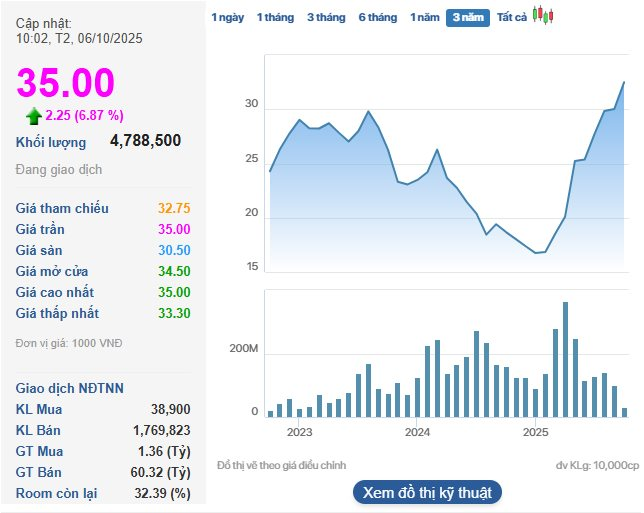

The Vietnamese stock market opened the October 6th trading session with a bullish gap, led by the impressive performance of Vingroup-affiliated stocks. Notably, Vincom Retail (stock code: VRE) surged to its ceiling price, even reaching a “zero sell” status, climbing to VND 35,000 per share—its highest level since February 2022. Consequently, its market capitalization exceeded VND 79.5 trillion.

This remarkable rally followed the grand opening of Vincom Mega Mall Ocean City at Vinhomes Ocean City (Hanoi) over the previous weekend, marking Vincom Retail’s 89th shopping center and its presence in 31 out of 34 provinces and cities nationwide.

Spanning nearly 70,000 m² with 3 above-ground floors and 2 basement parking levels, Vincom Mega Mall Ocean City is a premier shopping destination developed under the “One-Stop Shoppertainment” model, seamlessly blending shopping, dining, and entertainment.

Among its tenants, AEON supermarket stands out with over 7,500 m²—its first appearance in the Vincom network. This marks a significant expansion for the Japanese retail giant in Hanoi, enriching Vincom Retail’s diverse service ecosystem.

ACBS Securities recently projected steady growth for Vincom Retail’s property leasing segment in 2025, forecasting VND 8.516 trillion in revenue driven by improved occupancy rates and contributions from five new malls launched in 2024.

VRE’s surge also reflects investor optimism surrounding an upcoming massive dividend payout from its subsidiary. Vincom Retail’s Board approved a VND 4.48 trillion profit distribution by Vincom Retail Operation LLC (100% owned), payable via bank transfer in Q3/2025.

As of June 30, 2025, Vincom Retail operates four subsidiaries: Vincom Retail Operation LLC (mall/office leasing, entertainment, real estate), Suoi Hoa Urban Development LLC, Vincom Retail Investment JSC, and Vincom Retail Landmark 81 LLC. To streamline operations, Suoi Hoa Urban Development LLC merged into Vincom Retail Operation LLC on August 26, 2025, reducing the subsidiary count to three.

Billionaire Pham Nhat Vuong Makes New Move with Over $400 Million in VIC Shares

Mr. Pham Nhat Vuong is set to transfer over 60 million VIC shares to VinEnergo as part of a capital contribution.

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

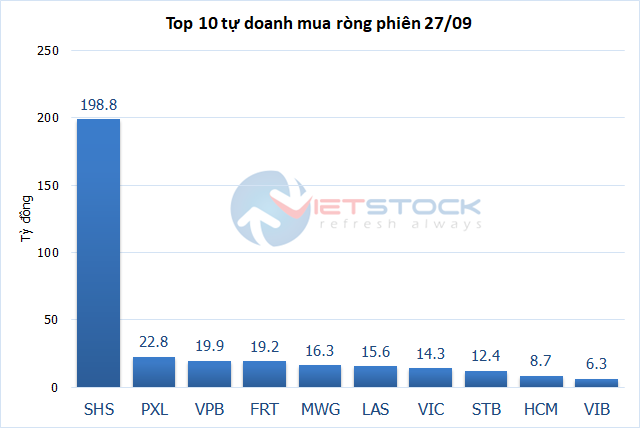

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.

Vingroup Proposes Feasibility Study for Can Gio – Ba Ria Vung Tau Cross-Sea Highway

According to Vingroup, investing in the new sea-crossing route connecting Can Gio to Ba Ria-Vung Tau will significantly reduce travel time and efficiently link key functional areas within the city.