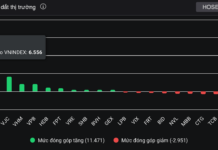

Cash flow reflects a cautious sentiment with significantly lower liquidity compared to yesterday’s session. The morning trading value stood at approximately 14 trillion VND. Market psychology is more cautious as the announcement of the market upgrade results approaches.

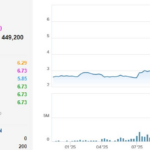

The securities group started the session positively but later experienced divergence. Some stocks maintained their gains, such as SSI, VND, CTS, VDS, ORS… However, others declined, including VIX, VCI, MBS, VFS, DSE, FTS…

Non-essential consumer stocks are showing notable movements. VPL hit its ceiling price. Meanwhile, FRT and MWG rose by 2-4%, and PNJ also recorded a 1% increase.

The number of advancing and declining sectors is quite balanced, reflecting the current market divergence. Nevertheless, selling pressure dominates, with 380 declining stocks compared to nearly 260 advancing ones.

The ceiling price of VPL and the nearly 3% rise of LPB are the main pillars preventing the index from falling further.

| Top 10 stocks influencing VN-Index in the morning session of 07/10/2025 (measured in points) |

10:40 AM: Tugging around the reference level

The upward momentum remains unclear, causing the market to oscillate. By 10:40 AM, VN-Index held a 2-point gain at 1,697.88 points, while HNX-Index rose over 1 point to 276.1 points.

Declining stocks exceeded 300, while advancing stocks numbered only 280, indicating stronger selling pressure. However, some large-cap stocks are still supporting the market. VPL, LPB, VHM, VRE… are contributing positively. The top 10 stocks driving the index added nearly 7 points.

VPL hit its ceiling price in the first half of the morning session, leading VN-Index with a contribution of over 2 points.

Several individual stocks across sectors also performed well. CTD rose over 5%, FRT gained 4%, and VND increased by more than 2%.

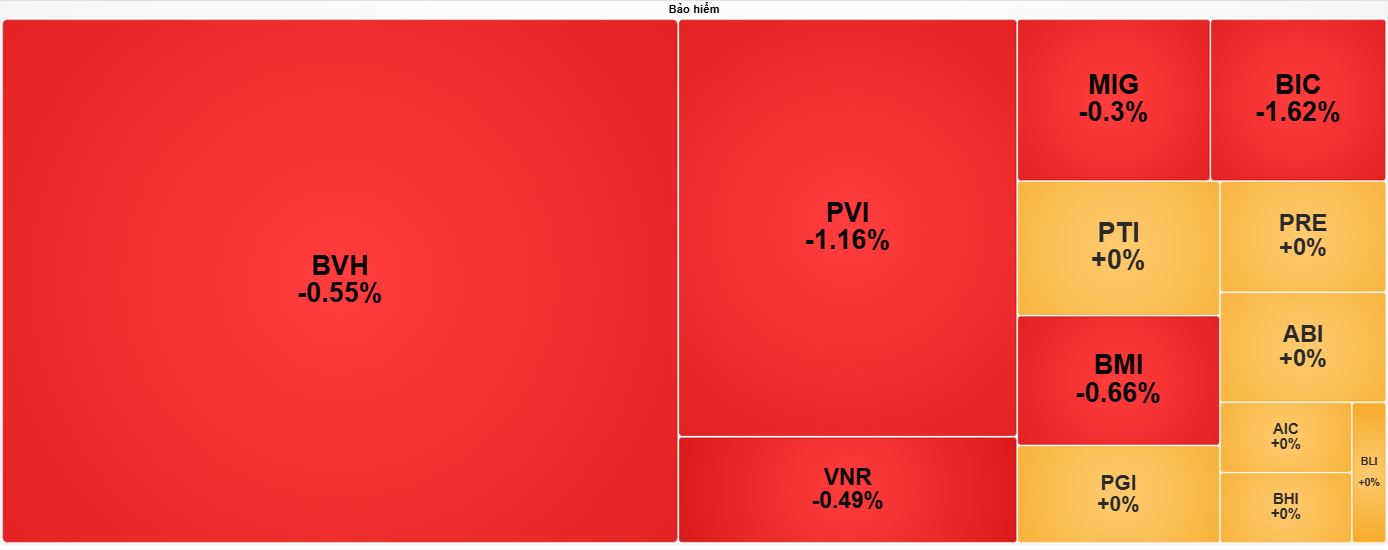

The insurance sector performed negatively this morning. Most stocks were in the red or at the reference level. BVH, PVI, MIG, BIC, BMI… declined by 0.5-1%.

Source: VietstockFinance

|

Opening: Vingroup and securities groups propel VN-Index toward the 1,700 mark

VN-Index briefly surpassed 1,700 points at the start of the 07/10 session. However, spreading losses restrained the index from sustaining this level.

The securities group is today’s primary leader. SSI, SHS, VIX, VND… performed well with leading liquidity. Within the financial sector, bank stocks were less positive. MBB, ACB, HDB, SHB, VIB… saw slight declines.

Divergence is widespread across sectors. For instance, in real estate, VRE, VHM, VIC, PDR… advanced, while DIG, DXG, CEO, SGR, TCH… declined.

The Vingroup family is the most positive influence on VN-Index’s rise. VHM, VRE, VIC, VPL led the group, contributing over 3 points to the index. The securities group had two representatives: SSI and VND.

Bamboo Capital stocks showed contrasting movements. BCG rose near its ceiling, while TCD fell sharply, even touching its floor price at times.

– 11:55 07/10/2025

Revolutionary Projects by Vingroup, Sun Group, Ecopark Shake Up the Market, Redefining the Real Estate Investment Landscape

A wave of mega-projects from real estate giants has been shaking up the market lately. Wherever a blockbuster development emerges, it attracts a flood of investment, drawing in both investors and brokers, transforming the area into a vibrant new hotspot.