Short-term psychology diverges, but long-term prospects remain irreversible.

In a discussion with the author amidst growing anticipation of an upgrade, Huynh Anh Huy – CFA, Director of Securities Industry Analysis at KAFI, predicts that under a positive scenario where Vietnam is upgraded to Emerging Market (EM) status, the initial impact will come from short-term speculative capital from foreign investors. Overseas investors will swiftly enter to seek opportunities, positively affecting liquidity and stock prices.

|

Regarding valuation, an upgrade to EM status implies that the market’s P/E ratio could align with regional peers. This opens up over 15% growth potential for the VN-Index in the short term, bolstering expectations of a new upward cycle.

Long-term prospects are even more promising. International investment funds, particularly large index funds, will have a basis to increase their allocation to Vietnam’s stock market. This will not only expand the market’s scale but also elevate its global financial standing. Alongside attracting new capital, efforts to improve trading infrastructure, information transparency, and operational mechanisms will deepen Vietnam’s integration into the global financial landscape.

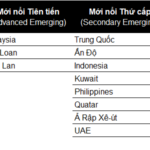

Also commenting on this topic, Tran Thai Binh – CFA, Senior Director of Securities Analysis at OCBS, forecasts a high probability of a successful upgrade in October, given that Vietnam has met all 9 criteria and a recent survey shows 85% of 26 major global funds support FTSE Russell’s upgrade decision.

|

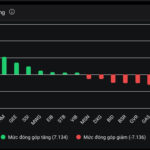

The most significant impact will be on market sentiment, triggering a rally with markedly improved liquidity. Subsequently, a portion of capital from FTSE EM index funds will begin flowing into Vietnam, focusing on large-cap, highly liquid stocks.

Amid recent market accumulation and declining liquidity, Mr. Huynh Anh Huy notes that smart money has turned cautious, opting to observe and await official upgrade news before taking decisive action. This reflects a wait-and-see sentiment but also serves as a necessary accumulation phase for a larger wave.

While upgrade expectations are high and considered nearly certain in the near future, a delay in this review would not be overly detrimental. Investors understand that an upgrade is a matter of time, and the market’s quality improvement trend is irreversible—core drivers of Vietnam’s sustainable securities development.

Mr. Tran Thai Binh adds that in a delay scenario, the market might face adjustment pressure with negative sentiment, but it won’t be overly pessimistic, thanks to strong fundamentals and the near-term certainty of an upgrade.

Businesses must self-upgrade to realize their potential

At the IR View seminar on October 2, Vu Ngoc Linh – Director of Market Analysis and Research at VinaCapital, shared insights on this hot topic.

According to Ms. Linh, Vietnam’s securities market capital dynamics will shift significantly. While retail investors dominate current trading, an October upgrade could attract $1 billion from ETFs and later $5-6 billion from active funds—not massive but substantial.

Ms. Vu Ngoc Linh – Director of Market Analysis and Research at VinaCapital

|

Addressing what the market seeks from businesses in this new context, Ms. Linh emphasizes that VinaCapital, with over 20 years of experience in Vietnam, values clarity on a company’s vision, core values, and operational efficiency.

Transparency is crucial for building long-term investor trust. Sustainability (ESG) and AI integration into operations are also key focuses for foreign investors. “Businesses must not only tell their story but do so convincingly. When everyone tells the same story, yours must stand out,” Ms. Linh advises.

– 08:00 06/10/2025

Elevate Stock Market Tiering to Reposition and Unlock New Growth Frontiers

Compared to its Asian counterparts, Vietnam, despite its rising economic prominence, lags in stock market rankings. This underscores the urgent need to reposition its market, often seen as the barometer of its economy.

Finance Ministry Leader Delivers Crucial Statement Ahead of Stock Market Upgrade Review

Next week marks a pivotal moment for Vietnam’s stock market as FTSE Russell announces its decision on the country’s market upgrade on October 8th. Ahead of this critical event, the Ministry of Finance has confirmed the completion of all necessary measures, ensuring readiness for the potential upgrade. The outcome now hinges on the impartial assessment of international organizations.

Unlocking Market Potential: Ministry of Finance Announces Initiatives to Upgrade Stock Market and Crypto Asset Framework

Elevating the stock market’s ranking is an ongoing process, intrinsically tied to fostering transparency and sustainability. The Ministry of Finance, the Securities Commission, and international agencies are collaborating closely to achieve this goal. Leadership from the Ministry of Finance underscores that the development of the stock market must prioritize stability, transparency, and long-term sustainability.

Vietnam Stock Market Upgrade Decision Meeting Scheduled for This Week

Vietcap Securities remains confident in its outlook, anticipating a positive announcement from FTSE Russell regarding Vietnam’s market classification next Wednesday.