Investment Legend Peter Lynch

|

During this period, Lynch achieved an impressive annual average return of 29.2%, consistently outperforming the S&P 500. He retired at 46 but, now at 81, remains Vice Chairman of Fidelity Management and Research.

In a recent interview with Josh Brown, co-founder and CEO of Ritholtz Wealth Management, the investment “wizard” shared an anecdote about a call with singer-actress Barbra Streisand. She expressed anxiety about owning stocks without understanding them—not even knowing what the companies did.

“People meticulously spend hours saving $50 on a flight but readily invest $10,000 in a stock they overheard on a bus—without understanding it. Someone coined the term ‘playing the stock market’ before I entered this field—a dangerous verb,” Lynch remarked. “Don’t play the market. Buy good companies and understand their business,” he emphasized. Investors should explain their stock choices to an 11-year-old in under a minute, not just say, “It’ll go up.”

Lynch reiterated his famous view: Investors lose more money preparing for or predicting corrections than in the corrections themselves. “Economists predicted 33 of the last 11 recessions,” he quipped.

He warned investors to expect losses. “Parents with college-bound children should avoid stocks and opt for safer money market funds,” he advised.

On market analysis, Lynch stressed focusing on current facts—savings rates, employment, oil prices, and improving sectors—over predictions. “I want today’s truth, not next year’s Wall Street Journal. I’ve tried predicting the future for 81 years,” he said.

Despite market changes, Lynch believes investing fundamentals remain constant. “Success stories like Amazon, Costco, and Walmart endure—forget tech firms like Oracle. These companies delivered solid returns based on public information,” he noted. He lamented the decline in publicly traded companies from 8,000 to 3,000–4,000.

Lynch admitted being “tech-illiterate” with no AI stocks. “My wife and daughter understand machines. I stick to yellow pads and phones,” he said, unsure if AI’s boom mirrors the late-1990s dot-com bubble.

On the “Magnificent Seven,” he praised Meta, Microsoft, Google, and Amazon but was skeptical about Tesla, favoring BYD’s affordable, quality cars.

Reflecting on history, Lynch noted the 1982 Dow Jones low of 777. “Since then, we’ve seen an extraordinary market with 10–12 declines. Everyone I know grew up hearing, ‘The next crash is coming,’” he shared. Despite 11 recessions, none matched the Great Depression’s severity. “Back then, no Social Security, unemployment insurance, or SEC. The Fed was asleep,” he explained.

Today’s investors, he argued, have advantages: modern safeguards, higher homeownership (63% vs. 1920s’ low rates), and broader stock ownership (1% in 1929 vs. wider participation now). “We’ve faced challenges—poor presidents, Congresses—but persevered,” Lynch concluded.

– 13:25 06/10/2025

Massive $7 Billion Buying Spree: Mystery Force Scoops Up Vietnamese Stocks in Friday’s Trading Frenzy

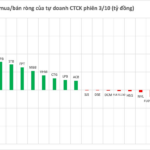

Proprietary trading firms continued their buying spree on the Ho Chi Minh City Stock Exchange (HOSE), netting a substantial VND 638 billion in purchases.