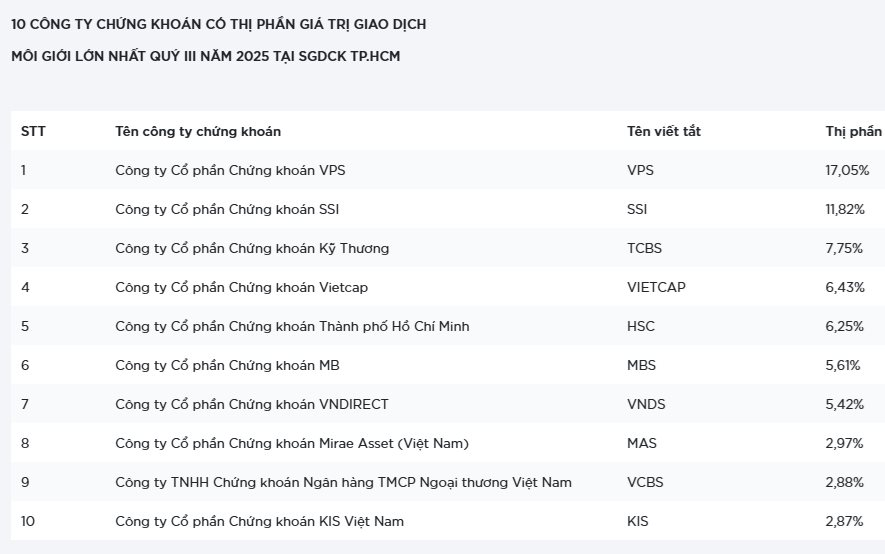

The Ho Chi Minh City Stock Exchange (HoSE) has released its Q3 2025 rankings of the top 10 securities firms by brokerage market share for stocks, fund certificates, and covered warrants. The list includes VPS, SSI, TCBS, Vietcap, HSC, MBS, VNDirect, Mirae Asset, VCBS, and KIS VN, collectively commanding a 69.05% market share.

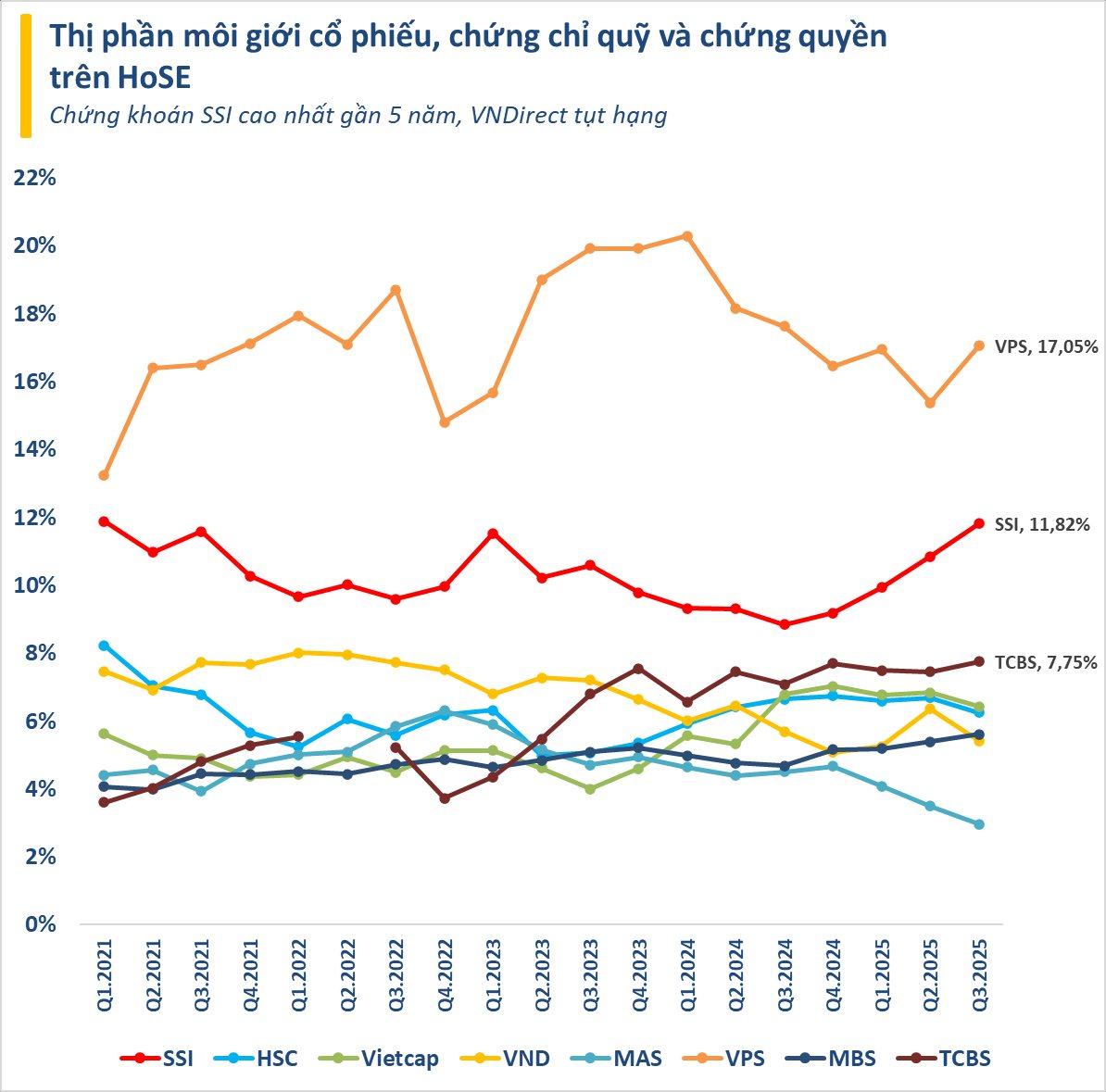

SSI Securities maintained its upward trajectory for the fourth consecutive quarter, achieving an 11.82% market share—its highest in nearly five years. Robust trading activity, coupled with enhanced service capabilities and capital strength, fueled SSI’s growth during this period.

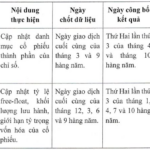

At an extraordinary shareholders’ meeting on September 25th, SSI disclosed that margin lending peaked at approximately VND 42 trillion during Q3’s record-breaking market rally. To bolster its capital base, SSI privately placed 104 million shares, increasing its charter capital to VND 20.779 trillion. The firm plans to issue an additional 415.6 million shares to existing shareholders, targeting a post-issuance charter capital of VND 24.9635 trillion. These funds will prioritize margin lending services, investment activities, technology upgrades, and customer experience enhancements.

In the broader rankings, VPS Securities reclaimed the top spot with a 17.05% share, rebounding from its previous quarter’s decline. TCBS and MBS also expanded their shares to 7.75% and 5.61%, ranking third and sixth, respectively. Conversely, VNDirect slipped to seventh place with a 5.42% share, down from sixth in Q2.

Vietnam’s Q3 2025 stock market witnessed the VN-Index surge 23% from 1,380 to a historic 1,700 points by early September. Liquidity soared, with multiple sessions exceeding VND 60-80 trillion. Despite September’s pullback, average daily trading value for the quarter reached over VND 38 trillion, a 74% increase from Q2.

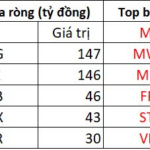

Foreign Blockades Unleash 1.9 Trillion VND Sell-Off as VN-Index Surges 50 Points: Which Stocks Faced the Heaviest Dumping?

In the afternoon trading session, HPG and VIX emerged as the top net buyers in the market, with each stock attracting approximately VND 146-147 billion in net purchases.