The first week of October concluded with subdued activity in the stock market. The VN-Index dipped slightly by 0.9%, settling around 1,645 points, while the HNX-Index and UPCoM-Index retreated to 276 and 109 points, respectively.

Green on the Outside, Red Within: Foreign Investors Net Sell

Although the decline was modest, investors are concerned about the sharp drop in liquidity, which has halved to approximately VND 25 trillion per session compared to August when the VN-Index approached the 1,700-point peak.

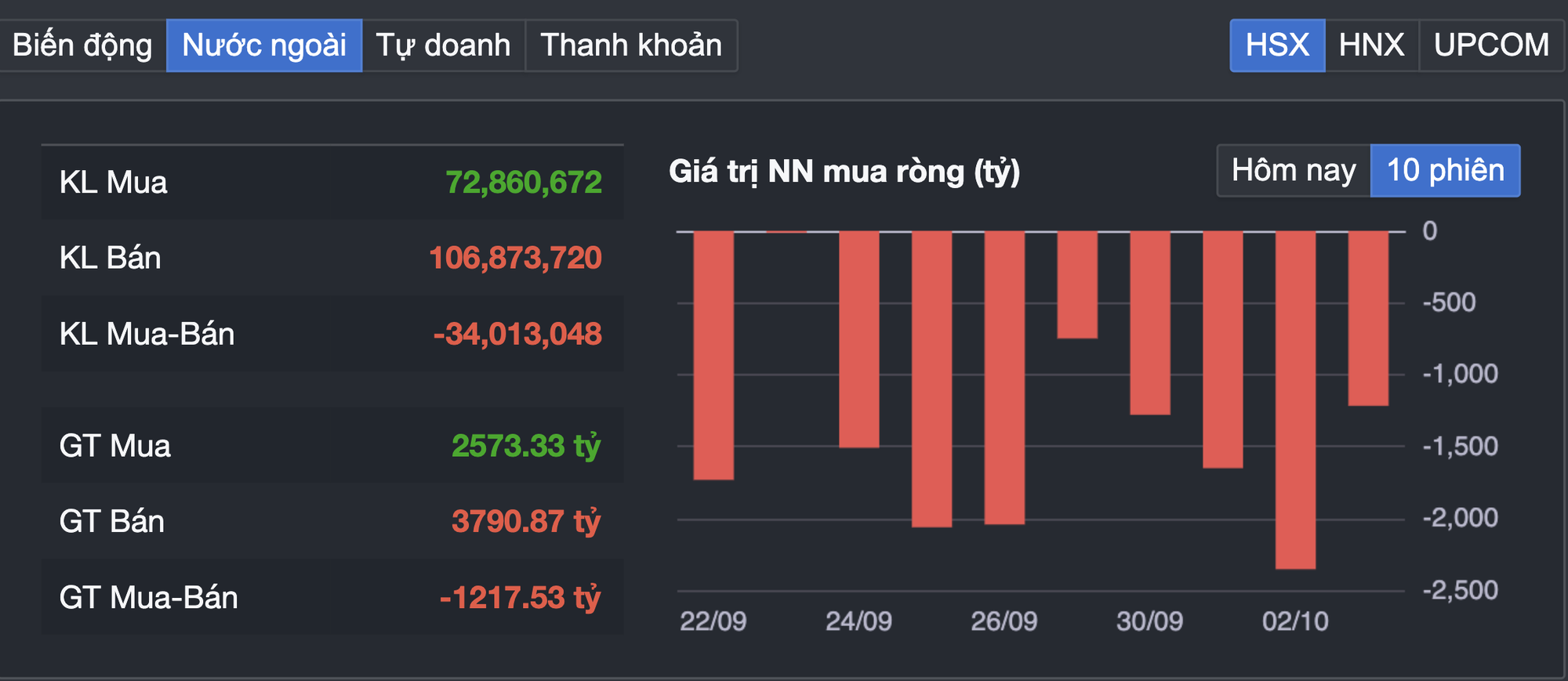

Notably, foreign investors have net sold for 11 consecutive weeks, withdrawing over VND 7.2 trillion from the HoSE market last week alone. SHS Securities attributes the market’s pessimism to a lack of strong supportive news and mounting short-term losses.

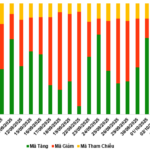

Weakening capital flows have stifled market momentum, while selling pressure has broadened across sectors such as fertilizers, chemicals, construction, ports, insurance, energy, steel, and real estate.

On financial forums, investors describe the situation as “green on the outside, red within”—the index remains above the psychological 1,600-point threshold, but portfolios are suffering heavy losses. Many are caught in a cycle of stop-loss selling and re-buying, eroding their accounts significantly.

Mr. Lê Hoàng, an investor in Ho Chi Minh City, reports a 10% decline in his portfolio, with securities and real estate stocks down 15%. “Many margin traders are down 15-20% but hesitate to cut losses, hoping for a market rebound. Even positive news about market upgrades or Q3 earnings hasn’t lifted prices,” he notes.

Persistent net selling by foreign investors over recent periods.

Patience Awaits Market Upgrade Results

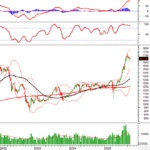

Nguyễn Tấn Phong, an analyst at Pinetree Securities, observes that the VN-Index has been consolidating for over a month, reflecting investor caution ahead of FTSE Russell’s market upgrade decision on October 8.

“The market remains ‘green on the outside, red within,’ with only a few large-cap stocks like VIC, VRE, and LPB supporting the index. Excluding these, the VN-Index would fall to 1,620-1,630 points,” Phong comments.

Despite market weakness, many securities firms view this as a necessary consolidation phase after the strong year-to-date rally. Index volatility is expected to narrow as investors await the upgrade outcome.

Thành Công Securities (TCSC) estimates a 90% chance of Vietnam’s market upgrade. However, the immediate impact will be psychological rather than tangible. “A sustained return of foreign buying is crucial for a genuine market rebound toward 1,700 points,” TCSC’s report emphasizes.

In the near term, experts advise investors to maintain moderate stock exposure, avoid high leverage, and await clearer signals post-October 8. The market is testing investor resolve, and those with robust risk management strategies are best positioned to weather the recovery.

The VN-Index has traded sideways for over a month, leaving investors grappling with losses.

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.

Market Pulse 06/10: Financial Stocks Soar, VN-Index Hits 1,680 Mark

The green hue dominated the market throughout the morning session. As the midday break approached, the VN-Index surged by over 33 points (+2.02%), reaching 1,679.1 points, while the HNX-Index also saw a robust increase of 2.54%, closing at 272.51 points. Market breadth strongly favored buyers, with 502 stocks advancing and only 168 declining.

Vietstock Weekly 06-10/10/2025: Is the Market Still Hesitant?

The VN-Index extended its decline for the fourth consecutive week, accompanied by a drop in trading volume. Recent weeks have seen the index consistently forming long-shadowed candlesticks, signaling investor hesitation and uncertainty. With the Stochastic Oscillator weakening further following a sell signal in overbought territory, short-term volatility risks remain elevated.

Market Outlook for Warrant Trading Week of October 6–10, 2025: Pessimism Continues to Rise

At the close of trading on October 3, 2025, the market saw 66 stocks rise, 176 fall, and 40 remain unchanged. Foreign investors continued their net selling streak, offloading a total of 1.23 million CW.