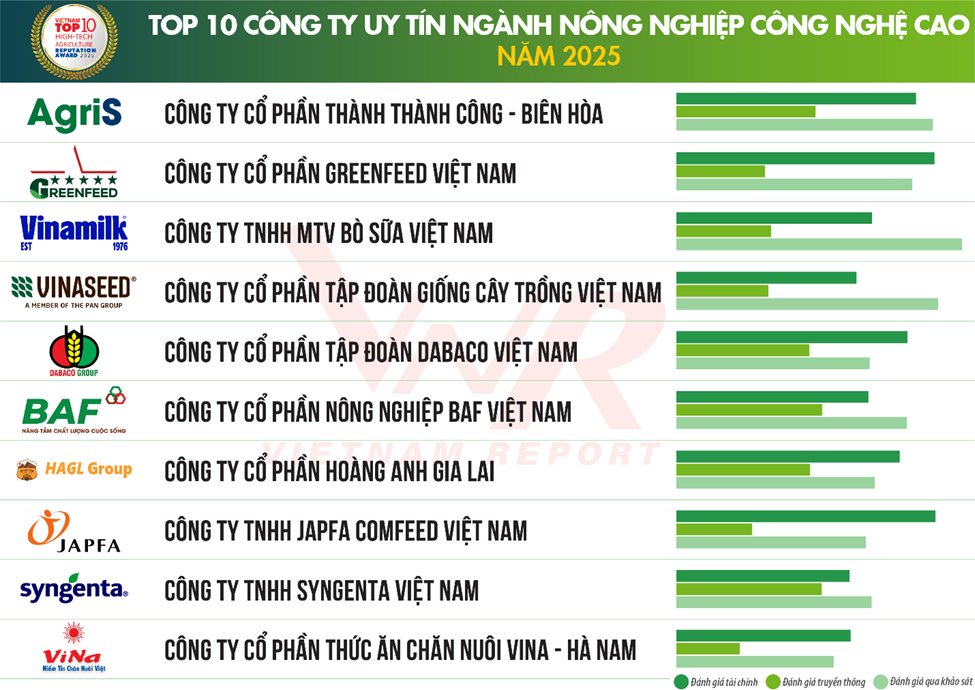

On October 6, 2025, Vietnam Report Joint Stock Company officially announced the Top 10 Reputable Companies in Vietnam’s High-Tech Agriculture Sector for 2025.

The companies were evaluated and ranked based on three key criteria: Financial Capacity, as reflected in the most recent financial reports; Media Reputation, assessed using the Media Coding method—encoding articles about the companies across influential media channels; and Surveys of research subjects and stakeholders, updated as of September 2025.

Compared to 2024, this year’s rankings saw significant shifts, notably the absence of former top contenders. These include C.P. Vietnam Livestock Joint Stock Company, which led the 2024 rankings; Loc Troi Group Joint Stock Company, ranked second in 2024; and Thaibinh SEED Group Joint Stock Company, previously in eighth place.

This year’s Top 10 features three new entrants: Thanh Thanh Cong – Bien Hoa Joint Stock Company (Agris), which debuted at the top spot; Greenfeed Vietnam Joint Stock Company, now in second place; and Japfa Comfeed Vietnam Co., Ltd., securing the eighth position.

Additionally, Vietnam Dairy Products Joint Stock Company (Vinamilk) climbed to third place. Similarly, Dabaco Group Vietnam and BAF Vietnam Agriculture also advanced in the rankings, surpassing Hoang Anh Gia Lai.

For decades, agriculture has been a cornerstone of Vietnam’s economy, ensuring social stability, food security, and a positive trade balance.

The sector’s strength lies in its robust foundation coupled with a drive for innovation.

However, the sector faces inherent challenges that require addressing. The most significant barrier is the fragmented and small-scale production, which hinders the large-scale and synchronized application of technology. Deeper issues include uneven R&D investment; surveys reveal that two-thirds of companies allocate less than 3% of revenue to R&D, a rate that could slow innovation.

Critically, the sector grapples with a shortage of high-quality, cross-disciplinary talent. This is no longer a subjective observation but a confirmed issue, with 25% of companies citing it as the second-largest obstacle to their growth.

Externally, the sector faces immense opportunities. Globally, demand for safe, traceable, and sustainably produced food is rising, opening doors for Vietnam’s high-quality agricultural products.

Paradoxically, the most promising growth opportunity is seen in the domestic market, with 47.62% of companies believing that developing premium, branded products for local consumers is the most viable path. Additionally, the carbon credit market presents a novel and lucrative revenue stream, transforming sustainable agricultural practices into economic assets.

Lastly, new-generation Free Trade Agreements (FTAs) remain a crucial lever, expanding access to premium export markets.

Alongside these opportunities are significant challenges. The most unpredictable and severe risk is the escalating impact of climate change, identified by 65% of companies as the greatest external barrier, surpassing even capital and land constraints.

Market-wise, intensifying competition from regional agricultural powerhouses like Thailand and Indonesia demands continuous innovation from Vietnam to maintain its position. Finally, increasingly stringent technical barriers and food safety standards in import markets pose both challenges and incentives for the sector to elevate its quality benchmarks.