Vietnamese stocks have just concluded a vibrant trading session, with investor enthusiasm soaring across the board. The market closed with the VN-Index surging nearly 50 points to reach 1,695.5. Trading value on HoSE also saw a notable improvement, hitting VND 29.5 trillion.

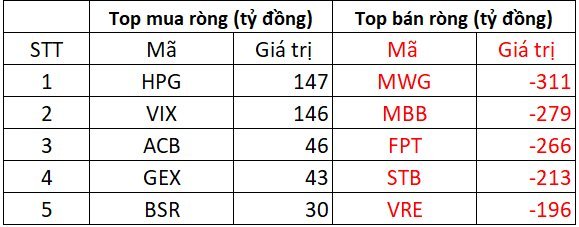

Amidst this upbeat atmosphere, foreign investors stood out as a contrasting note, continuing their net selling streak with a total of VND 1,902 billion across the market. The breakdown is as follows:

On HoSE, foreign investors net sold approximately VND 1,857 billion

On the buying side, HPG and VIX were the most favored stocks, with net purchases of around VND 146-147 billion. Following closely, ACB, GEX, and BSR were also net bought, ranging from VND 30 billion to VND 46 billion.

Conversely, MWG saw the heaviest net selling at VND 311 billion. Other stocks like MBB, FPT, and STB were also net sold by foreign investors, ranging from VND 210 billion to nearly VND 280 billion each. Additionally, VRE faced net selling of approximately VND 196 billion.

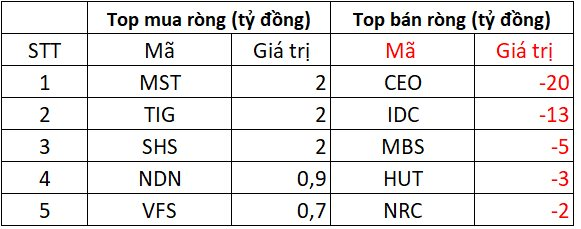

On HNX, foreign investors net sold over VND 38 billion

In terms of purchases, MST, TIG, and SHS were net bought by VND 2 billion, while NDN and VFS saw lighter net buying of a few hundred million each.

On the selling side, CEO and IDC faced net selling of VND 20 billion and VND 13 billion, respectively. MBS, HUT, and NRC also saw net selling ranging from VND 2 billion to VND 5 billion.

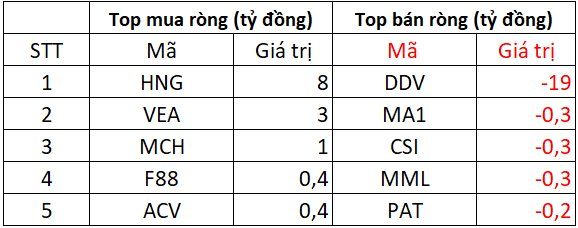

On UPCOM, foreign investors net sold VND 6 billion

HNG and VEA were net bought with values of VND 3 billion and VND 8 billion, respectively. MCH, F88, and ACV also saw net buying ranging from a few hundred million to VND 1 billion each.

In contrast, DDV faced net selling of VND 19 billion, while MA1, CSI, MML, and PAT saw lighter net selling of a few hundred million each.

Yuanta: Vietnam’s Stock Market Poised for Upturn by Mid-October

In its October report, Yuanta Securities characterizes the current market movement as a technical correction, affirming that the long-term upward trend remains intact.