According to the General Statistics Office, the business trend survey results for manufacturing and processing enterprises in Q3/2025 reveal the following: 33.6% of businesses reported improved production and business performance compared to Q2/2025; 44.2% indicated stable operations, while 22.2% faced difficulties. For Q4/2025, projections show 40.8% of businesses expect improvement, 41.7% foresee stability, and 17.5% anticipate challenges. Foreign direct investment (FDI) enterprises are the most optimistic, with 83.2% predicting better or stable conditions in Q4/2025 compared to Q3/2025. This figure stands at 8.4% for non-state enterprises and 80.5% for state-owned enterprises.

Regarding production volume, 35.0% of businesses reported an increase in Q3/2025 compared to Q2/2025, 42.2% remained stable, and 22.8% experienced a decline. For Q4/2025, 39.9% anticipate growth, 43.4% expect stability, and 16.7% predict a decrease.

In terms of orders, 31.1% of businesses received more orders in Q3/2025 than in Q2/2025, 46.3% maintained stable order levels, and 22.6% saw a decline. Looking ahead to Q4/2025, 38.0% expect an increase in orders, 45.6% foresee stability, and 16.4% predict a decrease.

For export orders, 26.2% of businesses reported higher new export orders in Q3/2025 compared to Q2/2025, 51.2% remained stable, and 22.6% experienced a decrease. In Q4/2025, 32.3% expect an increase in new export orders, 51.2% anticipate stability, and 16.5% predict a decline.

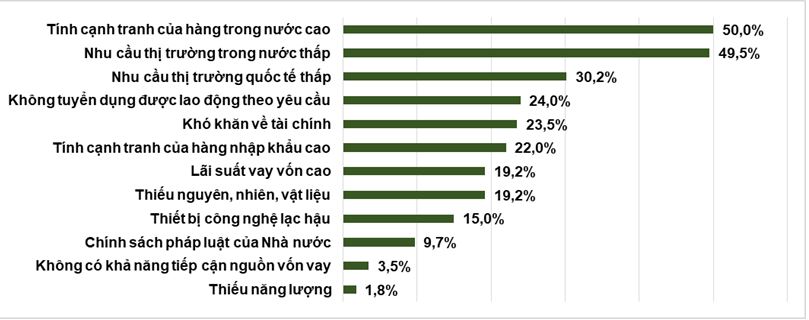

Factors Affecting Production and Business Operations of Manufacturing and Processing Enterprises in the First 9 Months of 2025

|

– 2:00 PM, October 6, 2025

Q3 2025 GDP Growth Surges to 8.23%

According to the latest data released by the Statistics Bureau, the Gross Domestic Product (GDP) for the third quarter of 2025 is estimated to have grown by 8.23% compared to the same period last year. This growth rate is second only to the 14.38% increase recorded in the corresponding quarter of 2022, marking it as the second-highest growth within the 2011-2025 timeframe.

Q3 2025 Industrial Production Index Projected to Surge 10% Year-Over-Year

Businesses ramped up production to meet export demands ahead of anticipated higher U.S. tariffs, while increased mining and electricity generation in recent months were the primary drivers behind the double-digit growth in the industrial production index for Q3/2025. The index is estimated to have risen by 10.0% year-on-year in Q3/2025; for the first nine months of 2025, it is projected to have increased by 9.1% compared to the same period last year. Within this, the manufacturing sector saw a 10.4% rise, marking the highest growth rate since 2020.

VN30-Listed Firm Projects 90% Annual Profit Target Achievement in Q3

Leading securities firms SSI, BVSC, VDSC, and VCBS have released their Q3/2025 earnings forecasts for a range of companies. Notably, several businesses are projected to achieve double-digit growth. In the retail and consumer sector, Masan Group Corporation (HOSE: MSN) stands out with an estimated profit of VND 1,700 billion, marking a 31% year-on-year increase. The company itself anticipates even higher figures, driven by sustained growth across multiple business segments.

Vietnam’s Q3 GDP Growth Hits Record High Since 2011: What Does This Mean for 2025’s First Nine Months?

The latest report from the General Statistics Office (Ministry of Finance) on the socio-economic situation highlights that Vietnam’s economy in the third quarter and the first nine months of 2025 has achieved remarkably positive results, with each month and quarter showing continuous improvement. This progress is particularly notable given the ongoing uncertainties in the global and regional economic landscape.

A Fresh Perspective on Exchange Rates

The U.S. Federal Reserve’s (Fed) 0.25 percentage point rate cut has eased pressure on the Vietnamese dong’s exchange rate against the U.S. dollar, allowing Vietnam to maintain its accommodative monetary policy. However, a more fundamental solution is still required to address this issue effectively.