This is a golden opportunity to transform underground capital into a driving force for development, solidifying the nation’s position on the global digital economy map.

Underground Capital: Investor Concerns

With nearly a decade of experience in the cryptocurrency market, Nguyen Thu Trang has often been troubled witnessing the massive flow of capital, estimated at tens of billions of USD, operating outside regulatory control, flowing through unofficial channels. For long-term investors like her, this legal “gray area” is not only a risk to assets but also a lack of a legitimate protection mechanism, directly affecting market confidence.

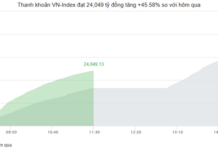

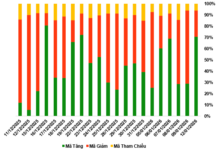

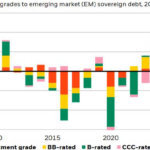

In reality, Vietnam is currently one of the hotspots in the global cryptocurrency market. International reports and domestic analyses estimate that about 17 million Vietnamese people participate in digital asset transactions—equivalent to nearly one-fifth of the adult population. The total annual transaction volume even surpasses 100 billion USD, demonstrating the scale and potential for rapid development. However, these massive numbers also place significant regulatory pressure, as most transactions still occur through foreign exchanges or channels not within the legal framework. This situation not only poses substantial risks for individual investors, making them vulnerable to scams and unpredictable fluctuations, but also results in a significant loss of revenue for the state budget, while missing the opportunity to manage crucial capital flows to promote sustainable digital economic development.

Vietnam legalizes the digital asset market, attracting 100 billion USD in capital

The government cannot allow this capital to continue flowing freely. Resolution No. 05/2025/NQ-CP dated September 9, 2025, officially approved a 5-year pilot program for the cryptocurrency market. This milestone marks the integration of cryptocurrency activities into the legal framework, with three core principles: “prudence – control – transparency.” The goal is not only to protect investors and manage risks but also to promote the development of domestic financial technology.

New Playground: Investors Must Be Protected from A to Z

The spirit of Resolution 05 is a commitment to a “clean” market, where transparency must stem from the technology platform itself and the public disclosure of operational reports. Accordingly, pilot exchanges will no longer be allowed to withhold information but must clearly disclose prospectuses, shareholder structures, digital asset custody mechanisms, and incident handling procedures.

Particularly, the Resolution sets extremely high technical safety standards for the information technology (IT) system. Exchanges must comply with smart contract audits, reserve proofs, periodic security reports, and display real-time public dashboards.

Vietnam is currently one of the hotspots in the global cryptocurrency market.

From an expert’s perspective, Mr. Tran Manh Hung, a market specialist, notes that smart contract audits, reserve proofs, and periodic security reports will be standards that international investors value. According to him, technological transparency and custody processes are the key factors for major financial institutions to feel secure in collaborating.

Alongside exchange transparency, investor protection is further strengthened by a robust “defense layer” from the state. This is no longer the sole responsibility of the exchange but a cross-sectoral duty. Resolution 05 has clearly assigned coordination tasks among the Ministry of Finance, the State Bank, and the Ministry of Public Security. Regulations on KYC (Customer Identity Verification) and AML/CFT (Anti-Money Laundering/Counter-Terrorist Financing) will be strictly enforced, especially for large or suspicious transactions. This requires a rapid information-sharing mechanism, the application of advanced monitoring technology, and clear incident handling procedures to closely track all financial flows.

Three Pillars Shaping Vietnam’s Digital Capital Future

Vietnam develops the cryptocurrency market

To turn Resolution 05 into a real development driver, Vietnam needs a strategy balancing safety and competition, regulation and innovation. High standards for charter capital, technology, and cybersecurity are necessary to filter out weak players. However, overly stringent regulations—such as setting excessively high charter capital or overly strict technical requirements—could inadvertently stifle liquidity, drive up transaction costs, and suppress creativity. Therefore, a reasonable solution is a phased capital increase roadmap, accompanied by technical support programs for domestic exchanges and startups, along with policies fostering healthy competition.

Notably, economic and financial experts believe that Vietnam’s digital capital future will be shaped by three critical strategic pillars. First, comprehensive operational standards and investor protection mechanisms must be perfected. Exchanges must audit smart contracts, publicly display reserve proof dashboards, establish domestic custody processes, and handle incidents transparently; while also disclosing detailed prospectuses. Alongside this is the construction of a cross-sectoral “shield,” strengthening KYC/AML/CFT enforcement, establishing a compensation fund, and a rapid dispute resolution mechanism. Dr. Can Van Luc emphasizes, “Without a strong enough defense layer, a single major incident could create a chain reaction, harming investors and shaking market confidence. Risks must be transparently communicated, and a sustainable protection mechanism established.”

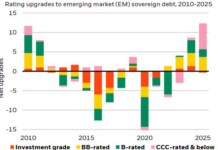

Next, policies supporting competition and enhancing domestic capabilities must be correctly focused. Encouraging service provider diversity through phased capital increase roadmaps, along with technical support programs, will help ensure liquidity and drive innovation. Simultaneously, maintaining high safety standards is crucial for attracting international investors.

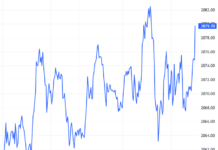

Finally, leveraging opportunities from tokenizing real assets (RWA) is seen as a breakthrough. Tokenization models for real estate, commercial invoices, or carbon credits—when ownership is standardized and independently audited—will create liquidity for traditional assets, while opening new capital mobilization channels, contributing to promoting the green economy. This is also a global trend, where real assets are “digitalized” to expand capital access opportunities, reduce transaction costs, and increase transparency.

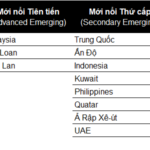

When these three pillars are implemented synchronously, experts predict the impact will spread across multiple dimensions. A clear legal framework will help Vietnam become an attractive destination for international investment funds and major financial institutions. It is estimated that even if just 5% of global capital flows into real estate and commodity tokenization, Vietnam could attract an additional 5-7 billion USD in foreign capital annually. For the domestic fintech ecosystem, expanded competition will create opportunities for financial technology startups to participate more deeply in custody, payment, and blockchain auditing. This will not only drive innovation but also form a supporting service market worth hundreds of millions of USD.

From a budgetary perspective, if the digital asset market is legalized with a tax rate equivalent to securities (0.1% of transaction value), revenue could reach 10,000-15,000 billion VND annually, while limiting revenue losses from underground transactions on foreign exchanges. On a macro level, Vietnam has the opportunity to become a digital asset hub in Southeast Asia, thanks to its young population, high technology access rates, and progressive legal framework. This will be a “bridge” for digital capital to connect with traditional finance, thereby enhancing the nation’s position on the global digital economy map.

State-Managed Real Estate Trading Center Set to Launch: Homebuyers to Receive Land Titles in Just 2 Days

The Ministry of Construction is finalizing a pilot project for a Real Estate and Land Use Rights Trading Center, managed by the state, with operations expected to commence in 2026. Once implemented, this model will enable citizens to obtain land ownership certificates (red books) within just two business days.

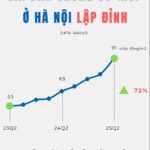

Experts Pinpoint Key Factors Driving Persistent Rise in Housing Prices

Soaring property prices show no signs of abating, fueled by a perfect storm of limited supply and escalating input costs. From revised land taxes to surging construction expenses, these factors are driving prices upward, making affordability an increasingly distant dream.