Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1 billion shares, equivalent to a value of more than 29.5 trillion VND; the HNX-Index reached over 95.1 million shares, equivalent to a value of more than 2.1 trillion VND.

The VN-Index opened the afternoon session with selling pressure re-emerging, but buying power remained strong, quickly regaining control and propelling the VN-Index to close in the optimistic green zone. In terms of influence, VCB, VPB, VIC, and HPG were the most positively impactful stocks on the VN-Index, contributing over 14 points of increase. Conversely, LPB, PGV, STG, and BCG faced selling pressure, but their impact was not significant.

| Top 10 Stocks Most Impacting the VN-Index on October 6, 2025 (by points) |

Similarly, the HNX-Index showed positive momentum, influenced by stocks like SHS (+9.88%), MBS (+8.87%), CEO (+8.09%), and NVB (+5.56%).

| Top 10 Stocks Most Impacting the HNX-Index on October 6, 2025 (by points) |

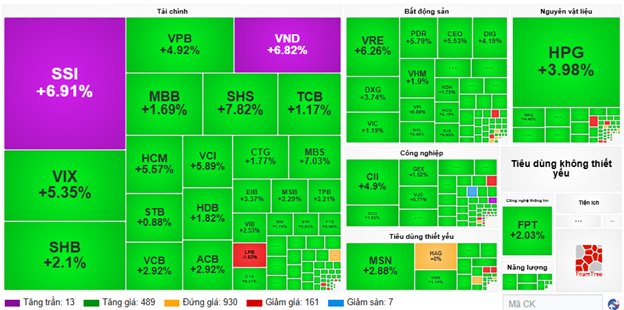

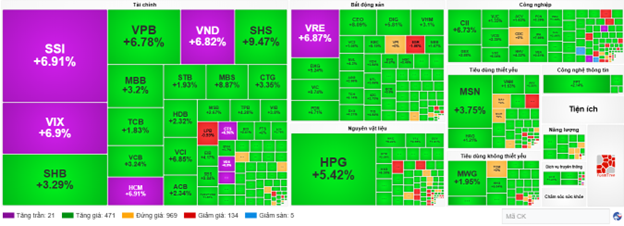

At the close, the market surged with green across all sectors. The financial sector led with a 3.8% increase, primarily from VPB (+6.95%), SSI (+6.91%), VIX (+6.9%), and VND (+6.82%). The materials and energy sectors followed with gains of 3.26% and 3.05%, respectively, featuring standout stocks like HPG (+5.61%), GVR (+3.18%), DGC (+1.42%), DCM (+4.15%), BSR (+4.61%), PLX (+2.09%), PVS (+2.54%), and PVD (+2.88%).

Foreign investors continued to net sell over 1.644 trillion VND on the HOSE, focusing on MWG (310.77 billion), MBB (278.82 billion), STB (211.9 billion), and VRE (169.43 billion). On the HNX, they net sold over 38 billion VND, concentrated in CEO (20.42 billion), IDC (12.89 billion), MBS (5.13 billion), and HUT (2.63 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Financial Stocks Soar, VN-Index Hits 1,680 Points

Green dominated until the morning session’s close. At the midday break, the VN-Index rose over 33 points (+2.02%) to 1,679.1 points, while the HNX-Index surged 2.54% to 272.51 points. Market breadth favored buyers with 502 gainers and 168 decliners.

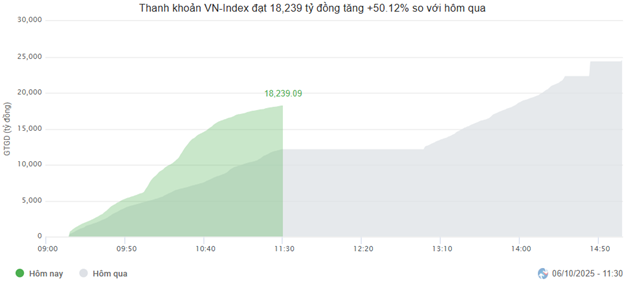

Increased trading in large-cap stocks boosted market liquidity this morning. The HOSE recorded over 622 million units, valued at more than 18 trillion VND, doubling the previous session’s volume. The HNX saw nearly 59 million units, valued at nearly 1.4 trillion VND.

Source: VietstockFinance

|

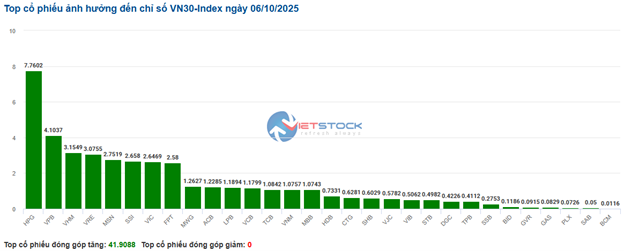

VCB and VPB were the most positively impactful stocks, adding 3.5 and 2.7 points to the VN-Index, respectively. HPG, VIC, and VHM contributed an additional 5.6 points. Meanwhile, the top 10 negatively impacting stocks collectively subtracted less than 1 point from the index.

All sectors turned green, with 7 out of 11 sectors rising over 1% by midday. The financial sector led, with widespread gains in banking and securities stocks like VCB (+2.92%), BID (+1.76%), CTG (+1.77%), VPB (+4.92%), ACB (+2.92%), SHB (+2.1%), VIB (+2.53%), VND, and SSI hitting their upper limits.

Source: VietstockFinance

|

Materials and real estate sectors also traded actively, with highlights like HPG (+3.98%), GVR (+2.06%), MSR (+2.16%), DCM (+2.15%), HSG (+3.32%); VIC (+1.19%), VHM (+1.9%), VRE (+6.26%), KBC (+3.32%), NVL (+2.98%), and PDR (+5.79%).

Foreign investors continued net selling over 1.2 trillion VND across all three exchanges, focusing on VRE (174.77 billion) and STB (151.94 billion). VIX and HPG led net buying with over 31 billion VND.

| Top 10 Foreign Net Bought and Sold Stocks in the Morning Session, October 6, 2025 |

10:30 AM: Financial Stocks Turn Purple

Buyers dominated, driving indices higher. By 10:30 AM, the VN-Index rose 33.13 points to 1,678.95, and the HNX-Index gained 6.01 points to 271.76.

All VN30 stocks turned green, led by HPG (+7.76 points), VPB (+4.1 points), VHM (+3.15 points), and VRE (+3.07 points). Blue-chip stocks like HPG (+4.88%), MSN (+3.38%), FPT (+2.03%), and MWG (+1.43%) also performed strongly.

Source: VietstockFinance

|

Financial stocks attracted significant inflows, turning all sector stocks purple. Notable gainers included SSI, SHS, VIX, VND, and VDS, with VPB (+4.92%), VCB (+3.4%), HCM (+5.95%), and VIX (+6.34%) also surging. This optimism reflects anticipation of FTSE Russell’s market upgrade announcement on October 8.

Real estate stocks also impressed, with VRE and PDR hitting their upper limits, and NVL (+4.3%), DXG (+3.74%), and DIG (+3.95%) rising sharply.

Buyers dominated, with 471 gainers and 134 decliners compared to the open.

Source: VietstockFinance

|

Market Opens with Widespread Green

At 9:30 AM on October 6, the VN-Index rose positively to 1,670 points, and the HNX-Index gained nearly 3 points to 268.51. VN30 stocks significantly contributed to the index’s gains.

The financial sector led early gains, with VCB (+2.27%), BID (+1.13%), TCB (+1.04%), and MBB (+1.13%) rising.

Materials stocks also contributed, with HPG (+1.99%), GVR (+1.69%), DGC (+1.09%), and KSV (+2.89%) turning green.

Real estate stocks supported the market’s early rise, with VIC (+1.53%), VHM (+1.4%), VRE (+2.75%), and BCM (+0.15%) all in the green.

– 15:35, October 6, 2025

Why Investors Must Stay Patient Despite Continuous Stock Market Erosion

Contrary to the anticipated positive market upgrades, stock investors are grappling with the dilemma of whether to cut their losses or hold onto their shares.

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.

Market Pulse 06/10: Financial Stocks Soar, VN-Index Hits 1,680 Mark

The green hue dominated the market throughout the morning session. As the midday break approached, the VN-Index surged by over 33 points (+2.02%), reaching 1,679.1 points, while the HNX-Index also saw a robust increase of 2.54%, closing at 272.51 points. Market breadth strongly favored buyers, with 502 stocks advancing and only 168 declining.