.23 million CW. CMSN2509 and CMSN2510 saw the highest net outflows. For the week, foreign investors net sold over 16.39 million CW.

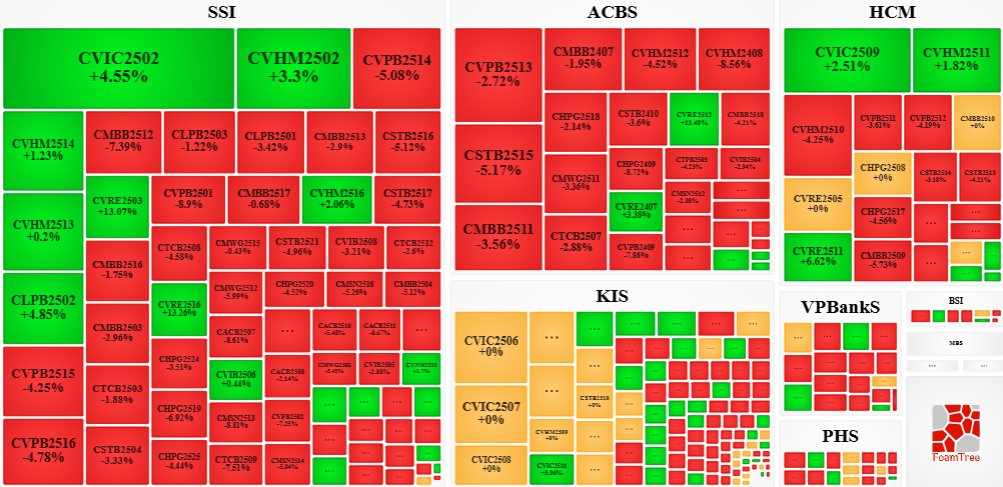

Securities firms SSI, ACBS, KIS, HCM, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

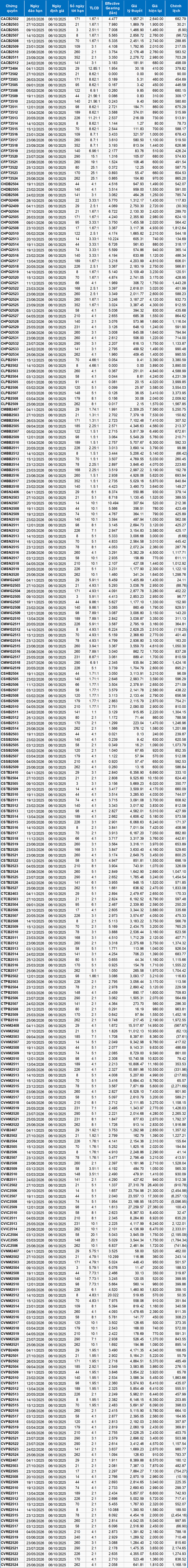

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from October 6, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVIC2507 and CVIC2508 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2512 and CVNM2502 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 05/10/2025

“It’s Not a Crash—Here’s How the Market Quietly Erodes Investors’ Portfolios Every Single Day”

Many individuals, despite not suffering significant losses, choose to withdraw due to the unbearable, prolonged sense of monotony and fatigue.

Week 29/9 – 3/10: Foreign Investors Offload Another VND 7.6 Trillion, Which Stocks Were Hit Hardest?

Foreign investors maintained their strong net selling pressure, recording another week of net outflows exceeding 7,000 billion VND.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.