The sole investor participating in the purchase is VII Holding JSC, expected to own 18.2% of JVC’s capital after the offering. This entity has a close relationship with JVC, as Mr. Vu Dinh Do, Chairman of VII Holding’s Board of Directors, is married to Ms. Nguyen Thi Hanh, a member of JVC’s Board of Directors.

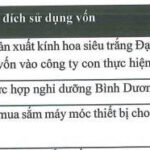

With an expected offering price of 10,000 VND per share, JVC aims to raise 250 billion VND. Of this, 150 billion VND will be invested in Vietnam-Japan Medical Technology Investment JSC (MIDS), established in 2021 and specializing in multi-specialty clinics, dental services, and headquartered in Hanoi. As of June 30, 2025, MIDS has a capital of 25 billion VND, with JVC directly owning 99%, equivalent to 24.75 billion VND.

The remaining 100 billion VND will be allocated for purchasing medical equipment and supplies.

This plan was initially approved at the 2024 Annual General Meeting but not implemented. It was re-approved at the 2025 AGM. During the recent AGM, JVC shareholders questioned the feasibility of this plan, prompting the company to reassess its viability.

According to JVC representatives, the need for additional capital to expand JVC’s and its subsidiary’s operations led the Board of Directors to propose a private share issuance in 2024. However, due to unfavorable market conditions, the plan was delayed.

JVC’s leadership also mentioned that the company had engaged with potential investors, who required more time for thorough evaluation and compatibility assessment. If an agreement is reached and market conditions improve in 2025, the private share issuance is expected to proceed successfully.

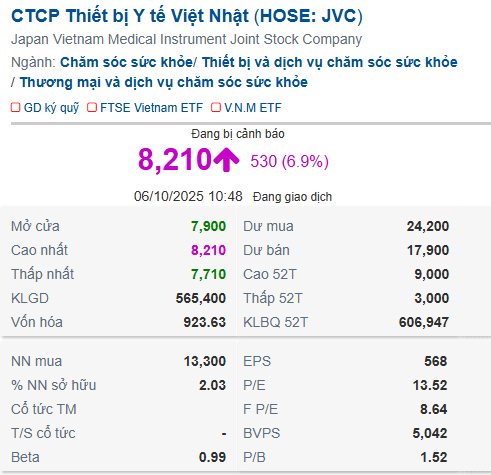

The resolution was published by HOSE on its website around 9 a.m. on October 6, causing JVC’s stock price to surge. By 10:50 a.m., JVC’s share price rose to 8,210 VND, ending a six-session losing streak.

JVC’s stock price quickly hit the ceiling on October 6, 2025

|

In another notable development, on September 5, the Ho Chi Minh City Stock Exchange (HOSE) maintained JVC’s warning status due to accumulated losses of nearly 980 billion VND as of June 30, 2025.

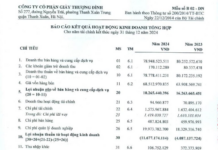

From 2010 to 2014, JVC operated steadily, maintaining profits ranging from tens to hundreds of billions of VND. However, after an unexpected loss of 1.3 trillion VND in 2015, the company has struggled to recover. In recent years, while JVC has consistently profited, it has yet to offset this massive loss.

| JVC struggles to eliminate accumulated losses |

To address this, JVC has signed an exclusive distribution agreement for Micro Vention (MVI), a cerebral angiography intervention product, with major tenders at hospitals like Bach Mai and Cho Ray. Additionally, the company is partnering with UI, a provider of comprehensive diagnostic imaging products, to expand its high-tech offerings. These initiatives are expected to drive significant revenue growth.

– 1:00 PM, October 6, 2025

Masan Consumer Set to List on HoSE

Masan Consumer is poised to list on the Ho Chi Minh Stock Exchange (HoSE) in Q4 2025 or the first half of 2026.

Đạt Phương Group Proposes Private Placement of Shares to Shareholders

At the upcoming extraordinary shareholders’ meeting, Dat Phuong Corporation will present a plan to issue nearly 17.8 million shares to its shareholders. This strategic move aims to increase the company’s chartered capital and strengthen its financial capacity, enabling greater investment in future projects.

Foreign Block “Dumps” VND 2.2 Trillion in Vietnamese Stocks in Final Week’s Session, Spotlight on a Single Stock

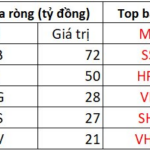

In the afternoon trading session, VCB emerged as the most heavily bought stock across the entire market, with a net buying value of 72 billion.