A 24-month bond, maturing on September 30, 2027, offers a fixed interest rate of 9% per annum, secured by assets.

In addition to the newly issued bond, IDTT has two other bond series from 2024: IDTCH2426002 and IDTCH2427001, valued at 50 billion VND and 200 billion VND respectively, both with an 11% annual interest rate. The 50 billion VND bond matures on December 30, 2026, while the 200 billion VND bond matures on May 3, 2027.

In the first half of 2025, IDTT successfully paid interest of 2.7 billion VND and nearly 11 billion VND for the IDTCH2426002 and IDTCH2427001 bonds, respectively.

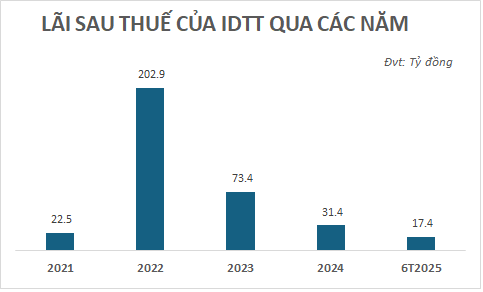

Regarding business performance, IDTT reported an after-tax profit of over 17 billion VND in the first six months of 2025, a 46% decrease compared to the same period last year.

As of June 30, 2025, the company’s total assets reached over 2,042 billion VND, a 26% increase year-over-year. Total liabilities rose by nearly 36% to over 1,532 billion VND, including bank loans of 1,151 billion VND, bond debt of over 247 billion VND, and other liabilities of nearly 134 billion VND.

Source: VietstockFinance

|

Established in 2018, IDTT is headquartered in Long An Ward, Tay Ninh Province. Originally named IDICO – CONAC Industrial and Urban Development JSC, it later became IDTT JSC and is now known as Thu Thua Industrial and Urban Development JSC.

The company specializes in constructing civil, industrial, transportation, irrigation, hydroelectric, and urban infrastructure projects, as well as industrial zones and industrial clusters in Long An Province and the Southwestern region of Vietnam.

IDTT is currently investing in and operating several projects, including the Thu Thua Industrial Zone (170.7 hectares, investment of nearly 3,000 billion VND) in Thu Thua Town, Thu Thua District, Tay Ninh Province; the Garden Riverside project; the Garden Central Park project; and a resettlement area project, along with infrastructure development for the upgrade and expansion of Provincial Road DT 818.

In a credit rating report published on September 26, 2025, Saigon Ratings assessed IDTT’s business profile as moderately risky. This reflects the company’s significant decline in performance in 2024, with revenue dropping 31% to 279 billion VND compared to 2023.

In the short to medium term, IDTT’s business prospects may improve as the company continues to collect payments and launch real estate products from the Garden Riverside and Garden Central Park projects, and begins leasing the Thu Thua Industrial Zone.

Given the capital-intensive nature of real estate development, IDTT is leveraging financial strategies to raise capital and accelerate project investments. As of December 31, 2024, the company’s debt-to-equity ratio stood at 2.7, with a debt-to-EBITDA ratio of 22.3.

– 09:34 October 7, 2025

Complexest Interchange of Ho Chi Minh City’s Ring Road 3 Project to Open by Year-End, Boosting Surrounding Real Estate Projects

Prime real estate projects strategically located along key transportation arteries such as Ring Road 3, Ring Road 4, the Tan Van interchange, the expanded National Highway 13, the Bien Hoa – Vung Tau Expressway, and the HCMC – Thu Dau Mot – Chon Thanh Expressway are poised for a significant price surge by year-end.

Unlocking Decades-Old Land Disputes: Resolution for Pending Cases Since 2003 on the Horizon

At today’s press conference on socioeconomic issues held on October 2nd, representatives from the Ho Chi Minh City Department of Agriculture and Environment announced accelerated efforts to finalize land pricing following the implementation of the 2024 Land Law and its accompanying decrees. Once resolved, these measures are expected to unlock numerous large-scale projects, paving the way for the approval of tens of thousands of residential units.