In the newly released upgrade report, BSC Securities highlights that Vietnam’s stock market will be driven by several key factors, according to its 2025–2030 development strategy. Firstly, domestic investor capital remains a strong pillar, benefiting from low-interest rates and attractive valuations. This is crucial as individual investors currently account for nearly 80% of market liquidity.

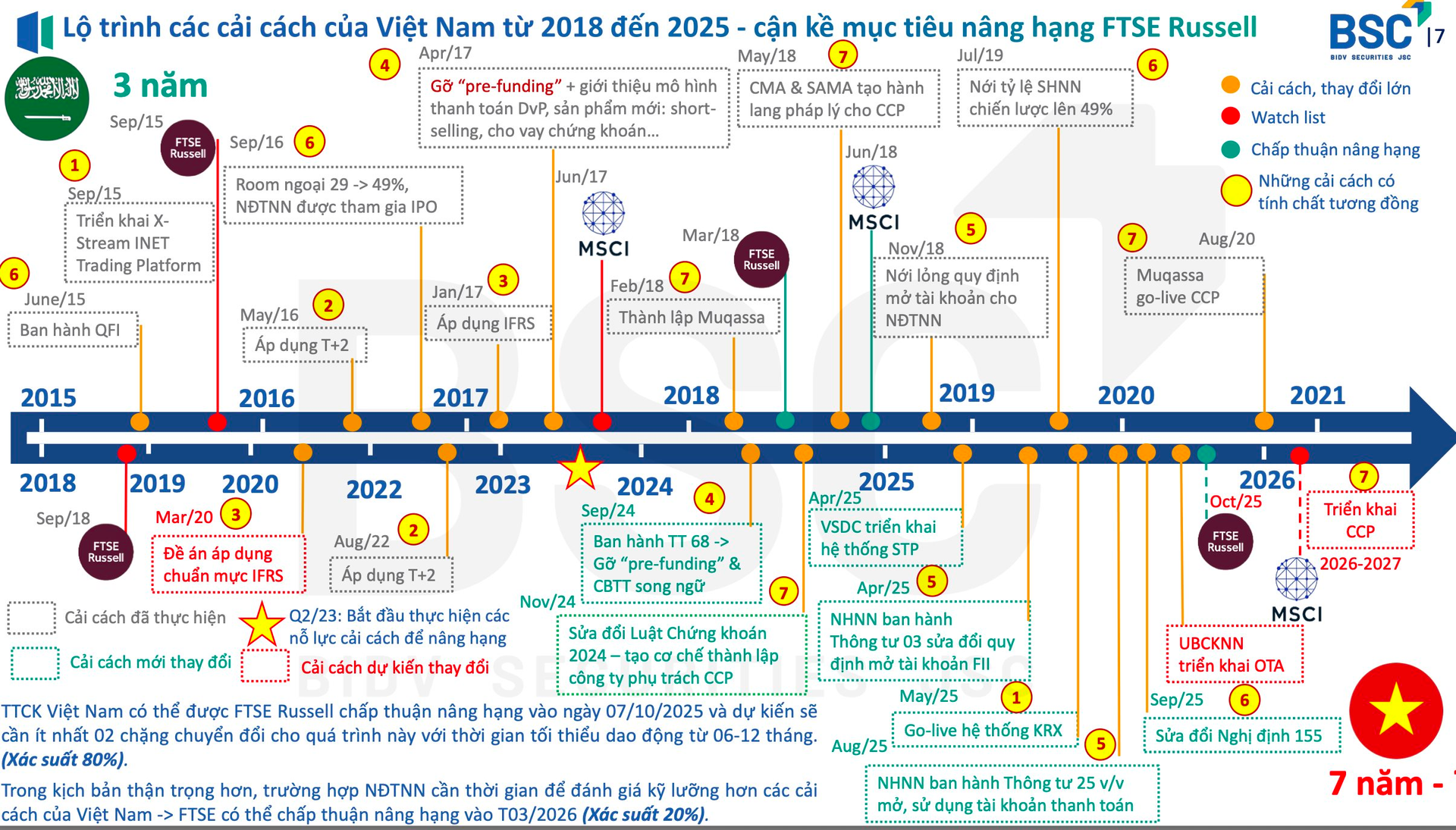

Secondly, the market upgrade initiative is a strategic priority. Vietnam aims for FTSE to elevate its status to Secondary Emerging Market by 2025 and MSCI Emerging Market by 2030. Success would unlock significant foreign capital inflows, estimated at tens of billions of USD in the medium to long term.

Enhancing liquidity is another focus. The goal for 2026–2030 is to achieve an average trading value of approximately $2 billion per session, comparable to regional emerging markets.

However, challenges persist. Foreign investors have net sold for three consecutive years, reflecting caution. Additionally, margin risks and global market volatility pose threats to the VN-Index.

BSC Research notes that Decree 245/2025/NĐ-CP aims to remove barriers for foreign investors, providing a legal framework for the Ministry of Finance, State Bank, and State Securities Commission to implement sustainable market development measures aligned with international standards.

The upgrade plan targets MSCI and Advanced Emerging Market standards. FTSE’s approval on 12/09/2025 demonstrates regulators’ long-term vision. The Ministry of Finance’s investor restructuring plan aligns with global upgrade roadmaps, as seen in Saudi Arabia’s successful case.

BSC estimates an 80% probability of FTSE upgrading Vietnam’s market by 07/10/2025, with a 6–12 month transition. A more cautious scenario suggests a March 2026 upgrade (20% probability) if foreign investors require additional assessment time.

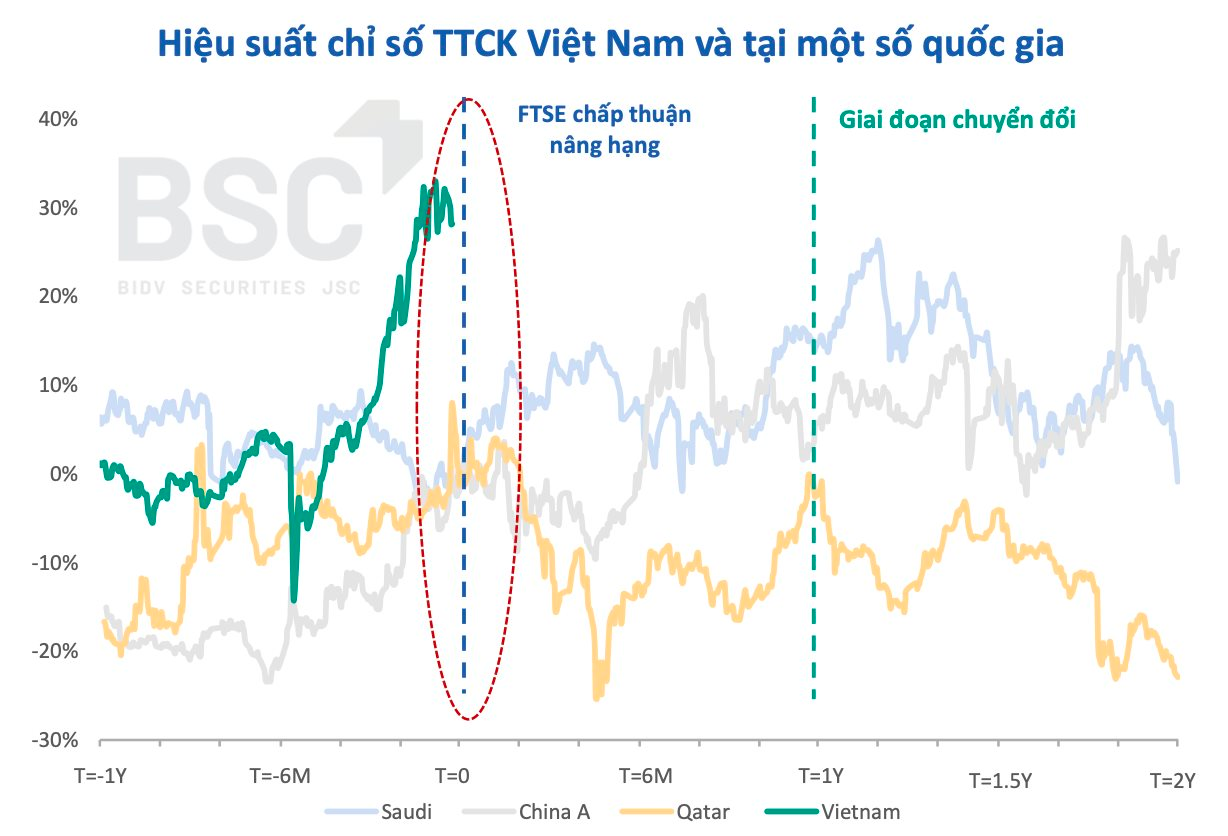

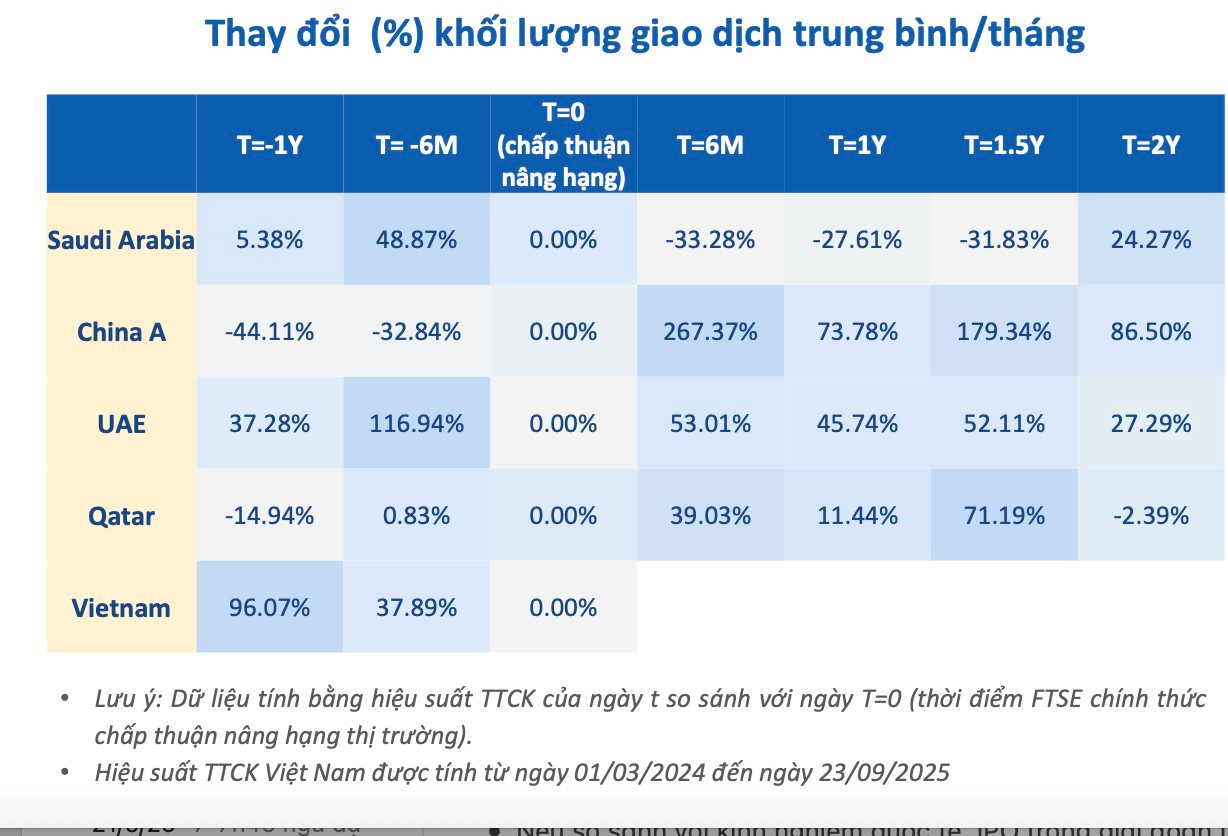

Historically, markets rally pre-upgrade, with liquidity surging 6 months prior to FTSE’s announcement. Post-upgrade, a 3–6 month correction typically follows.

Markets often surge pre-upgrade due to foreign fund rebalancing but may correct post-inclusion amid profit-taking. In downgrade scenarios, pre-effective date outflows pressure markets, yet recovery follows post-exit from major indices, driven by undervalued assets and speculative inflows.

While net returns from reclassification events are modest, short-term volatility is pronounced, especially in smaller markets where ETF flows dominate local liquidity.

Vietnam’s Stock Market Surges Among World’s Top Performers Ahead of Historic Milestone

The buoyant performance of the stock market underscores an atmosphere of heightened investor optimism, particularly as the anticipated announcement of an upgraded rating draws near.

Market Pulse 06/10: Green Dominates as VN-Index Surges Nearly 50 Points

At the close of trading, the VN-Index surged by 49.68 points (+3.02%), reaching 1,695.5 points, while the HNX-Index climbed 8.94 points (+3.36%) to 274.69 points. Market breadth was overwhelmingly positive, with 542 advancing stocks and only 194 declining ones. Similarly, the VN30 basket saw a dominant green trend, with 29 gainers and just 1 loser.

Market Pulse 06/10: Financial Stocks Soar, VN-Index Hits 1,680 Mark

The green hue dominated the market throughout the morning session. As the midday break approached, the VN-Index surged by over 33 points (+2.02%), reaching 1,679.1 points, while the HNX-Index also saw a robust increase of 2.54%, closing at 272.51 points. Market breadth strongly favored buyers, with 502 stocks advancing and only 168 declining.