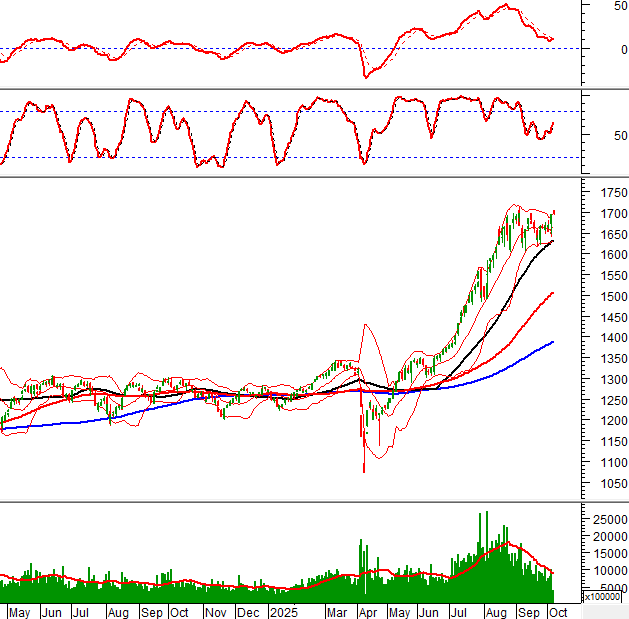

Technical Signals of VN-Index

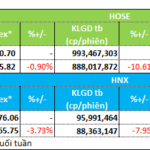

During the morning trading session on October 7, 2025, the VN-Index is retesting the September 2025 high (equivalent to the 1,700-1,711 point range). The outcome of this test will determine the short-term trend.

The Stochastic Oscillator has already provided a buy signal. The MACD is also trending upward and may generate a similar signal in the upcoming sessions.

Technical Signals of HNX-Index

During the morning trading session on October 7, 2025, the HNX-Index is retesting the Middle line of the Bollinger Bands with strong volatility.

The short-term outlook for the index continues to improve as the Stochastic Oscillator provides a buy signal.

CTD – Coteccons Construction Corporation

During the morning trading session on October 7, 2025, the share price of CTD surged for the fifth consecutive session, accompanied by a Big White Candle pattern and trading volume exceeding the 20-session average, indicating investor optimism.

The price of CTD has successfully broken through the medium-term downtrend line and continues to adhere to the Upper Band of the Bollinger Bands, signaling a positive recovery outlook.

Additionally, the stock has breached the neckline (equivalent to the 83,300 – 84,500 range) of the Inverse Head and Shoulders pattern, while the MACD indicator continues to rise after providing a buy signal. If these positive signals persist, the potential price target is the 94,200-96,500 range.

VND – VNDIRECT Securities Corporation

During the morning trading session on October 7, 2025, the share price of VND rebounded, accompanied by a Rising Window pattern and projected trading volume exceeding the average, indicating renewed investor activity.

Currently, VND’s price is recovering after retesting the August 2025 low (equivalent to the 21,300 – 22,300 range) and is positioned above the Middle line of the Bollinger Bands. This suggests a more optimistic short-term outlook.

Furthermore, the Stochastic Oscillator has risen from the oversold region after providing a buy signal. If this technical signal continues to improve, the short-term uptrend will gain further support.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:02 October 7, 2025

HoSE Brokerage Market Share Q3/2025: SSI Hits 5-Year High, MBS Surges to Push VNDirect Out of Top 6

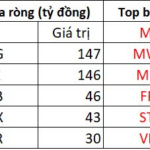

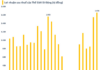

In Q3 2025, the top 10 brokerage firms dominated the HoSE market, collectively commanding a staggering 69.05% share of trading volume in stocks, fund certificates, and covered warrants.

Which Stock Codes Were the Focus of Securities Companies’ Proprietary Trading Accumulation in the First Session of the Week on October 6th?

Proprietary trading desks at securities companies recorded a net purchase of VND 392 billion on the Ho Chi Minh City Stock Exchange (HOSE).